Based on the level of neutral rate, the current level of policy rate is just right: Namrata Mittal, Chief Economist, SBI Mutual Fund

FinTech BizNews Service

Mumbai, August 8, 2024: RBI kept the policy rate unchanged at 6.50% in its monetary policy meeting today. Stance was retained at ‘withdrawal of accommodation’. The outcome was attainted with a majority of 4:2. Prof Jayanth Varma and Dr Ashima Goyal, on the other hand, opined for a 25bps rate cut and change in stance to ‘neutral’.

Namrata Mittal, Chief Economist, SBI Mutual Fund, observes: RBI’s growth projection is solid at 7.2%, slightly more than the economic survey’s expectation of 6.5-7%, with every quarter until Q1 FY26 reporting a +7% growth. While the 7% growth in FY25 seems doable, we would watch out for the risks from moderating global growth momentum and weakening fundamentals for the US consumers which could potentially impact export outlook and business sentiments in India.

The a) 60bps of upward revision to Q2 FY25 CPI, b) the categorical reinstatement of importance of food inflation in overall inflationary expectations in India, c) the ongoing challenges within the banking system to secure sticky long-term deposit and d) OMO sale in July to keep the overnight rate aligned to Repo are strong signals that monetary easing is comfortably some time away in India. During the media conference, it was highlighted that India’s neutral rate (revised up to 1.4-1.9%) has been driven up by higher potential growth rate and is projecting a better performance of the Indian economy. And based on the level of neutral rate, the current level of policy rate is just right.

The chances of rate cut by the US Fed in September is high- they have telegraphed as much. The market is pricing in 50bps cut in September followed by another 50-75bps through the course of 2024. If the US Fed is firmly on the path of monetary easing, market expectations on monetary easing in India could build up. That said, the assumptions of monetary easing in the US begs deeper probing. Fed Funds rate at 5.25-5.% for a year now, contractionary money supply and positive real rates are a recipe for slowdown in the US demand. The wipe out of excess savings and cooling labour market conditions implies that both growth and inflation should moderate going ahead. But for now, the growth in the US is moderating, not collapsing. Further, in all probability, the fiscal policy is unlikely to turn restrictive any soon. And hence, the rate cuts by the US Fed may not be as aggressive as market is expecting. During the September meeting, the Fed may do it best to both sound dovish but nonetheless pass the message that further cuts are 'data dependent'. This, in turn means that, RBI could continue to focus on the domestic dynamics of misaligned credit to deposit ratio within banks and elevated food inflation.

Now coming to the inflation outlook in India. RBI has maintained the FY25 inflation projection at 4.5% but significantly revised up its Q2 FY25 projection to 4.4% vs. 3.8% in the previous policy. Headline CPI in India stands at 5.1% y-o-y in June and is expected to moderate to under 4% over the next two months (aided by the base effect). More importantly, CPI ex of veggies has averaged around 3.6% y-o-y during 6M 2024, which begs a more nuanced outlook on vegetable inflation outlook.

RBI’s growth and inflation projection over the monetary policies

| RBI's growth projections | RBI's CPI projections |

| |||||||||||||||||||

October 2023 Policy | December 2023 Policy | February 2024 Policy | April 2024 Policy | June 2024 Policy | August 2024 Policy | October 2023 Policy | December 2023 Policy | February 2024 Policy | April 2024 Policy | June 2024 Policy | August 2024 Policy |

| ||||||||||

Q1FY24 | 7.8 | 7.8 | 7.8 | 8.2 | 8.2 | 8.2 | 4.6 | 4.6 | 4.6 | 4.6 | 4.6 | 4.6 |

| |||||||||

Q2FY24 | 6.5 | 7.6 | 7.6 | 8.1 | 8.1 | 8.1 | 6.4 | 6.4 | 6.4 | 6.4 | 6.4 | 6.4 |

| |||||||||

Q3FY24 | 6.0 | 6.5 | 8.4 | 8.6 | 8.6 | 5.6 | 5.6 | 5.4 | 5.4 | 5.4 | 5.4 |

| ||||||||||

Q4FY24 | 5.7 | 6.0 | 7.8 | 7.8 | 5.2 | 5.2 | 5.0 | 5.0 | 5.0 |

| ||||||||||||

FY24 | 6.5 | 7.0 | 7.3 | 7.6 | 8.2 | 8.2 | 5.4 | 5.4 | 5.4 |

| 5.4 | 5.4 |

| |||||||||

Q1FY25 | 6.6 | 6.7 | 7.2 | 7.1 | 7.3 | 7.1 | 5.2 | 5.2 | 5.0 | 4.9 | 4.9 | 4.9 |

| |||||||||

Q2FY25 |

| 6.5 | 6.8 | 6.9 | 7.2 | 7.2 |

| 4.0 | 4.0 | 3.8 | 3.8 | 4.4 |

| |||||||||

Q3FY25 |

| 6.0 | 7.0 | 7.0 | 7.3 | 7.3 |

| 4.7 | 4.6 | 4.6 | 4.6 | 4.7 |

| |||||||||

Q4FY25 |

| 6.9 | 7.0 | 7.2 | 7.2 |

| 4.7 | 4.5 | 4.5 | 4.3 |

| |||||||||||

FY25 |

|

| 7.0 | 7.0 | 7.2 | 7.2 |

|

| 4.5 | 4.5 | 4.5 | 4.5 |

| |||||||||

Q1FY26 |

|

|

|

|

| 7.2 |

|

|

|

|

| 4.4 |

| |||||||||

Coloured value highlights the actuals | ||||||||||||||||||||||

Source: RBI, SBIFM Research

Heatwaves in April and May had impacted vegetables supply and drove vegetables prices higher in June and July. Doing a bottom-up analysis and assuming weather conditions to normalize, Vegetables index can correct by 15% between August’24 to March’25. Vegetables prices had risen 16% in FY24. Typically, looking at historical patterns, a sharp rise in one year is followed by a deflation or paltry inflation in the immediate next year. The vegetable price Index tends to stay in a range in 3-4 years and then correct up to a new level. This adjustment to a higher new level has already materialized in FY24.

Consequently, even as we worry about recent telecom and electricity tariff hikes, and vegetables inflation, we still stay in the camp that CPI inflation could hover around 4% in 2H FY25. The key factors attributing to moderation in headline inflation a) scope for big correction in vegetables inflation in 2H FY25, b) potential for moderating inflation in sugar, spices, and pulses. There are a few segments such as telecom, electricity and select services which could see higher inflation. But the very fact that transportation cost (petrol and diesel) has been flat for last two years, and the household goods businesses see a lack of pricing power would keep core inflation benign. Weather stays as a risk to the inflation call (as always).

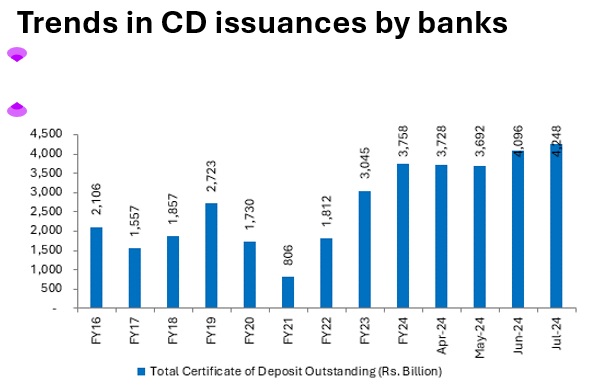

This brings us to the third subject of elevated bank credit to deposit ratio in India. Since 2000, there have been three phases of a sustained positive gap between credit and deposit growth (2004-07, 2010-13, 2017-19). By the very nature, deposit growth cannot jump massively unless the return offered become extremely lucrative, while credit creation could be at the discretion of the banks. But at the same time, the credit growth in India is not excessive (except for a certain segment of retail loans). Credit growth (ex of HDFC merger) has moderated from the peak of 16% in Nov’23 to 14% by mid Jul’24. Overall, for FY25, we expect credit growth at 14%y-o-y, while deposit growth could be ~13.0% y-o-y vs. the current levels of 14% and 11% presently. Which means that, even as policy rate hikes have been done by the central bank, the cost of funds could possibly remain elevated for a while. By conducting the OMO sales over July, RBI has clearly signalled that it is keen to keep overnight rate closely anchored to the Repo rate and prevent excess build up in core liquidity. The questions to LCR were averted citing it to still be in consultation mode.

To sum, the policy statement was decisive in terms of communicating RBI's mandate to align headline inflation closer to the target of 4%.

Notwithstanding comforting signals from the easing core inflation, the importance of headline in shaping expectations and avoiding spillover to general prices was emphasized. This clearly pushes back expectations on RBI reacting to short term market volatility and US FED actions in changing the stance of policy in the near term. In the backdrop of robust domestic growth monetary policy will likely remain focused on aligning inflation closer to the target, while being alert to any threats to financial stability from external spillovers. Lack of any specific mention of OMO sales in the Governor's statement was at the margin comforting, even as we expect any excess liquidity to be gradually sterilised so that the overnight rate settings are aligned closer to the repo rate.