"We continue to expect USD/INR to trade in the range 83-83.50 by March 2024"

Radhika Piplani

Chief Economist

DAM Capital Advisors

Mumbai, December 27, 2023: India’s Q2FY24 current account deficit (CAD) moderated to USD8.3bn (1% of GDP) from USD9.2bn (1.1% of GDP) in Q1FY24, led by higher net services surplus followed by net transfer receipts (salaries).

Q2 FY24 CAD/GDP moderates to 1% on higher services exports

Net services surplus grew by 14% QoQ to USD40bn in Q2FY24 (+USD5bn) led by rising exports of software, business, and travel services. Net private remittances increased by USD2bn to USD25bn due to higher transfers by Indians employed overseas. On the other hand, merchandise trade deficit widened to USD61bn in Q2FY24 from USD56.6bn in Q1FY24, with increase in imports outpacing the increase in exports. Both gold and non-oil-non-gold imports saw a sharp quarterly pickup however oil imports moderated (volume decline).

Lower FDI, FPI and banking capital weight on capital account surplus

India’s capital account registered a surplus of USD10bn (1.2% of GDP) in Q2FY24 vs. USD34.3bn in Q1FY24 (4% of GDP). The moderation was led by: (1) negative FDI inflow (-USD0.3bn); (2) lower net portfolio inflows (USD4.9bn in Q2FY24 vs. USD15.7bn in Q1FY24; and (3) reduced banking capital inflows. Within key loan accounts, external commercial borrowings turned negative whereas external assistance moderated. Short-term credit to India turned positive after two consecutive quarters of net outflow.

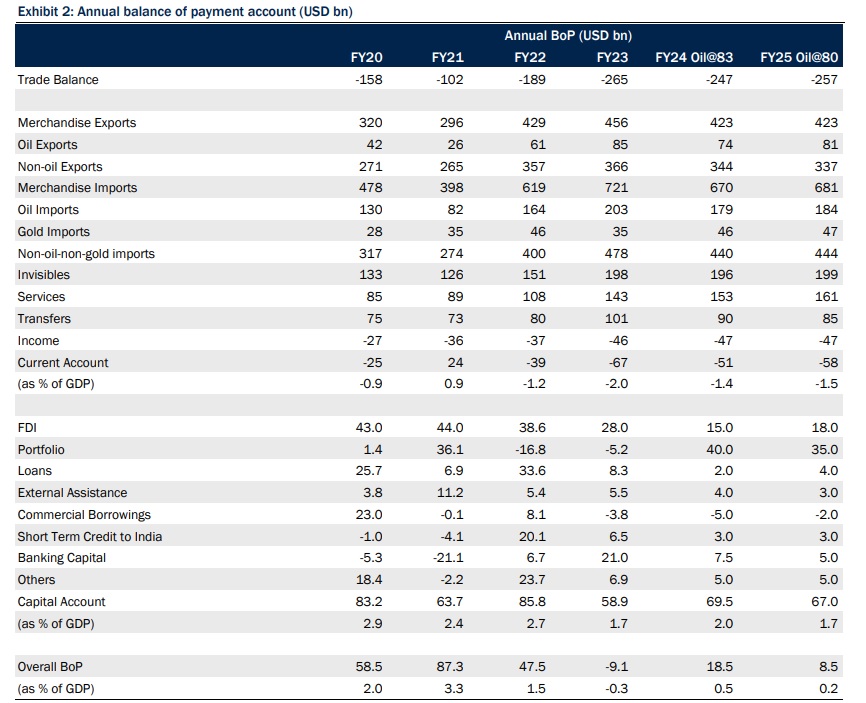

Growth in services exports to cushion negative surprises in FY24-FY25 CAD

Monthly services exports have been surprising on the positive, and this is adequately reflected in H1FY24 CAD statistics. H1F24 services balance is higher by USD10bn as against the corresponding period of last year despite global headwinds of higher interest rates, geopolitical tensions, and modest global growth. This trend in our view is expected to last in both H2FY24 and FY25. We believe that even if there are any headwinds to merchandise trade due to unexpected global growth slowdown or commodity market volatility, services exports can to an extent act as a strong buffer. As such we expect CAD/GDP at 1.4% and 1.5% in FY24 and FY25 respectively (assuming average oil prices at USD83pb and USD80pb respectively). On the capital account, FDI flows weakened considerably in Q2FY24 on account of global risk aversion. While we do expect the FDI flows to recover partially in H2FY24, it is unlikely to see the levels witnessed last year. Net FDI inflow was at USD4.8bn in H1FY24, lower than USD19.6bn in H1FY23. For FY25, we have considered a modest jump in FDI flows yet its lower than the levels seen during FY20-FY23. Domestic policy certainty, continuation of domestic growth momentum, shallow global growth slowdown and reduced geopolitical risks would be the key factors to track for higher-than-expected FDI inflows. FPI flows, on the other hand, are expected to be strong in both FY24 and FY25. JPM bond index inclusion could result in higher flows on the debt side starting January 2024 (active inflows). The passive fund inflow starts in June 2024. Overall, we expect capital account surplus at USD70bn and USD67bn for FY24 and FY25 respectively.

On net basis, BoP is expected at USD19bn (0.5% of GDP) and USD9bn (0.2% of GDP). With the adequacy of FX reserves (USD615bn as of 15 December), any sudden capital outflows are likely to encounter RBI’s FX intervention. As such, we continue to expect USD/INR to trade in the range 83-83.50 by March 2024. We expect USDINR to average at 84 in FY25, pricing in lower depreciation than historical average.

(Disclaimer/Disclosures: DAM Capital the Research Entity (RE) is also engaged in the business of Investment Banking and Stock Broking and is registered with SEBI for the same. DAM Capital and associates may from time to time solicit from or perform investment banking or other services for companies covered in its research report. Hence, the recipient of this report shall be aware that DAM Capital may have a conflict of interest that may affect the objectivity of this report. Investors should not consider this report as the only factor in making their investment decision. The RE and/or its associate and/or the Research Analyst(s) may have financial interest or any other material conflict of interest in the company(ies)/ entities covered in this report.)