NFO will open on Nov 18, 2024, and close on Dec 02, 2024

FinTech BizNews Service

Mumbai, November 11, 2024: Shriram Asset Management Company Limited, part of the Shriram Group, announced that the company will launch Shriram Multi Sector Rotation Fund, the first of its kind in the industry. This new fund aims to give capital appreciation over the medium to long term in an actively managed equity portfolio which rotates across identifiable trending sectors that are performing well. The fund's strategy is to leverage sector rotation to capture opportunities in outperforming sectors while reducing exposure to underperforming sectors.

Fund investment approach

The focus of the fund will be to invest in minimum 3 to 6 trending sectors, based on the relative momentum of the sectors, and exiting them when indications suggest a weakening trend. The sectors will be selected based on Shriram AMC’s proprietary Enhanced Quantamental Investment (EQI) framework. Quantitative Factors will be used to shortlist trending sectors, while the sectors so identified will be vetted based on fundamentals including macro-economic parameters, investment indicators, sentiment, prices etc before final sector selection. This approach will also help decide when rotation across sectors will be require. The final sector selection with sector weights, and decision to rotate will lie with the fund manager. Once the sectors are selected in this top-down approach, stocks from each sector will be decided bottom up by the EQI strategy, with the fund manager taking the final decision on portfolio construction and rebalancing. For the awareness of investors, the sectors which the Shriram Multi Sector Rotation Fund will focus on at any given point in time will be published in the monthly fund fact sheet.

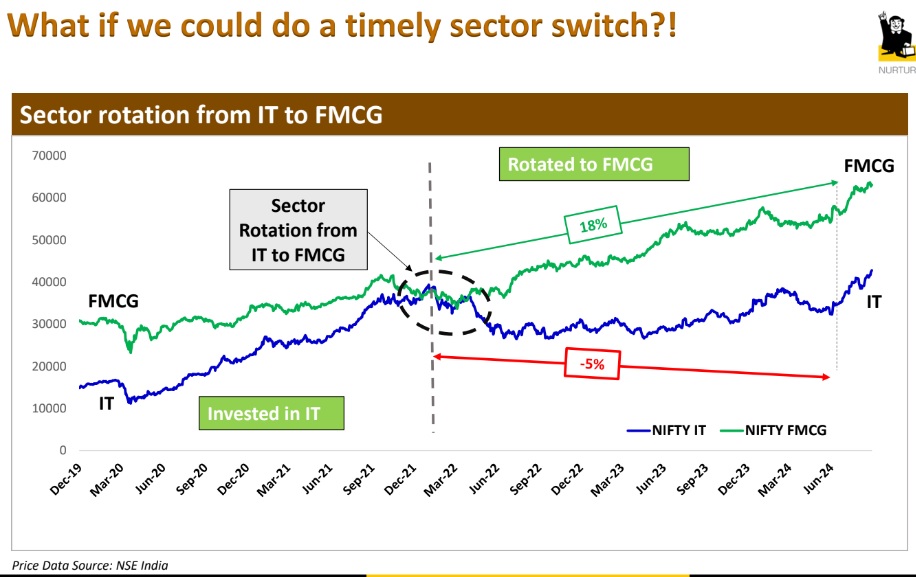

Mr. Kartik L Jain, MD & CEO, Shriram Asset Management Company Limited said, “Feedback from advisors indicates that investors often get caught in ‘sector traps’ when they invest in upcoming sectors that are trending due to macro-economic cycles or policy shifts. While their portfolio benefits from the uptrend, they usually remain invested even when the trend reverses or plateaus, due to inertia or behavioural biases. As a result of this, they may end up with lower or even negative annualised returns vs. if they had rotated their sector allocation on time. Shriram Multi Sector Rotation Fund aims to address this investor pain point to help them avoid sector traps and instead, ride sector trends by rotating across sectors in a timely manner. Our catch line ‘Jaisa sector trend, waisa aapka portfolio’ captures this essence. This is also tax efficient for the investor as there is no capital gains tax implication when the fund manager rebalances across sectors within the scheme.”

Mr. Deepak Ramaraju, Sr Fund Manager, Shriram AMC added: “Our two-tier approach of first doing a sector selection based on relative trends, and then doing stock selection, ensures that the fund remains true to label. Sector rotation and stock selection based on our proprietary Enhanced Quantamental Investment framework is also aimed at delivering sustainable alpha to our investors over time.”

Investment Options:

Investors can regularly invest in this fund through a Systematic Investment Plans (SIP), top-ups or a Systematic Transfer Plans (STP) from Shriram Overnight Fund to meet their financial and family goals. The minimum investment amount for lumpsum or SIP is ₹500. There is no lock-in period involved. The frequency of SIPs can be weekly, fortnightly, monthly or quarterly. Once a corpus is built up, investors can also set up a Systematic Withdrawal Plan (SWP) at a similar frequency to get regular income. Investors can purchase and manage their investments in all Shriram Mutual Funds online in a secure way via the ShriFunds portal at https://shrifunds.shriramamc.in.

The fund offers the investor the benefit of Long Term Capital Gains tax (LTCG) @12.5% (plus surcharge and cess) if they cross ₹1.25 lakh of capital gains in a fiscal year. If an investor redeems their investment in any sector fund to rebalance their sector allocation, they might face capital gains tax with each transaction. When the fund manager transacts within the scheme, there is no capital gains tax on the scheme. These two aspects make this fund a tax efficient investment option for investors who are looking at exposure to trending sectors.

Shriram Group has re-energized its mutual fund business, bringing in US-based Mission1 Investments LLC as its strategic partner. Shriram AMC has diversified its product portfolio, bringing relevant and differentiated investment solutions to its customers. The AMC is focusing on ‘Performance, Products and Placement’ to set the foundation for sustainable growth.