PL Wealth Management: Flexi Cap Fund was the best performing category where 79.49% of the schemes outperformed the benchmark

FinTech BizNews Service

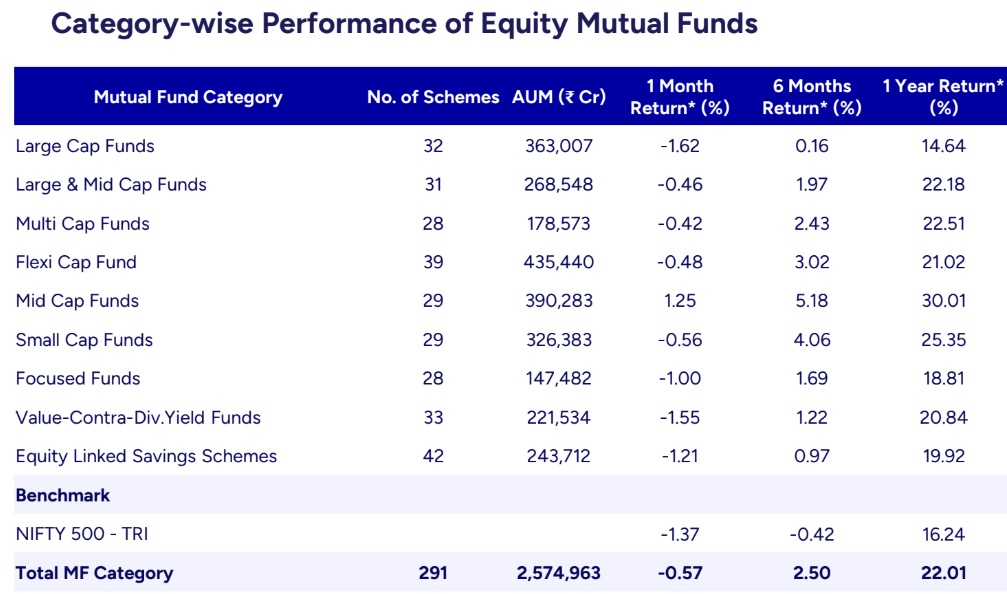

Mumbai, January 24th ,2025: PL Wealth Management, PL Capital - Prabhudas Lilladher’s wealth management arm, in its latest study on mutual fund performance analysis cited that the AUM (assets under management) of equity mutual funds have witnessed a decline/growth by 0.41% sequentially to INR 25,84,851 crore in December 2024 from INR 25,74,205 crore in November 2024 excluding Sectoral / Thematic Funds). The study which is based on 291 open-ended equity diversified funds cited that 60.82% of these funds have outperformed their respective benchmarks over the past one month, ending December 31st, 2024. The cumulative total of funds that outperformed stood at 177 during the month ending December 31st, 2024 (one month).

Category

| Benchmark | Number of Schemes | Number of schemes that Outperformed | Scheme Outperformance (%) |

Large Cap funds | S&P BSE 100 - TRI | 32 | 23 | 71.88% |

Large & Mid Cap Funds | NIFTY LargeMidcap 250 - TRI | 31 | 20 | 64.52% |

Multi Cap Funds | Nifty500 Multicap 50:25:25 - TRI | 28 | 20 | 71.43% |

Flexi Cap Fund | NIFTY 500 - TRI | 39 | 31 | 79.49% |

Mid Cap Funds | Nifty Midcap 150 - TRI | 29 | 14 | 48.28% |

Small Cap Funds | Nifty Smallcap 250 - TRI | 29 | 12 | 41.38% |

Focused Funds | NIFTY 500 - TRI | 28 | 16 | 57.14% |

Value Contra Div. Yield Funds | NIFTY 500 - TRI | 33 | 12 | 36.36% |

Equity Linked Savings Schemes | NIFTY 500 - TRI | 42 | 29 | 69.05% |

Total |

| 291 | 177 | 60.82% |

Source: Ace MF

Flexi Cap Fund was the best performing category where 79.49% of the schemes outperformed the benchmark. It was followed by schemes of Large Cap funds and Multi Cap Funds which outperformed their respective benchmarks by 71.88% and 71.43% respectively during the month of December 2024.

Value Contra Div. Yield Funds were the least performing fund category with only 36.36% of funds outperforming the benchmark.

For the month ended December, 2024, monthly returns of Nifty 50 TRI, Nifty Midcap

150 TRI & Nifty Small Cap 250 TRI were -2.02%, 1.12% & 0.2% respectively.

Out of the 291 open-ended equity diversified funds, about 60.82% of the funds were able

to outperform their respective benchmarks over the past one month, ended December

31st, 2024. Previous month, 64.53% of the schemes were able to beat their benchmarks.

For the 1-year ended December, 2024, returns of Nifty 50 TRI, Nifty Mid Cap 150 TRI &

Nifty Small Cap 250 TRI ret6urns were 10.09, 24.46% & 27.21% respectively.

Out of the 275 open-ended equity diversified funds, about 71.27% of the funds were able

to outperform their respective benchmarks over the past one year, ended December 31st

,2024. Previous month, 70.27% of the schemes were able to beat their benchmarks.

Investors are advised to stick to their SIP investments and keep a long-term focus. SIPs

over the past 3-years have yielded a return in excess of 15% p.a. on an average for the top

quartile equity funds.