Every US recession in the last 5 decades has been preceded by a yield curve inversion, or negative term spreads

FinTech BizNews Service

Mumbai, December 25, 2023: As we are fast approaching the new year, Milan Mody, Fund Manager, Fixed Income, 360 ONE Asset, shares his well studied debt outlook for the year 2024:

Debt Market Outlook 2024

The outlook for the bond market looks favourable with the rate environment seeming benign. The monetary policy will continue to be actively disinflationary keeping an eye on global cues & events, being strongly inter-related. Despite the core inflation steadily easing, food inflation remains volatile and broad-based & remains a key concern. A reasonable visibility on the potential attainment of 4% inflation target and easing in policy rates from the developed markets could pivot the reaction by RBI in favour of a rate cut, possibly in Q2 FY24, we estimate a total of 50bps rate cuts in the next financial year.

Image Caption

Image Caption

Global Landscape:

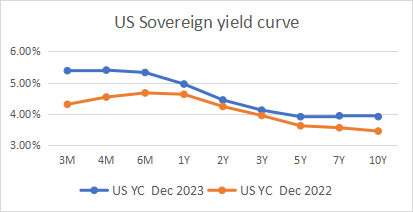

US: Every US recession in the last 5 decades has been preceded by a yield curve inversion, or negative term spreads. Since 1900, the yield curve has inverted 28 times; in 22 of these occasions, a recession has followed. There has often been a 22-month lag between curve inversion and the beginning of a recession. The US Yield Curve has been inverted since July 2022 signalling a recession where dates coincides with Fed guidance near May 2024. Recent FED’s dovish statements along with rate cut guidance surprised investors helping 10-year benchmark moving below 4% mark. Question for bond yields to ease further will depend on the extent of slowdown in US economy. The dot plot also showed that members now expect indicates 75 bps rate cuts in 2024 and another 100 bps in 2025. We see US inflation slowing to 2.9% mark by June 2024 and to the 2.6% mark by December 2024 that would open up space for 75bps worth of cumulative rate cuts over the next calendar year starting from June 2024. Most of this pricing is getting reflected in yields with a 55bps fall in 10-year yield since November 2023. Nevertheless, a rate cut cycle in US should drive dollar lower as is visible since November 2023. And a weaker dollar should drive commodity prices higher. But that should be happening in the later part of 2024.

Besides the US Fed, ECB is increasingly confronted with calls for rate cuts given that deteriorating economic momentum shows the eurozone economy has more problems digesting higher rates than the US. The downward surprise in November inflation brought forward the market pricing of the first ECB rate cut to March 2024, with a total of 125 basis points of cuts priced in for 2024. While the core inflation in the UK is stickier than elsewhere and is expected to recede slower than in peer economies, BOE has reasons to be patient with cutting rates but is likely to follow with some lag. China’s growth issue and financial stress is well articulated and is likely to remain supportive from loose monetary policy by government through various formats. While BOJ remains in a tight spot for now for the loose policy outlook ahead. Currently, global bond yields outlook looks benign, but we think there will be volatility due to fast changing macro-data points and markets repricing the events hence it don’t be a linear decline in bond yields.

Local Landscape:

Indian economy seems to be in an extended Goldilocks period, with strong headline growth, stable political mandate, capped core inflation with small risk of higher food inflation but softer lower crude prices. In terms of the reversal of policy in India, we think it would happen in three stages. First will be when the RBI starts loosening the liquidity stance. The first sign of liquidity easing is likely with RBI’s announcement of VRR (variable rate repo) operations to infuse liquidity in markets. As government spending picks up, RBI is likely to allow liquidity to flow to the system, expected to happen in Feb-March 2024. Feb-March is typically the time when the bulk of the spending happens and government surplus by then would have come down. Post that, based on global clues there could be a change in the stance followed by a rate cut.

We remain conservative in our CPI inflation forecast for FY24 to 5.6%, due to sudden climate changes impacting food prices, supply bottle-necks and volatility in imported commodity while the core inflation might have bottomed out but is likely to remain low & sticky as higher housing EMI/ rent comes for revision in index. We expect headline CPI inflation to remain ~5.50% in H1 2024 but is likely to ease to 4.0-4.5% in H2 2024. The moderation in H2 2024 reflects not only base effects, but we think that food inflation might ease, due to lower pulses inflation assuming a normal monsoon allowing rate action in June encouraged from rate cuts actions by FED & ECB in April -May . For FY25, our forecast remains unchanged at 4.50% similar to the RBI’s outlook. we are concerned about headwinds from uneven growth drivers, weaker global growth conditions and waning terms-of-trade support, which could lead to GDP growth slowing to a below-consensus 5.6% y-o-y in FY25 vs 6.7% in FY24.

The MPC members have often expressed comfort around a real rate of around 1.50%. With inflation likely at 4.5% levels, the current 6.50% nominal repo rate would result in a real rate of close to 2.0% which would be restrictive in times of a growth slowdown. Hence, we think RBI will deliver total 50bps of rate cuts cumulatively starting with June 2024, it is likely to be a shallow rate cutting cycle and it will largely follow the Fed especially if followed by an increase in the quantity of dollars in the global system, can give comfort to the RBI towards easing liquidity conditions.

On the fiscal maths front, Centre has incurred only 45% of its FY deficit target which is among the lowest in 15 years. Receipts over seven months are at 60% of budgeted revenues, a 20-year high. Direct tax collections have surprised positively with 23.4% growth YoY at 10.64 trln. Given the strong tax growth and given the fact that the government has front-loaded the capex this year despite being an election year. Government has done a capital expenditure of 3.16 trln rupees i.e. 39% of the budgeted capital expenditure in the 22 states for 2023-24 (Apr-Mar). As a percentage of the Budget target, the spending of major 22 states have been the highest for Apr-Oct period in the last four financial years. according to data from the Comptroller and Auditor General of India.

We remain comfortable on the fiscal situation believing the centre will remain committed to the FY26 deficit target of 4.5%. So, if the 6% to 4.5% journey has to be traversed in two years, centre might set a 5.5% target for 2024-25 and 5.00 later. If so, the supply of would remain unchanged for nearly two- three years bonds (G-sec gross borrowing 14-16 trln rupees) as the nominal GDP likely to go up by 10% and hence the absolute figure remains the same, even as its demand from banks (40%), insurance and pension (35%) funds and Corporates/FPI/ MF (10%) is likely to keep growing. There is likely to be addition due to inflows from inclusion in global bond indices around USD23bn starting June 2024, with some debt inflows already underway. This can also bring down long-term funding costs.

Apart from duration in government securities, our preference for spread instruments would increase towards March, both on corporate bonds and state bonds during Jan-Mar in state bond supply, when spreads are likely to peak and become attractive. We think as the expectations of rate cut and higher liquidity gathers peace, for coming months the short-medium term yield curve (3-7-year segment) is set to outperform the longer maturity. The 10-year benchmark paper is likely to trade between 7.10% -7.20% in near-term and is likely to close the year 6.90% levels after the rate cut. Also corporate bond credits space also looks attractive especially as spreads have widened as sovereign’s outperformance due to index inclusion.