New business premium growth for private insurers estimated at a resilient 13-16% in FY2024

FinTech BizNews Service

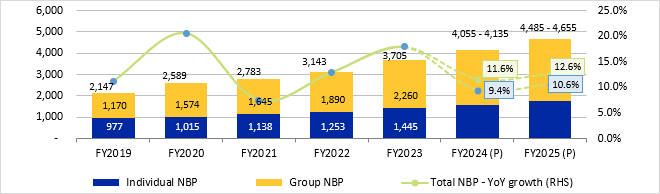

Mumbai, November 9, 2023: ICRA expects the life insurance industry’s new business premium (NBP) to grow to Rs. 4.06 4.14 trillion in FY2024 and Rs. 4.49-4.66 trillion in FY2025, up from Rs. 3.71 trillion in FY2023, translating into an industry-wide NBP growth of 9-12% for FY2024 and 11-13% for FY2025 respectively. With steady growth in renewal premium income, the gross premium written (GPW) is expected to increase to Rs. 8.56-8.64 trillion in FY2024 and Rs. 9.37-9.55 trillion in FY2025, from Rs. 7.86 trillion in FY2023E.

The individual NBP for the industry expanded at a sharp 15.4% year-on-year (YoY) in FY2023 (4-year CAGR of 10.3%) to Rs. 1.45 trillion, partly attributed to the significant growth in the guaranteed non-par individual segment. The expansion was also driven by the levy of taxes on the returns from these policies if the annual premium paid exceeded Rs. 5 lakh per annum. This change was applicable from April 2023 onwards leading to sharp increase in premium in FY2023 resulting in a moderation in the industry’s individual NBP growth to 7.7% on YoY basis during H1 FY2024. ICRA expects the individual NBP to rise by 8-10% in FY2024 and 10-12% in FY2025.

Contrary to the individual segment, the group NBP for the industry witnessed a contraction by 22.6% in H1 FY2024, because of shrinkage in LIC’s group business. Given that the latter accounted for 75% of LIC’s NBP in FY2023 and LIC accounted for 63% of industry NBP, the revival in its group business will be critical for the overall NBP growth of the industry. In the absence of this, the NBP for the industry is likely to contract.

Ms. Neha Parikh, Vice-President and Sector Head – Financial Sector Ratings, ICRA, says: “Notwithstanding the contraction in NBP for LIC’s group business, the private sector continues to maintain the growth momentum in individual as well as group businesses. Accordingly, we expect the NBP expansion for private sector to continue to outpace industry growth; the NBP of the private sector is expected to expand by 13-16% to Rs. 1.57-1.59 trillion in FY2024 and further by 14-16% to Rs. 1.80-1.87 trillion in FY2025. The market share of private sector in NBP will increase to 40% for FY2025 from 37% for FY2023.”

Ms. Parikh added: “Despite the growth in NBP, the value of new business (VNB) growth for the industry is estimated to moderate in FY2024 compared to FY2023, as the share of high margin (guaranteed non-par individual) businesses is likely to decline.”

Profitability for the large private insurers, as reflected in VNB and VNB margins, has improved during the last few years, which in turn was driven by strong growth in the premium as well as change in product mix to higher margin non-par individual savings products. Accounting profitability is likely to remain range-bound in FY2024 (return on equity (RoE) of ~10-11%). LIC’s profitability in terms of VNB and VNB margins will remain contingent on its ability to diversify its product mix and widen its distribution network.

The solvency for private insurers remains comfortable in relation to the regulatory requirement of 1.50x. LIC’s capital consumption would depend on its ability to grow its individual business. In addition, insurers have the headroom available to raise sub-debt, that could support the solvency.