There has been an unaddressed demand, which would resurface if and when the lumpsum investments are accepted again

Prayesh Jain, Nitin Aggarwal, Nemin Doshi,

All Research Analysts,

Motilal Oswal Financial Services

Mumbai, 23 October, 2023: We interacted with a few large Mutual Fund distributors (with AUM exceeding INR10b), and institutional sales representatives to analyze customer behavior in the current environment. Overall equity flow continues to be strong driven by SIPs. However, recently there has been a slowdown in gross flows owing to Shraddha Paksha, and an increase in redemptions as consumption demand is improving. On the debt side, the momentum remains weak as large institutional investors are waiting on the sidelines given the geopolitical tensions across the world. FD is emerging to be a stronger product vs. longer duration MF schemes. However, demand remains strong for the shorter duration (< 1 year) schemes. We remain positive on 360ONE and CAMS in the AMC space, and have a BUY rating on both the stocks. 360ONE is well placed to leverage the emerging trends in the UHNI segment, wherein inter-generational wealth transfer is picking up momentum especially in the smaller tier cities. CAMS, on the other hand, is seeing improved AUM and revenue traction driven by strong equity markets and healthy trends in the non-MF segments such as PMS/AIF RTA.

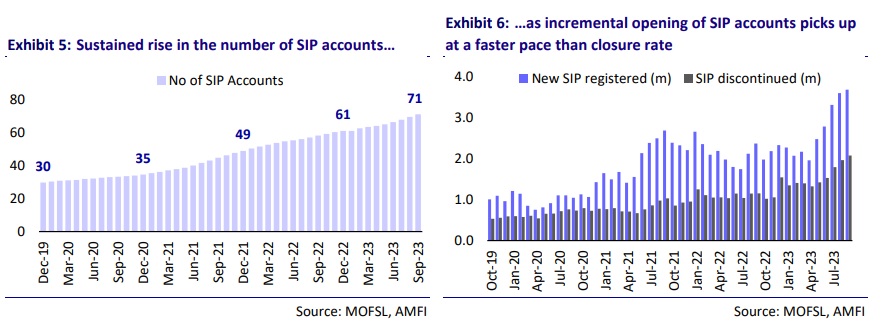

Equity segment flows healthy driven by strong SIP momentum

During Oct’23, there has been some pressure on gross flows owing to the Shraddha Paksha period. Further, with festival season around the corner, the demand for consumption will eat into incremental savings. This is expected to revive post-Diwali. Redemptions increased in the previous month led by profit booking and will increase further in case Nifty’s sustainably stays above 20,000. SIP momentum, however, has continued to remain strong and the penetration is intensifying in lower-tier cities. Cancellation and bounce rates have seen a marked reduction over the past few months. SIP ticket sizes have also been moving higher in the smaller towns and cities. Almost 95% of SIPs in terms of count are in the equity segment. Within the equity segment, demand for Small Cap funds has been the strongest. However, with lumpsum flows being stopped in a few large schemes, there has been an unaddressed demand, which would resurface if and when the lumpsum investments are accepted again. The momentum of HNI money shifting to alternates continues to pick up pace with the launch of new AIFs and PMS schemes. The commission on existing schemes has not seen any major changes even by the smaller AMCs. However, NFO commissions, after a hiatus, have started increasing again. This was corroborated by the commentary from the UTI AMC, which recently launched the Balanced Advantage Fund. Among the major AMCs, Nippon AMC and HDFC AMC continue to attract large inflows aided by the sustained healthy fund performance.

Debt flows muted

The 10-year bond yield in India has moved up to 7.35% from 7.0% in May’23. Given the geopolitical tensions, large institutions are expecting further hardening of yields which is keeping them on the sidelines. Shorter duration funds (< 1 year) continue to attract a lot of interest. FDs (6M to 3Y) are in demand among the large institutions as against these, Line of Credit is also available that makes it an attractive proposition. Some demand is arising for floating rate funds but this is a much smaller category in the overall debt segment. Debt index funds, which had witnessed strong momentum over the past few quarters, have also seen a reduction in inflows.

Retail customers still elusive to the passive space

There has been a significant increase in product launches on the passive side. However, retail segment investments via distributors are not moving towards these products. HNI investors are incrementally using the passive route, especially through the wealth management platforms, which allow them to invest under the direct route. Under the advisory route, these assets still garner income for the wealth managers. The commission on these products can range between 25bp and 40bp vs. 90bp and 100bp for the equity schemes. The expansion of passive investment options in the retail market is expected to take considerably more time.