While PSB captured home loan share from private banks, HFCs have been able to defend its share and continue to have about 20% share.

FinTech BizNews Service

Mumbai, July 5, 2025: “How India Lends: Credit Landscape In India FY 2025” Report by CRIF India encapsulates detailed analysis on Consumptions Lending, MSMEx Lending (Individual and Entity) and Microfinance Lending and deep dive into major lending product categories in India.

INDIAN CREDIT LANDSCAPE

Consumption Loans refers to loans given to individuals for wide variety of consumption needs like Home, Vehicle, Personal, Education, Agri etc. These loans are reported to Consumer Bureau. MSMEx Loans refers to loans given to self-employed individual (reported to Consumer Bureau) and entities with aggregate credit exposure up to Rs50 Crore (reported to Commercial Bureau).

HOME LOANS

Portfolio outstanding (POS) grew double digits in Mar'25, but home loan originations slowed to 2.7% YoY (Rs1,070,614 Cr), down from 9.9% in FY24, with volumes falling 5.4% due to higher property prices and macroeconomic challenges. PSU Banks increased market share of value originated, by 6% and is largest share at almost 43%, in volume originated the share increase is only 3%, resultant of more lending in large ticket size loans. While PSB captured share from private banks, HFCs have been able to defend its share and continue to have about 20% share. Origination value shifted toward higher-ticket loans (Rs75L+), moving away from sub-Rs35L, driven by price inflation and evolving buyer preferences. PAR 31-90% improved across lenders, except for HFCs (2.5% → 2.7%), though later-stage delinquencies (PAR 91-180%) showed recovery. Private banks maintained one of the lowest PAR levels. PAR 31-180% showed overall improvement for larger loans but deteriorated significantly for loans below Rs5L, which remained weak.

Personal loans

Personal loan originations value declined 2.9% in FY25 to Rs880,030 Cr, with volume growth slowing to 8.3% YoY, down from 26.9% in FY24, due to rising risk perception and delinquencies. NBFC market share increased, with origination value rising from 32.2% in FY24 to 36.4% in FY25, and volume growing from 86.3% to 91.2%. Loans above Rs1L still dominate origination value but declined from 87.1% (FY22) to 83.1% (FY25). High-ticket loans drive total value, while low-ticket loans fuel transaction volume, reflecting financial inclusion shifts or changing preferences. Delinquencies rising, with PAR 31-90% worsening across lenders except private banks and PAR 91-180% deteriorating across most lender types. PAR trends persist, as Rs10K loans remained stable. Higher-ticket loans require closer monitoring, with similar trends in PAR 91-180%.

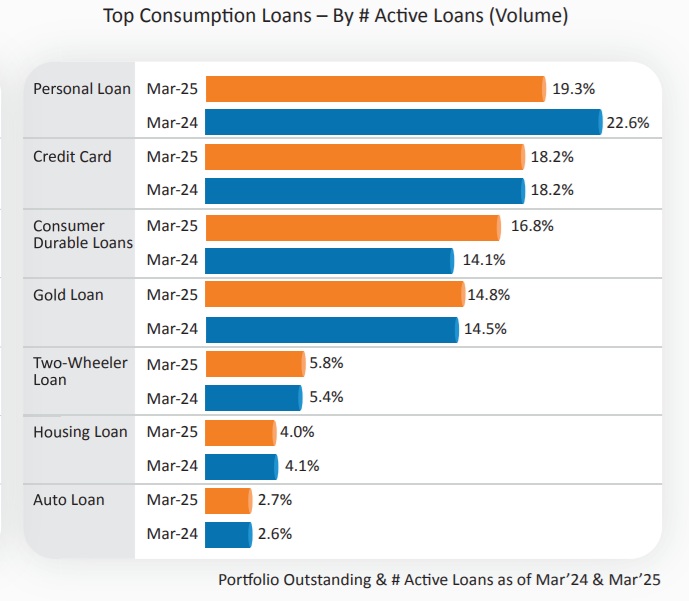

CONSUMPTION LOANS

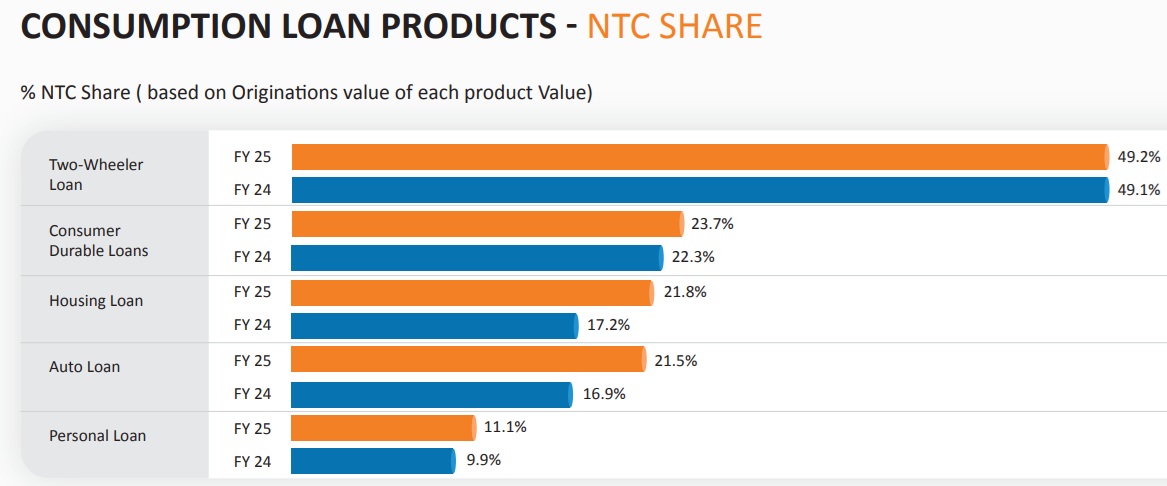

TWO-WHEELER LOANS The origination value of two-wheeler loans increased from Rs99,543 Cr in FY24 to Rs110,056 Cr in FY25, though growth slowed, declining from 25.1% to 10.6% YoY. Origination volumes also slowed down, growing 6.9% YoY in FY25, compared to 16.0% in FY24. NBFCs continued expanding their market presence, maintaining a dominant 68.1% share in FY25 (by value), with volumes reaching 70%. Similar to other consumption-driven loans, the shift toward higher-ticket loans (Rs75K+) persisted, with both value and volume market share rising, likely driven by increasing vehicle prices. Meanwhile, delinquencies (PAR 31–180%) increased across all lender types from Mar’24 to Mar’25. Private Banks saw PAR 91–180% rise to 1.60% in Mar’25, up from 1.17% in Mar’24, while NBFCs initially showed improvement in Mar’24 but deteriorated again by Mar’25, highlighting fluctuating risk trends.

CONSUMPTION LOANS

AUTO LOANS Auto loan growth moderated sharply in FY25, with origination value rising just 5.2% YoY to Rs359,507 Cr, down from 15.3% in FY24 and a peak of 37.6% in FY23, reflecting weaker consumer demand and post-pandemic normalization. PSU banks and NBFCs gained market share, while private banks saw a decline—their origination value share dropped from 32.0% to 28.6%, and volume share fell from 23.2% to 21.2%. Loan mix continued to shift toward larger-ticket segments, with Rs10L+ loans increasing from 36.5% in FY22 to 49.1% in FY25, driven by rising vehicle prices and changing consumer preferences. Delinquency trends diverged by lender: PSU banks demonstrated greater control across PAR 31–180%, while NBFCs saw a rise in both early and later-stage stress, reflecting increased risk exposure.

CONSUMER DURABLE LOANS

Consumer Durable loan origination growth slowed notably in FY25, with value rising just 3.3% YoY to Rs160,182 crore, compared to 18% YoY growth in FY24. NBFCs strengthened their dominance, expanding their share of origination value to 80.9% and volume to 83.7%, continuing a steady upward trend since FY22. The market also witnessed a gradual shift toward mid-range loans (Rs25K–Rs50K), even as the Rs10K–Rs25K segment remained the largest by value. Portfolio stress indicators slightly worsened, with rising delinquencies across both NBFCs and Private Banks—particularly in the PAR 91–180% range. While the Rs10K–Rs50K segment showed moderate strain, loans above Rs50K displayed a rising trend in delinquency, signaling the need for closer risk monitoring

CREDIT CARDS

New Card Originations Slow Sharply in FY25 After Sustained Growth New card issuances fell to 216.4 lakh in FY25, down 26.4% YoY, marking a reversal from the robust growth seen in FY22 and FY23. This follows a peak of 294.1 lakh cards in FY24, indicating a clear loss of momentum likely driven by tightening credit standards and demand moderation. Private Banks remained the dominant issuer group, though their share of new card originations declined marginally by 1.7 percentage points in FY25, suggesting increased competition or strategic recalibration. Credit performance trends were mixed: early-stage stress (PAR 1–30%) improved steadily—from 4.1% in Mar’23 to 2.7% in Mar’25—while mid-stage PAR (31–90%) remained stable. However, longer-term delinquencies (PAR 90%+) surged to 15.0%, signaling a build-up of repayment pressure among overdue accounts.

MICRO, SMALL, MEDIUM EXPOSURE BUSINESS LOANS Entity MSMEs witnessed 7.4% Y-o-Y degrowth in Originations value and 17.1% Y-o-Y growth in Originations volume in FY25. ORIGINATIONS VALUE -7.4% ORIGINATIONS VOLUME 17.1% For Individual MSMExs, Y-o-Y growth in Originations value stood at 4.5% in FY25. At the same time, Y-o-Y degrowth in Originations volume stood at 11.4% in FY25.

ORIGINATIONS VALUE 4.5% ORIGINATIONS VOLUME -11.4%

Originations include both fresh disbursements and renewals. Individual MSMExs and Entity MSMExs witnessed overall improvement in delinquency across many bands compared to Mar’24. The number of registrations in India have crossed 6.5 crore as per Udyam Registration Portal including Udyam Assist Platform*, indicating the potential of India’s entrepreneurial boom. With the support of government initiatives and proactive participation from financial institutions, the sector is poised for significant growth in the years to come.

MICRO, SMALL, MEDIUM EXPOSURE BUSINESS LOANS

Micro, Small, Medium Exposure Businesses (MSMEx) loans, crucial for the growth and sustainability of small businesses in India have grown exponentially over the years. Total MSMEx lending comprises of Entity MSMEx Loans (Rs40.4 L Cr) and Individual MSMEx segment (Rs43.1 L Cr). Credit facilities availed by Enterprises like Proprietorships, Partnerships, Pvt Ltd, Public Ltd, HUFs etc. and reported to Commercial repository are referred to as Entity MSMEx loans. Credit facilities availed by self-employed individuals taking loans for business purposes and reported to Consumer repository are referred to as Individual MSMEx loans. Individual MSMEx segment witnessed robust Y-o-Y growth of 25% in portfolio outstanding while Entity MSMExs grew by 20% as of Mar’25.

MICROFINANCE LOANS

Microfinance in India saw contraction across portfolio outstandings and loan originations. Portfolio outstanding of Microfinance Loans witnessed degrowth from 26.8% as of Mar’24 to -13.9% to reach Rs381.2 K Cr as of Mar’25. NBFC-MFIs and Banks are instrumental in driving growth for MFI. In the last few years there has been shift in loan size towards higher ticket-size loans. Between FY24 and FY25, MFI witnessed 11.1% increase in Average Ticket Size from Rs46.2K to Rs51.3K. The microfinance portfolio contracted as lenders recalibrated exposure and adopted more cautious lending strategies to manage rising stress.

Microfinance in India saw contraction across portfolio outstandings and Portfolio outstanding of Microfinance Loans witnessed degrowth from NBFC-MFIs and Banks are instrumental in driving growth for MFI. In the last few years there has been shift in loan size towards higher ticket-size loans. Between FY24 and FY25, MFI witnessed 11.1% increase in The microfinance portfolio contracted as lenders recalibrated exposure and adopted.

Y-o-Y degrowth in Originations value deepened from 20% in FY24 to -26.4% in FY25. At the same time, Originations volume saw a sharper declined from 6.8% in FY24 to -33.7% in FY25.

According to Sachin Seth, Chairman - CRIF High Mark Credit Information Company Regional MD - CRIF India / South Asia; In recent years, the Indian economy has demonstrated remarkable resilience, navigating challenges, supply chain disruptions, and inflationary pressures. Despite these hurdles, lending dynamics continue to evolve, reflecting shifting borrower preferences and macroeconomic influences. FY25 saw moderated originations growth, with higher-ticket loans gaining traction while smaller-ticket segments facing stress. Risk aversion by lenders and regulatory guidelines have shaped lending trends across categories, leading to a recalibration in lender strategies. PSU Banks and NBFCs expanded their market share, while private banks saw relative declines in select segments. Risk management remains a key priority, with early-stage stress showing improvement, though later-stage delinquencies continue to pose challenges, particularly among subprime borrowers and low-value loans. Lenders are refining credit policies to balance portfolio risk and sustain growth amid evolving market conditions. Leveraging our expertise in the lending ecosystem, advanced analytics, and big data capabilities, we aim to equip stakeholders with valuable perspectives to drive informed decision-making and foster growth in India’s financial landscape.