Five Trends That Will Shape the Next Chapter in Fintech

FinTech BizNews Service

Mumbai, June 2, 2025: QED Investors and Boston Consulting Group (BCG) have come out with a new report titled "Global Fintech 2025: Fintech’s Next Chapter - Scaled Winners and Emerging Disruptors". The report explores how fintech is entering a new era of profitability, innovation, and AI-driven disruption and India stands out as one of the most promising markets globally.

Sandeep Patil, Partner and Head of Asia at QED Investors and Co-author of the "Fintech's Next Chapter" report

Key highlights from the report include:

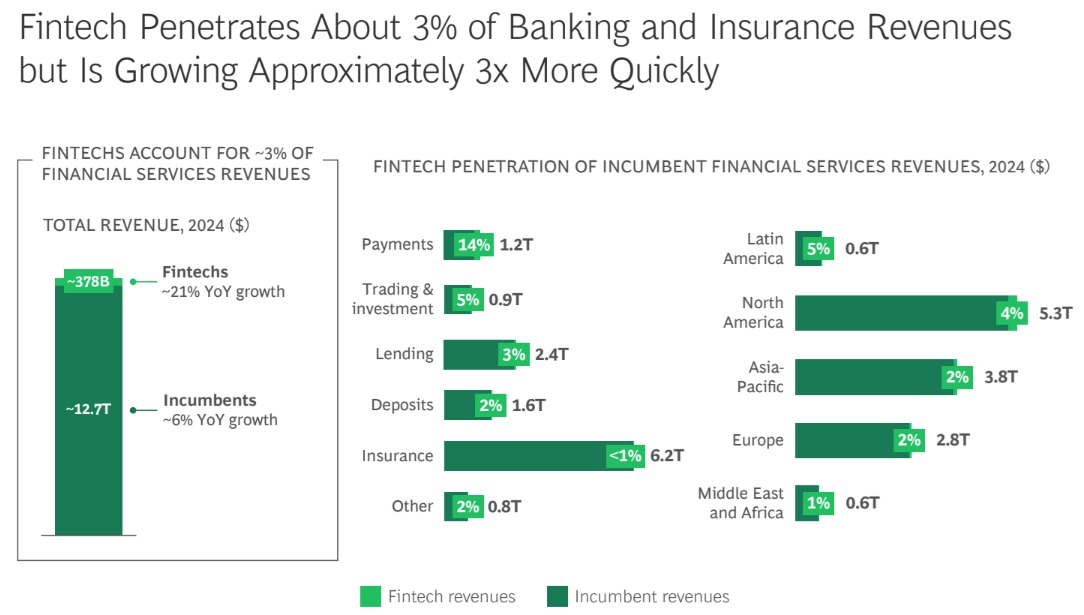

· Fintech revenues surged 21% in 2024, significantly outpacing the 6% growth in traditional financial services

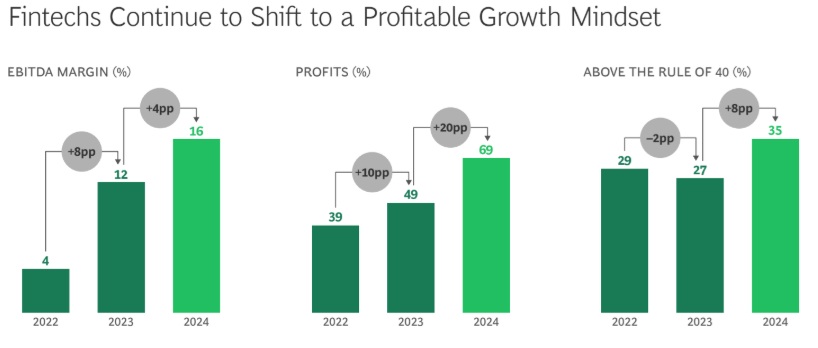

· 69% of public fintechs are now profitable, with EBITDA margins rising from 12% in 2023 to 16% in 2024

· India is spotlighted as a standout growth market, driven by digital infrastructure (UPI, Aadhaar, Account Aggregator), regulatory clarity, and a mobile-first population

· Over 150 private fintechs globally (founded before 2016, with $500M+ in equity) remain IPO-ready but are waiting for the right market window

· Private credit is emerging as a core funding pillar, with a $280 billion opportunity to support fintech-originated loans

Insights on India:

1. India stands out as a global fintech bright spot

India has emerged as one of the most dynamic fintech markets globally, driven by a potent combination of digital public infrastructure (UPI, Aadhaar, Account Aggregator), a mobile-first population, and regulatory clarity. Tools like UPI have enabled a wave of fintech innovation from digital lending to payments to wealth particularly benefitting underserved and unbanked populations. These enablers have accelerated innovation and financial inclusion at scale, making India a key focus for both global investors and domestic fintech players

2. Investor appetite for Indian fintech is growing

India features among the top geographies poised for future fintech investment. Investors are encouraged to diversify capital into high-growth regions like India, with an emphasis on AI integration and disciplined scale

3. Credit demand in India is on the rise driven by a booming middle class

India's affluent middle class currently 31% of the population is projected to grow to 40% (approx. 600 million) by 2031. This demographic shift is fueling a surge in consumer demand for credit across retail, consumption, and SME sectors

4. India is still significantly underpenetrated in secured lending

Only 36% of India’s nominal GDP in 2024 is made up of outstanding retail debt, compared to:

· 76% in the US

· 82% in the UK

· 67% in Japan

· Even more striking: just 23% of India’s retail debt is secured (e.g., housing, vehicle), versus 68% in the US and 78% in the UK

5. Fintech-led digital lending is growing at a 35% CAGR

Fintechs like Paytm and LendingKart are transforming credit delivery in India, leveraging alternative data and frameworks like the Account Aggregator to underwrite borrowers with little or no credit history. This has supported unsecured lending, particularly among new-to-credit segments

6. Fintechs are enabling access without sacrificing prudence

Players like OneCard are simplifying unsecured revolving credit in a market where only 45 million Indians hold credit cards despite over 2 billion active bank accounts. Fintechs are expected to continue leading credit innovation with AI, personalization, and risk-layered product design.

Sandeep Patil, Partner and Head of Asia at QED Investors and Co-author of the "Fintech's Next Chapter" report, explains: "India stands at a unique inflection point in the global fintech landscape. With a strong foundation in digital infrastructure like UPI, Aadhar, Account Aggregator, and tech-savvy mobile-first population, the country has already shown how innovation can drive financial inclusion at scale. As this report has shown, India's fintechs have scaled up in payments— but the real opportunity lies in going deeper: unlocking credit, banking, insurance and wealth for both individuals and businesses.

To win the next chapter, fintechs must pair innovation with disciplined execution. That means building trust, demonstrating profitability, and navigating an evolving regulatory landscape with maturity. The Indian market is large, dynamic and underpenetrated— well-positioned to be one of the defining arenas for global fintech over the next decade. "