The challenge is not generating returns; it is having the patience to stay invested through market crashes, recessions, and global crises.

FinTech BizNews Service

Mumbai, March 24, 2025: According to Mutual Fund Pointer Report from Ventura, the benchmark indices Sensex and Nifty 50 both ended on a negative note, recording returns of 5.6% and 5.9%, respectively, in the month of Feb'25 as compared tothe previous month.India's retail inflation decreased to 3.61% in Feb'25. Also, the 10-year G-Sec yield increased by 3 basis points to close at 6.72% compared to 6.69%, in the last month.In the equity segment, FIls sold equities worth Rs. 34,574 crores, and DIls were net buyers worth Rs.64,599 crores inthe monthof Feb'25.Major worldwide indexes concluded February with a mixed performance. The Hong Kong Hang Seng saw the highest growth at 13.4%, while the BSE 500 posted the lowest close of 7.8% return.

Mutual Fund Update

SIP: A Tool to Convert Income into Wealth

Market cycles are an inevitable part of investing, often swinging between steep spikes and deep corrections. And yet, every downturn triggers panic — ‘Should | stop my SIPs? If timing the market were that easy, fortunes would be effortless. But history proves otherwise: panic breeds regret, while patience drives rewards. The key is to embrace volatility and let compounding build wealth.

In the last 5 years post-COVID, investors have not seen any meaningful correction in the markets till today. AMFI data shows new SIP registrations declined by ~21% while cancellations also saw a sharp drop by ~11%. Whereas there was a 4% increase in the new SIP registrations from Dec '24 to Jan '25; there was a very sharp rise of ~37% in cancellations, resulting in the stoppage ratio crossing 100% for the first time. The increase in this ratio in Feb 25 has more to do with a huge fall in new SIP registrations rather than cancellations per se.

Many investors pause their SIPs during market downturns, hoping to reinvest at a "better time" or chase higher returns elsewhere. Consider two investors, each starting a 71,000 SIP—one for 25 years at say 12% pa, growing it to 717.0 lacs, and another for 15 years at 15%, ending up with 76.2 lacs. Despite the higher returns, the investor who stayed invested longer earned ~2.8x more returns.

As pectacular case in point is Warren Buffett’s investment approach; his fortune was built not by chasing the highest returns but from the sheer duration of his investments. From $1M at age 30 in 1960 to S1B by age 56 (1986) and $161B when he is 94 (2025). TIME, not just high returns, is the real multiplier of wealth.

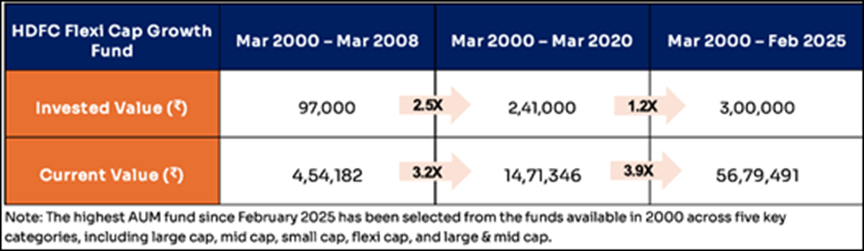

Let us analyse the investment journey over the last 25 years vs. exiting markets during corrections:

A 21,000 SIP started on March 1, 2000, would have seen different returns if the investor had discontinued during the 2008 financial crisis or stopped in March 2020 amid the COVID-19 crash, or stayed invested till Feb 2025. The data reveals how compounding plays a crucial role in wealth creation.

In the initial phase, it took nearly 12 years for the portfolio value to grow by 3.2x, while the total investment addition was 2.5x. Post-2020, a comparatively smaller 1.2x investment led to a 3.9x portfolio appreciation, a testament to the accelerating impact of compounding in later years.The power of compounding is not exclusive to equity markets; for instance, an investor who started a 71,000 SIP in PPF for 20 years invested 72.4 lacs, which grew to 25.2 lacs. However, by extending the investment duration to 25 years, with a total investment of 73.0 lacs, the corpus grew to %8.0 lacs.

The final five years alone massively contributed to returns; the investor only contributed 760,000 more but saw an extra 22.2 lacs gain—reflecting how Warren Buffett’s net worth compounded in later years. The only change has been that the rate of compounding was at 7% pa.

While the data is real, reality is different!

Consider starting a 1,000 SIP in the same fund we discussed above; since its launch in Jan 1995 till today, it would have accumulated to 1.9 crores.

The numbers are real—but is the reality of long-term investing the same? The challenge is not generating returns; it is having the patience to stay invested through market crashes, recessions, and global crises.

How many investors who started a SIP in 1995 have truly stayed the course for 25+ years? 1%? Maybe 2%? And even among them, how many remember their investments, and how many simply forgot about them in an old account? For the rest, fear, changing financial priorities, or the temptation to "book profits" led them to exit long before compounding could work its magic.

The irony? The real wealth in SIPs is created in the later years, yet most investors exit before they get there. SIP is not just about investing; it is a tool to generate wealth over a longer duration. By consistently investing, you can transform your income into wealth and work toward important goals, like retirement or education.

As Warren Buffett said, “The stock market is a device for transferring money from the impatient to the patient.” The only question is—on which side do you want to be?