Equities: Valuations, Sentiment Moderated, May Need Further Correction To Stabilize

Though foreign investors show interest in Indian bonds, volatility in US yields may continue to influence inflows

FinTech BizNews Service

Mumbai, 7 November, 2024: SBI Mutual Fund has come out with a Market outlook report of November by Mr. Rajeev Radhakrishnan, CIO, Fixed Income, SBI Mutual Fund and Mr. Gaurav Mehta, CIO, Alternatives Equity, SBI Mutual Fund

The report provides a well-rounded perspective on market dynamics, risks, and opportunities in a manner that aligns with current economic insights and investment outlook.

Key Highlights:

- US 10-Year Yields Surge Amid Uncertainty: Following a recent rate cut, the benchmark US 10-year yield increased by ~70 basis points due to strong data and US election uncertainties, leading to global market volatility.

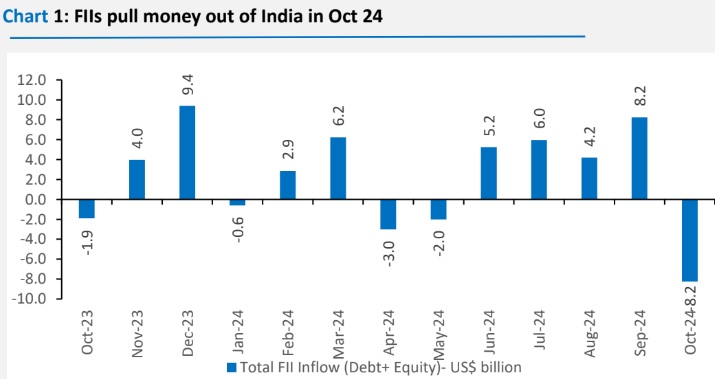

- Chinese Stimulus Draws Portfolio Flows: Stimulus measures in China have driven portfolio flows back into Chinese assets, potentially causing some outflows from Indian markets.

- Indian Equities Underperform: Amid global volatility, Indian equities, historically strong performers, saw underperformance in October as defensive sectors (Consumer, Healthcare, Technology) outpaced cyclical sectors (Defense, Real Estate, Industrials, PSUs). Quality stocks began to outperform Value stocks, and market breadth narrowed, indicating weaker broader market support.

- Elevated Valuations & Earnings Slowdown: Indian equities remain richly valued compared to emerging markets, while earnings downgrades outnumber upgrades. Valuations and sentiment have moderated but may need further correction to stabilize.

- Fixed Income: Indian government bond yields rose across tenors, mirroring the trend in US Treasury yields. Though foreign investors show interest in Indian bonds, volatility in US yields may continue to influence inflows.

- RBI Policy Stance Shift: RBI adopted a neutral stance in October, providing flexibility in response to evolving macro challenges. Policy rates are expected to remain stable for the coming quarter, with potential easing in early 2025 if inflation trends align with targets.

- Outlook for Fixed Income Portfolios: With anticipated yield softening, short- to medium-term bond investments (up to 5-year maturity) are positioned to benefit from favorable risk-reward dynamics in H2 FY25.

- Long-Term Equity Positives Remain: Despite near-term market turbulence, India’s structural growth story remains supported by an uptrend in corporate profitability relative to GDP, benefiting from manufacturing revival and EM recovery.

In conclusion, global factors like rising US yields and China’s stimulus have brought volatility to Indian markets, leading to outflows and shifts toward defensive and quality stocks. While short-term pressures remain, India’s long-term growth outlook is strong, supported by structural earnings growth and favorable economic fundamentals. A focused approach on quality equities and shorter-duration bonds provides a balanced strategy in this evolving landscape.