Motilal Oswal Asset Management Company: Nifty Smallcap 250 saw a surge of 0.20% in Dec; Shown growth of 26.43% in a year

FinTech BizNews Service

Mumbai, January 6, 2025: According to Motilal Oswal Asset Management Company’s Global Market snapshot report, The Nifty Midcap 150 has shown growth of 1.12% in December. Index experienced a decline of 5.52% over the past 3 months, a surge of 1.48% over the past 6 months, and a one-year growth of 23.80%.

The Nifty Smallcap 250 has experienced a decline of 3.58% over the past 3 months, 3.75% growth over the past 6 months, and a 26.43% increase over the past year.

The Nifty Next 50 has seen a decline of 11.81% over the past 3 months, and a decline of 4.94% over the past 6 months, and growth of 27.45% over the past year.

The Nifty 50 has seen an 8.39% decline over the past 3months and a decline of 1.52% over the past six months and 8.80% increase over the past year.

The Nifty Microcap 250 index has declined by 2.64% over the last 3 months, an increase of 8.68% over the past 6 months, and 34.20% growth over the past year

In December 2024, the Nifty 500 Index declined by 1.37% in December 2024, reflecting broad market weakness. The Nifty 500 Index saw a decline of 7.71% over the past 3 months, a 0.82% over the past 6 months and a growth of 15.16% over the past year.

Momentum, Low Volatility, Quality, and Value strategic indices, also faced a downturn, with declines ranging from 3% to 4%.

Healthcare and IT sectors emerged as the top contributors with returns of 0.29% and 0.07%, respectively, while Financial Services and Energy sectors dragged the index down with contributions of 0.42% and 0.37%.

Defensive sectors like Healthcare outperformed with a surge in 5.84% in December, whereas cyclical sectors, particularly Financial Services and Energy, underperformed amid broader market sell-off. Realty Sector and Consumer Durables also has seen a surge of 3.16% & 4.06% respectively.

Global Market Update

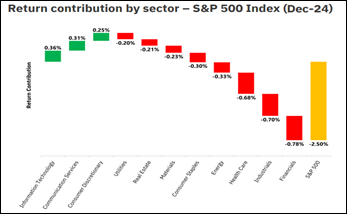

The S&P 500 Index declined sharply by 2.50% in December 2024, driven by significant weakness across major sectors.

IT and Communication Services were the key positive contributors, 0.36% and 0.31% respectively, while Financials and Industrials led the decline, 0.78% and 0.70% respectively. The index's negative performance was largely attributed to declines in Financials, Industrials, and Healthcare, which outweighed modest gains from IT and Communication Services.

Growth-oriented sectors like IT showed resilience, whereas value-heavy sectors such as Financials and Industrials underperformed significantly.

In December, Gold and silver declined by 1.58% and 5.85%, respectively.

Bitcoin fell by 2.92%, and Ethereum declined by 6.80%, reflecting subdued performance for digital assets during the month.

Inflation eased to 5.48% in November, down from 6.21% the previous month, reflecting a moderation in price pressures.

GST collections reached ₹1.77 lakh crore in December, reflecting strong economic activity and marking consistent growth in tax revenues.

Inflation in the US slightly increased to 2.70% in November, maintaining a controlled trend within the Federal Reserve's target range.

The unemployment rate in the US remained steady at 4.2%, suggesting a stable labor market despite ongoing economic challenges.