In India, roughly 26% of the SMBs on average, have already implemented AI

FinTech BizNews Service

Mumbai, September 23, 2024: Payoneer's Second Annual SMB Ambitions Barometer examines the opportunities—and challenges—that small- and medium-sized businesses (SMBs) are experiencing in the contemporary economic landscape. Payoneer, in collaboration with Oxford Economics, surveyed 3,779 SMB decisionmakers globally, both from advanced and developing economies including 252 from India. Out of 252 Indian SMBs, only, 32.1% have an equal mix of clients from both business and customers, while 46% are into completely B2C. This report highlights the progress, goals, and crisis faced by SMBs in India and also revealed several takeaways for SMBs in India. Payoneer, the financial technology company empowering the world’s small and medium-sized businesses to transact, do business, and grow globally.

INDIAN SMBs AT A GLANCE

As per data from the Ministry of Micro, Small & Medium Enterprises, as of March 2024, there are 6,08,935 small enterprises and 55,488 medium-sized enterprises in India.

The small enterprises record a turnover of around Rs 50 crores with an investment of less than Rs. 10 crores annually, while medium enterprises record a turnover of Rs250 crores annually with an investment amount between Rs 10 crore and Rs 50 crores.

The number of MSMEs in the country is expected to grow from 6.3 crore, of which only 2.5 crore have ever availed credit from formal sources to approximately 7.5 crore in the coming times, growing at a projected CAGR of 2.5%.

72% of payments for the Indian MSMEs are done through the digital mode, while merely 28% of payments happened through cash transactions. SME accounts for 45% of industrial output and 40% of the total exports in India.

KEY TAKEAWAYS FOR SMBs IN INDIA

Globalization has been a top priority for the Indian SMBs to boost resilience, revenue, and customer base. Currently, the Indian SMBs primarily have their client base in countries like the US, Australia, China, and the UK. The US account for nearly 40% of the cross-border transactions for Indian SMBs. However, better global presence means better exposure and higher capital flow. 61% of Indian SMBs believe will pave their path to better global exposure. They are ahead of their peers in other countries in adopting AI for improving customer service, content creation, inventory management and merchandising. technological advancement Hiring local talents 6 lakh jobs has been the focus of several Indian SMBs. According to various media reports that quoted Government of India, the Indian small and medium businesses have created more than in the domestic market in 2021-22. With such huge job creation, the SMBs also boost the local economy. Business expansion in the domestic market and the neighboring countries continue to be one of the key areas of focus for the Indian SMBs. Thus, they aim to penetrate deeper into various Asian markets. This focus on regional expansion highlights their strategic goals to tap into nearby emerging markets, driven by growth opportunities and market proximity.

Going global

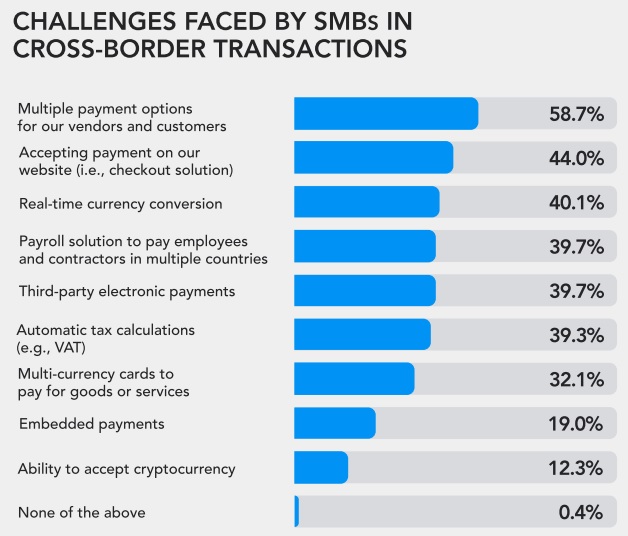

65% of Indian businesses believe a diverse and global vendor network helps protect against disruptions, demonstrating resilience and agility against external threats. Currently, Indian SMBs have nearly 47.6% international vendors and 52.4% domestic vendors. More than 58% of Indian SMBs have multiple payment options for accepting payments from international vendors and customers. Additionally, nearly 40% of them have adopted several other cross-border payment facilities like real-time currency conversion and automatic tax calculations to ease cross-border payments. However, more than 45% of the Indian SMBs face challenges in terms of making or receiving cross-border payments. Some of the major challenges include foreign exchange rates, international trade compliance requirements, slow transaction time, etc.

Language and cultural barriers (38%), economic conditions (51%), limited networks (41%), and high debt-to-income ratios (39%) are key challenges for Indian SMBs aiming to expand globally. Language and cultural barriers (38%), economic conditions (51%), limited networks (41%), and high debt-to-income ratios (39%) are key challenges for Indian SMBs aiming to expand globally.

CHALLENGES IN GETTING GLOBAL

SMBs have nearly 47.6% international vendors and 52.4% domestic vendors. In India, even though SMEs account for 97% of total enterprises, their share in exports is only slightly more than 40% on an average. Of 51 million SMEs in India, less than 1 million participate in global trade, according to Reports of SME World Asia.

AI AND THE TECH (R) EVOLUTION

While globally, around 20% of the respondents have implemented AI in some or all areas of businesses, India is ahead of its peers. In India, roughly 26% of the SMBs on average, have already implemented AI.

61% of Indian SMBs find digitization lowers barriers to entering the global market, and 78% cite technological change as a driver of innovation.

More than 17% of the Indian respondents have technological upliftment as their top goal. Their plans not only include increasing the investment in emerging technology but also focus on improving the technological skills of their employees.

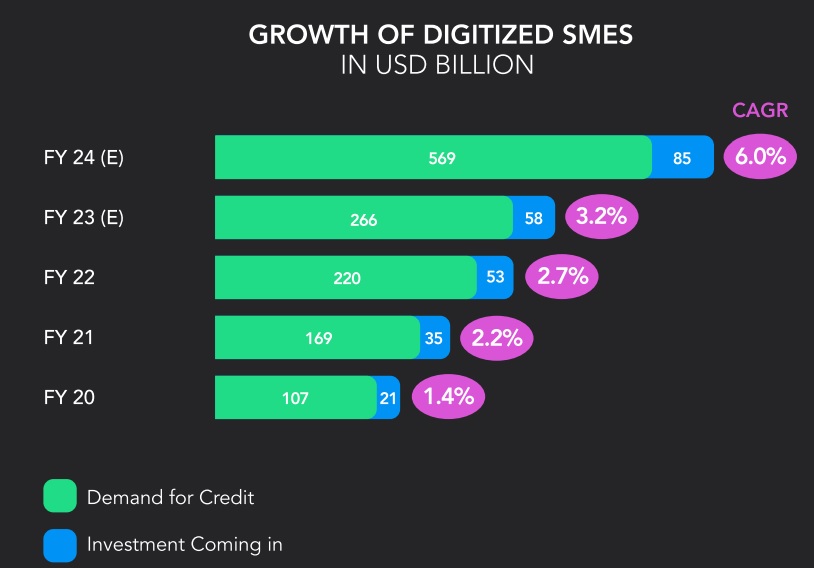

According to India Digital SME Credit Report 2023, published by the Internet and Mobile Association of India (IAMAI) on October 11, 2023, digitized SMEs attract 40% of the total invested capital.

The supply of credit amongst digitized SMEs is expected to be USD 85 Bn by 2027.

The digital infrastructure has been receiving significant focus as the government has been nudging businesses, and developers including private Venture Capitalists, to support India Stack 2.0—the platform aimed at integrating and bridging the gap between financial services and SMBs.

GET LOCAL FIRST TO GET GLOBAL

In terms of hiring local talent, Indian SMBs are still behind the global average. Globally, local hirings by SMBs account for more than 57%, followed by regional hiring (25.6%) and international hiring (17.4%). However, for Indian SMBs, local and international hiring stood at 49.8% and 20.8% respectively. One of the biggest challenges has been their inability to attract talented and tech-savvy manpower.

The situation is gradually changing as 73% of Indian SMBs are now planning to prioritize hiring local talent, planning to hire an average of 11 employees, with half being local hires.

83% of Indian SMBs are confident in increasing revenue over the next 12 months, and 80% expect local economic health to improve, indicating a positive feedback loop between SMB performance and the local economy.

67% of Indian SMBs state their business is the sole source of household income, emphasizing the importance of SMB success for local economic stability.

EXPANSION AND INNOVATION

More than 60% of the Indian SMBs are expanding strongly into the global markets. Nearly 38% of Indian SMBs have recorded an average annual revenue growth rate of 10% or more over the past two years.

The share of revenue from exports for the Indian respondents has gone up from 67.2% in 2022 to 72.3% in 2023. The SMBs expect the share of revenue to go beyond 77% in 2024.

For Indian SMBs, South and East Asia and Pacific will provide the maximum opportunity for growth in terms of expanding customer base. Thus, Indian SMBs have been investing more than 38% of their resources in these regions to expand their customer base in the next five years. Indian SMBs are looking to expand into South Asia (20%) and East Asia and the Pacific (19%) over the next five years, with both percentages higher than the survey averages of 11% and 12%, respectively.

This focus on regional expansion highlights their strategic goals to tap into nearby emerging markets, driven by growth opportunities and market proximity.

CONCLUDING INSIGHTS: INDIAN SMBs GOING GLOBAL

In an ever-evolving landscape of cross-border trade and rapid digitalisation, Indian SMBs are keeping no stone unturned to tap the global market and contribute significantly to the Indian economy by creating ample job opportunities. However, the Indian SMBs have a lot of room for improvement.

For further expansion and growth, Indian SMBs still need to overcome several hurdles and keep themselves abreast with an ever-changing global market. At a time, when global uncertainties like war, and political turmoil are most evident, Indian SMBs need to become resilient to ensure their growth momentum.