India’s success with UPI offers a replicable model for other nations, showcasing how combining public digital infrastructure with Open Banking policies can reduce financial exclusion, foster innovation, and promote equitable economic growth

FinTech BizNews Service

Mumbai, 8 December, 2024: A recent groundbreaking research report, *Open Banking and Digital Payments: Implications for Credit Access*, sheds light on the transformative role of the Unified Payments Interface (UPI) in driving financial inclusion and reshaping credit access in India. Conducted by prominent researchers from ISB, IIM Bangalore, CAFRAL, and Duke University, the report highlights UPI’s role in revolutionizing India’s financial landscape.

Transforming Credit Access through UPI and Open Banking in India: Key Highlights

1. UPI’s Groundbreaking Role in Financial Inclusion:

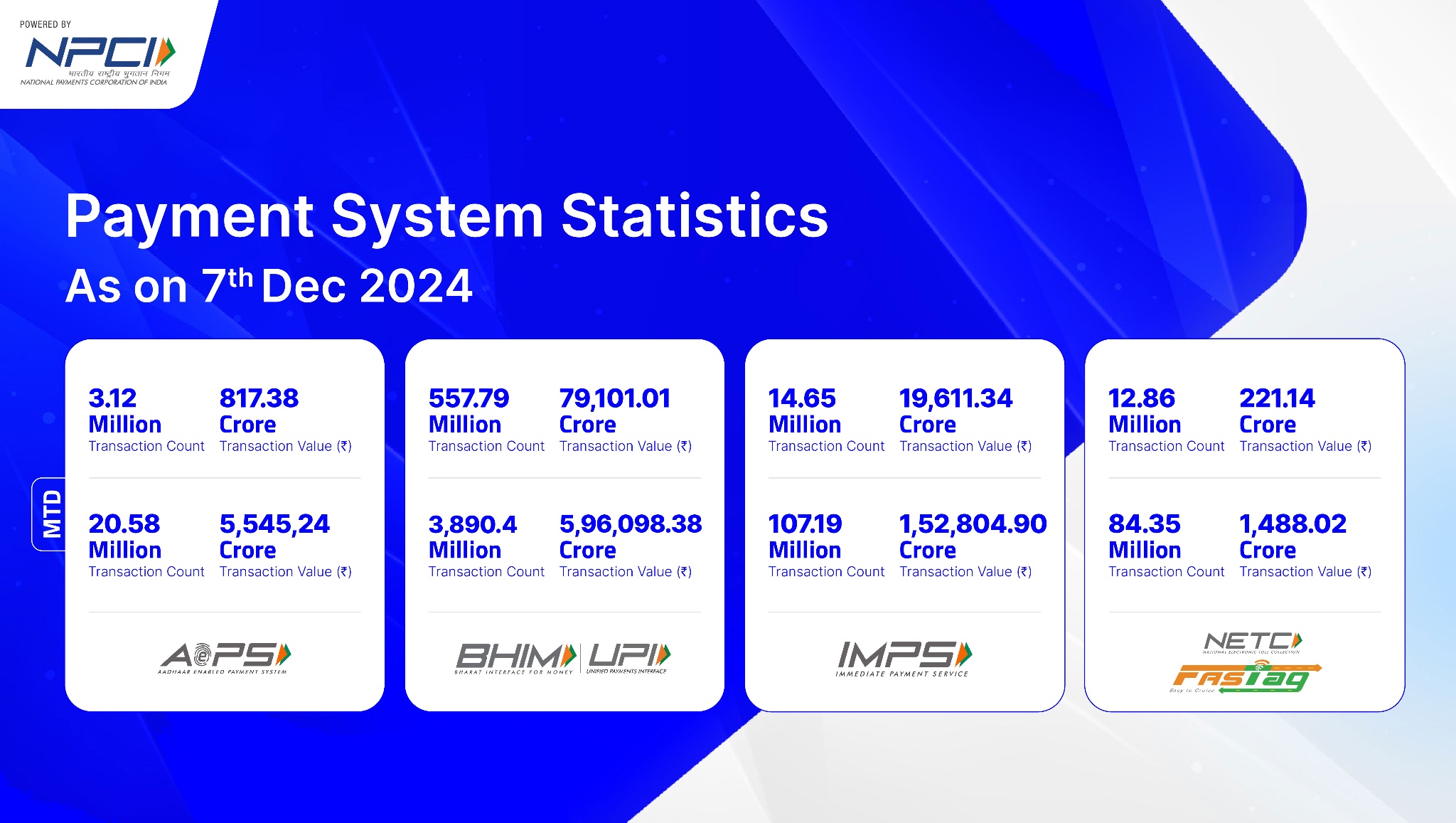

◦ Since its launch in 2016, the Unified Payments Interface (UPI) has transformed financial access in India, enabling 300 million individuals and 50 million merchants to perform seamless digital transactions. By October 2023, 75% of all retail digital payments in India were through UPI.

2. Empowering Marginal Borrowers:

◦ UPI has enabled underserved groups, including subprime and new-to-credit borrowers, to access formal credit for the first time.

In regions with high UPI adoption:

▪ Loans to new-to-credit borrowers grew by 4%, and to subprime borrowers by 8%.

▪ The average size of a fintech loan was Rs27,778—about 7 times the rural monthly expenditure.

◦ Fintech lenders scaled rapidly, increasing their loan volumes by 77 times, far outpacing traditional banks in catering to smaller, underserved borrowers.

3. Affordable Internet as a Catalyst:

◦ The affordability of digital technology played a critical role, enabling widespread UPI adoption in rural and urban areas alike.

4. Credit Growth Through UPI:

◦ A 10% increase in UPI transactions led to a 7% rise in credit availability, reflecting how digital financial histories enabled lenders to assess borrowers better.

◦ Between 2015 and 2019, fintech loans to subprime borrowers grew to match those of banks, with fintechs thriving in high UPI-usage areas.

5. Safe Expansion of Credit:

◦ Despite the credit surge, default rates did not rise, showing that UPI-enabled digital transaction data helped lenders expand responsibly.

6. Global Implications:

◦ India’s success with UPI offers a replicable model for other nations, showcasing how combining public digital infrastructure with Open Banking policies can reduce financial exclusion, foster innovation, and promote equitable economic growth.