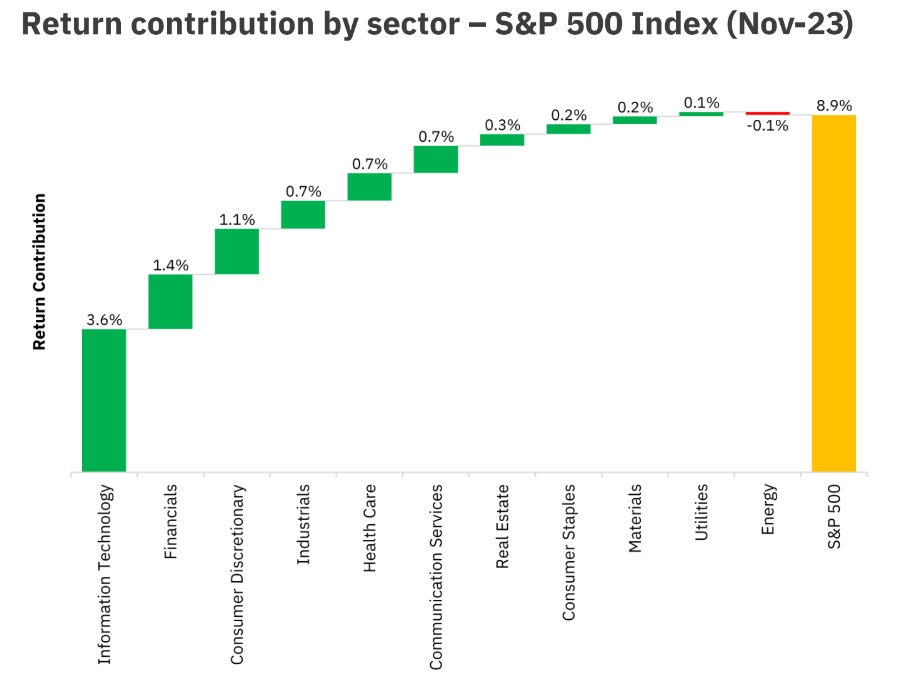

IT & Financial Services: The largest contributor to the S&P 500’s rise

Global Market Snapshot Nov 2023 by Motilal Oswal Asset Management Company

FinTech BizNews Service

Mumbai, December 6, 2023:

Indian Market Update

Nifty Smallcap 250 rose by 10.22% in November 2023

- Nifty 50 rose by 5.52%

- Nifty Next 50 rose by 9.09%

- Nifty Midcap 150 rose by 9.59%

- Nifty Microcap 150 rose by 10.64%

- Nifty 500 rose by 7.06%

Quick Take

- According to Motilal Oswal Asset Management Company’s Global Market snapshot report, in November 2023, the Indian stock markets experienced a notable upturn, as evidenced by a 6% surge in the Nifty 50 index. While the Smallcap 250 index outperformed, leading the gains with an impressive growth of 10%. Nifty Smallcap 250 rose by 10.22% in November 2023 and 11.07%, 33.68%, and 37.31%, in the last 3 Months, 6 Months, and 1 year, respectively.

- Across the board, all sector indices closed the month on a positive note. The realty sector emerged as the top performer, witnessing a substantial increase of 18%.

- Following a month of negative returns in factor-based indices, November marked a remarkable turnaround, with all factor-based indices experiencing notable increases.

Momentum emerged as the frontrunner, registering the highest rise at 12% during the month.

- The Financial Services sector continued to play a pivotal role in propelling the Nifty 500 index,

contributing significantly to its overall 7.1% increase in November 2023.

Global Market Update

- In the US, S&P 500 and NASDAQ 100 both experienced a 9% & 11% gains in November 2023, with the IT & Financial Services sector being the largest contributor to the S&P 500’s rise.

- Globally, both emerging and developed markets saw positive performance, rising by 9% and 8%, respectively. South Korea witnessed the most significant rise 16% followed closely by Germany & Taiwan rising by 13%

- Crude oil prices nosedived by 6% during November, due to rising geo-political risks, low demand from the US and mixed Chinese data.

- On the commodities front, precious metals were in the green with gold and silver prices rising by 2% and 8% respectively, amid rising tensions in the middle east. Cryptocurrencies like Bitcoin and Ethereum went soaring at 9% and 13%, respectively.

Economic Indicators

GST revenue collection rises 15% in November 2023. According to the Ministry of Finance, this is the highest YoY growth in monthly GST collections. It amounts to Rs.1.68 lakh crore

- India's Gross Domestic Product (GDP) growth rate came in at 7.6 percent for July-September, beating all estimates, data released by the Ministry of Statistics

- At the recent FOMC meeting, the Federal Reserve maintained interest rates at 5.50%, showing confidence in the US economy despite high inflation.

- Boosted by expectations of another rate hike, November saw US 10-year Treasury yields rise by 7 bps to 4.36% after having fallen below 4.3% for the first time since September

(Disclaimer: This has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The stocks/sectors mentioned herein is for explaining the concept and shall not be construed as an investment advice to any party. The information / data herein alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. All opinions, figures, estimates and data included in this material are as on date. This content does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken on the basis of this article. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)