In capital markets, AMCs benefit from a market rebound, while rating agencies benefit from a weak base and healthy issuance momentum.

FinTech BizNews Service

Mumbai, July 9, 2025: The Kotak Institutional Equities has come out with a special report on Banks / Diversified Financials sector:

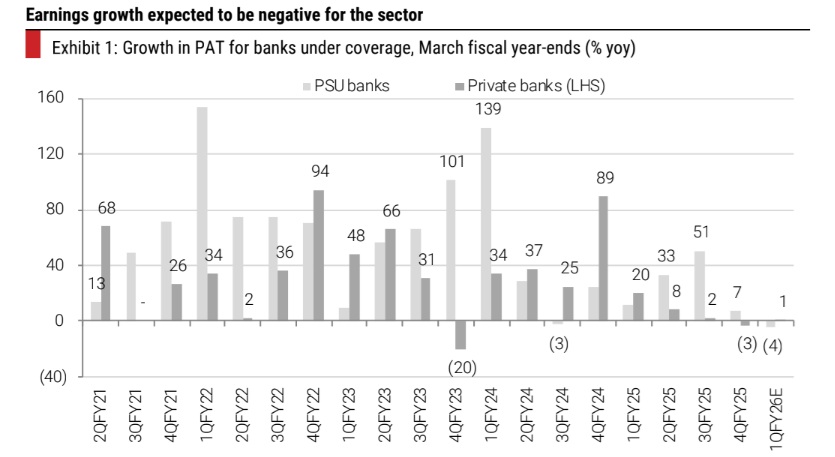

We should expect a relatively weak performance of banks, led by weak loan growth and NIM compression. 1QFY26 would be the first quarter where the recent rate cuts start to hurt revenue growth. Banks have fewer levers to offset this weakness, although trends in asset quality and consequently in credit costs should partially cushion this impact. Performance of NBFCs may be eclipsed by slowdown in disbursements and inch-up in delinquencies during the quarter. In capital markets, AMCs benefit from a market rebound, while rating agencies benefit from a weak base and healthy issuance momentum.

Entering a period of cyclically weak revenue growth for banks

We expect earnings to decline ~2% yoy on the back of weak revenue growth for banks. Provisional business data released by various banks confirms loan growth for frontline banks is at 7-12% yoy. FY2026 is expected to be a challenging year for NII performance across banks, as we enter a sharp downward rate cycle wherein loans re-price faster than deposits. We are building in NIM to decline by ~10-15 bps qoq, but note that different lenders may display different sensitivities to interest rates, given their composition of loans linked to different benchmarks and the timing of the pass-through. We expect public banks to take a higher impact in 1Q, while private banks would see a higher impact in 2Q. From a near-term commentary perspective, we expect most discussions to center around loan growth and the path of NIM over the next few quarters. The asset quality outlook is likely to be favorable. We expect lenders to report lower slippages from unsecured loans and MFI (slippages peaked in FY2025, but we are awaiting 1QFY26 trends, especially in the early warning buckets).

Rough patch for non-banks

Slowdown in new businesses and inch-up in delinquencies will likely be key takeaways from 1QFY26 performance of non-banks. Weak 1Q trends are typically discounted to be seasonal, although they remain monitorable this year. 1QFY26 NIMs enjoy comfort from falling rates, although the majority of borrowing-side benefits are expected in 2H. Stabilization of stress in unsecured PL and microloans is positive with moderate weakness in vehicles and secured MSMEs. Affordable home loans remain stable compared to most others; the performance of gold loans is likely at its peak.

Capital markets: Rising tide lifts some boats

1QFY26 was a strong quarter for equity markets, with Nifty-500 up ~10% on closing and 5% on an average basis, along with largely stable net MF flows. Among AMCs, equity AAUM growth is the highest for Nippon/HDFC due to healthy net inflows, reflecting the underlying fund performance. Among RTAs, Kfin’s earnings trends are likely to be stronger versus CAMS (impacted by pricing issues). Angel One is likely to report weak earnings due to both revenue pressures and high expenses. The rating business is likely to have a decent quarter, given mid-teen qoq growth in bond issuances (along with a weak yoy base), while non-rating revenue growth remains uncertain.