Passive Debt funds recorded net outflows of around Rs9K Cr

Pratik Oswal, Chief of Business Passive Funds, Motilal Oswal Asset Management Company

FinTech BizNews Service

Mumbai, February 3, 2025: According to ‘Where the money flows’ study by Motilal Oswal Asset Management Company (MOAMC), India's asset management industry has witnessed a remarkable growth of >6X in the last 10 years, with its assets under management (AUM) growing to INR 66.93 lakh crore in December 2024 compared to INR 10.51 Lakh crore in December 2014. The Study reveals that Passive Funds AUM grown to INR 10.85 lakh crore with total of 16% Market Share, while Active Funds AUM stands at INR 56.08 lakh crore as of December 2024.

The study ‘Where the money flows’ aims to present a snapshot, highlighting the dynamic shifts and patterns that have shaped the mutual fund landscape in the past quarter. As per the study, Equities take away majority of the share with 60.19% of total AUM, followed by 26.77% in Debt, 8.58% in Hybrid and 4.45% in others.

Prateek Agrawal, MD & CEO, Motilal Oswal Asset Management Company Ltd said, “India’s mutual fund industry has seen remarkable growth, with AUM reaching ~Rs67 lakh crore, driven by economic progress and rising financial literacy. This expansion reflects the industry’s ability to meet diverse investor needs and strengthen the financial ecosystem. Innovation, technology, and tailored investment solutions will be key to sustaining growth and navigating future opportunities.”

Pratik Oswal, Chief of Business Passive Funds, Motilal Oswal Asset Management Company Ltd said, “Gaining clarity on the movement of funds within financial markets is essential for making strategic and informed investment decisions. Our latest report comprehensively examines cash flow trends and investor behavior within the mutual fund industry for the quarter ending December 2024, showing remarkable 6x growth in AUM over the past decade, reaching Rs66.93 lakh crore. These insights highlight emerging patterns, such as the dominance of Active Flexi Cap and Mid Cap funds, the rise of Passive Funds to a 16% market share, and may help in anticipating market shifts while aligning our strategies with evolving investor preferences."

Equity funds take a front seat

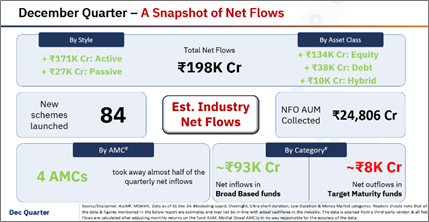

The MF Industry recorded net inflows of approximately Rs 199k Cr in the quarter. Equity and debt collectively account for 67% and 19% of the quarterly flows, respectively.

Active Equity led the way with net inflows of about Rs105K Cr, followed by Rs29K Cr in Passive Equity. Active Debt funds experienced net inflows of approximately Rs47K Cr, while Passive Debt funds recorded net outflows of around Rs9K Cr.

Investors preferred Broad Based funds

Broad-Based funds accounted for approximately 69% of market share, capturing the majority of equity net inflows. The share of Active Broad-Based funds rose from 57% to 70% on a quarter-on-quarter basis (QoQ), while share of Passive Broad Based Funds declined from 90% to 66% QoQ.

Among Active Equity, Thematic funds saw decline in net inflows from previous quarter, settling at Rs14K Cr. In Passive Equity, the decline in Broad-Based flows was offset by an increase in net inflows into Factor and Sector funds, which accounted for 22% and 10% of net inflows in this quarter, respectively.

Flexi Caps lead the Broad-Based segment

Investors preferred Active Flexi Cap & Mid Cap funds, each taking away around Rs15k Cr net inflows. Investors continued to prefer Passives for their Large Cap allocations with the category receiving ~84% of net inflows. However, there was a slight decline in the share of flows, which shifted towards the Mid-Cap and Small-Cap segments.

Investors preferred Consumption & Infrastructure in the Thematic segment

Overall, net inflows in thematic mutual funds declined from around Rs17K Cr to Rs14K Cr. Consumption and Infrastructure received significant inflows in the thematic space and accounted for Rs4.5K Cr. Passively managed Thematic funds saw emergence of new themes like Capital Markets, EV and Tourism.

Active Constant Maturity drive net inflows

Constant Maturity funds dominated the inflows, making up around Rs37k Cr, overall. This was followed by categories like Corporate Bond and Gilt, receiving inflows of around Rs6k Cr and Rs4k Cr respectively. Target Maturity funds, on the other hand, recorded net outflows of around Rs8K Cr.

Liquid funds drive Estimated Net Flows

Overall, Liquid funds constituted around 41% net flows, totaling at Rs15k Cr. This was followed by Low Duration & Ultra Short Duration categories, receiving inflows of Rs7.5k Cr and Rs7k Cr respectively. Generally, investors use debt funds with maturity up to 1 year to park excess cash in the short term leading to high volatility in inward & outward flows. The share of net inflows of Money Market funds declined from 27% to 9% (QoQ).

Multi Asset funds continue to see strong traction

Multi Asset funds led the Hybrid category, securing 48% of the net inflows, followed by Balanced Advantage (25%) funds. The share of net inflows for Equity Savings funds declined from 26% to 15%, while Aggressive Hybrid funds experienced a notable increase in their share, rising from 4% to 12% on a QoQ basis.

International Funds see continued pause in inflows

The international category experienced minimal flows across segments, largely due to restrictions on new investments in such schemes imposed by the RBI threshold. Active Broad-Based and Passive Broad-Based funds each recorded net inflows of Rs0.1k Cr. Passively managed thematic international Funds saw net outflows of Rs0.3K Cr.