UPI processes over 16 billion transactions a month; RBI publishes Payment System Report, December 2024

FinTech BizNews Service

Mumbai, January 27, 2025: The Reserve Bank has today published the Payment System Report, December 2024. This report, in addition to analysing the trends in payment transactions carried out using various payment systems in India during the last five calendar years up to CY-2024, covers important developments in the payment ecosystem and provides an in-depth analysis into UPI. Henceforth, the Report will be published on RBI website on half yearly basis.

Retail digital payments in India have grown from 162 crore transactions in the financial year 2012-13 to over 16,416 crore transactions in the financial year 2023-24 i.e., approximately 100-fold increase over 12 years. The remarkable growth in payment infrastructure and payment performance is also apparent in the Digital Payment Index published by RBI, which has witnessed more than four-fold rise in the last six years (445.50 for March 2024, base 100 as of March 2018).

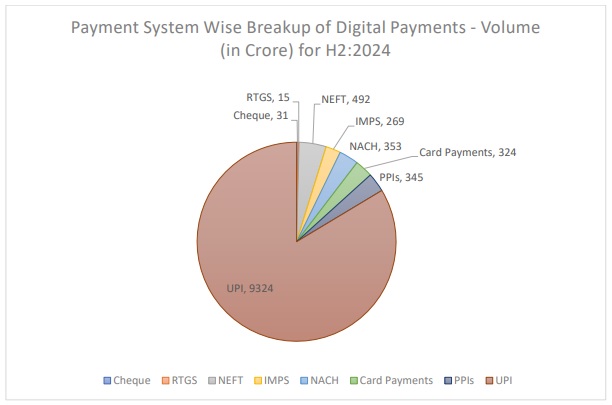

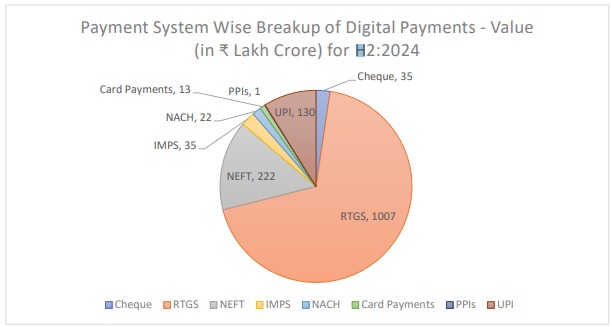

Digital Payments in India have grown exponentially in the last decade. While in calendar year (CY) 2013 there were 222 crore digital transactions valued at Rs772 lakh crore, it has increased 94 times in volume and more than 3.5 times in value to over 20,787 crore transactions valued at Rs2758 lakh crore in CY-2024. In the last five years alone, digital payments in India have increased 6.7 times in volume and 1.6 times in value. This amounts to a five-year CAGR of 45.9% in terms of digital payments volume and 10.2% in terms of digital payments value.

Tokenisation of cards

Payment safety measures such as two factor of authentication have been promoted, which incidentally, is still not mandatory in many advanced countries. Tokenisation of cards has within a period of two years seen large-scale adoption by consumers with over 91 crore card-on-file tokens created as on December 31, 2024.

During the last decade, the payment landscape has witnessed rapid expansion in terms of availability, user adoption and acceptance infrastructure. 2.4 Unified Payments Interface (UPI), launched in 2016 by the National Payments Corporation of India (NPCI), has emerged as the most used and preferred payment channel, and has revolutionized India's payment ecosystem by consolidating multiple bank accounts into one mobile interface. UPI's real-time, user-centric functions democratize payments and extend digital payments to previously unreached 4 segments. Since its launch in 2016, UPI has seen multiple enhancements. Key being UPI lite for small value transactions, UPI lite X for offline payments and UPI123 Pay for feature phone users. UPI processes over 16 billion transactions a month.

Impact Of 24X7 Availability Of RTGS And NEFT

Factors that have contributed to the significant expansion in both high-value and retail payments have been identified. Analysis on the impact of 24X7 availability of RTGS and NEFT has shown that not only the transaction ticket size for both systems has decreased; the volatility in RTGS’s ticket size has also decreased substantially, making the system more stable.

Growth Charts Of NPCI Operated Retail Payment Systems

Analysis of the growth Charts of NPCI operated retail payment systems is also presented in the report. Analysis over a five year period is presented for UPI, IMPS, AePS-Fund Transfer, BHIM Aadhar Pay, National Automated Clearing House (NACH) Credit and Debit, National Electronic Toll Collection (NETC) – both transactions as well as infrastructure and Bharat Bill Payment System (BBPS).

Growth Of Cards

The report also covers the growth of Cards (credit and debit) and PPI payment systems. At end-December 2024, the number of credit cards has more than doubled to around 10.80 crore as compared to December 2019, when there were 5.53 crore cards in circulation. In contrast, number of debit cards have remained relatively stable, with a marginal increase from 80.53 crore in December 2019 to slightly more than 99.09 crore in December 2024. A bank group-wise analysis is presented to further disaggregate these dynamic growth patterns in the card infrastructure. A similar growth trajectory is witnessed in card transactions as well.

The analyses derive from World Bank's report on global remittances for 2023 which underscores India's pre-eminence as the top recipient with $125 billion, significantly ahead of other countries like Mexico and China, reflecting the substantial contribution of its diaspora to the economy and foreign exchange reserves. The report also highlights that the cost of sending remittances to South Asia remains the lowest globally, although it still exceeds the Sustainable Development Goals' target. Within this framework, India's strategic position is further highlighted by its diverse cost efficiencies across different remittance corridors, with the Malaysia to India corridor being the most cost-effective.

Growth In UPI P2P And P2M Transactions

A detailed disaggregated level analysis on the trends in growth of UPI payments has also been presented. A comparative analysis of growth in UPI Person-to-Person (P2P) and Person-to-Merchant (P2M) transactions for different value buckets shows that with the increased onboarding of merchants and growth in UPI payment acceptance infrastructure, the growth in UPI P2M transactions far outstrips UPI P2P transactions.