Trump's protectionist trade policies and their impact on India also needs to be watched out for in the coming months

FinTech BizNews Service

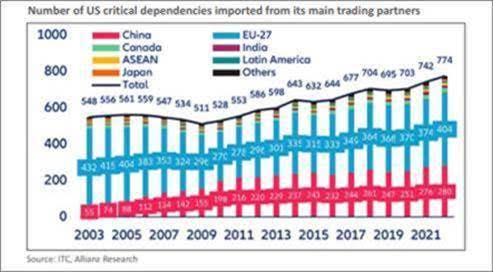

Mumbai, 23 November, 2024: According to Motilal Oswal Private Wealth (MOPW), Trump's "America First" policy could reshape international trade. His approach involves reducing imports, particularly from China, to bolster U.S. manufacturing. However, increased tariffs might prompt retaliatory measures from trade partners, potentially affecting U.S. exporters in sectors like agriculture and technology.

The European Union (EU) may impose tariffs on U.S. goods, impacting industries such as automotive and steel, and potentially slowing European growth.

Emerging markets face a mixed bag of challenges and opportunities. Some countries could see increased costs for exports due to a stronger dollar and higher tariffs, particularly affecting IT and pharmaceutical sectors. Conversely, nations like Mexico may benefit by diverting manufacturing operations from China.

Geopolitically, Trump's policies are likely to intensify tensions with China and could alter alliances, as countries like Japan and South Korea reassess their strategies. The EU may seek to become more self-reliant and potentially fostering new alliances beyond the U.S. sphere of influence.

Implications for India

For India, Trump's policies could have varying effects. The potential for higher U.S. corporate tax cuts may enhance IT spending, benefiting Indian IT companies. However, a stronger dollar and possible tariffs could undermine Indian exports. India could bolster its position in global supply chains, particularly in technology sectors like AI and semiconductors, due to previous investments and policy shifts such as the "China+1" strategy.

Indian businesses in sectors such as pharmaceuticals and defense might also find new opportunities, especially if U.S.- India collaboration strengthens in response to a more robust Indo-Pacific defense strategy.

Conclusion

Motilal Oswal Private Wealth believes that Trump's potential second term is filled with both promises of economic growth and challenges of global trade tensions. The strength of the U.S. dollar and fiscal policies could significantly influence global markets, driving various strategic realignments. As policies unfold, countries and sectors must remain nimble to adapt to the evolving landscape fuelled by "Trump II."