Majority of the complaints received by the ORBIOs during the year pertained to public sector banks (PSBs), although their share in the total declined

FinTech BizNews Service

Mumbai, 29 December, 2024: The Reserve Bank of India has released its “Report on Trend and Progress of Banking in India 2023-24” on 26 Dec, 2024.

During 2023-24, the Centralized Receipt and Processing Centre (CRPC) and Offices of Reserve Bank of India Ombudsman (ORBIOs) received 9.34 lakh complaints, an increase of 32.8 per cent over the previous year. Of these complaints, 31.5 per cent were received by the ORBIOs and the rest were received at the CRPC. Majority of the complaints received by the ORBIOs during the year pertained to public sector banks (PSBs), although their share in the total declined.

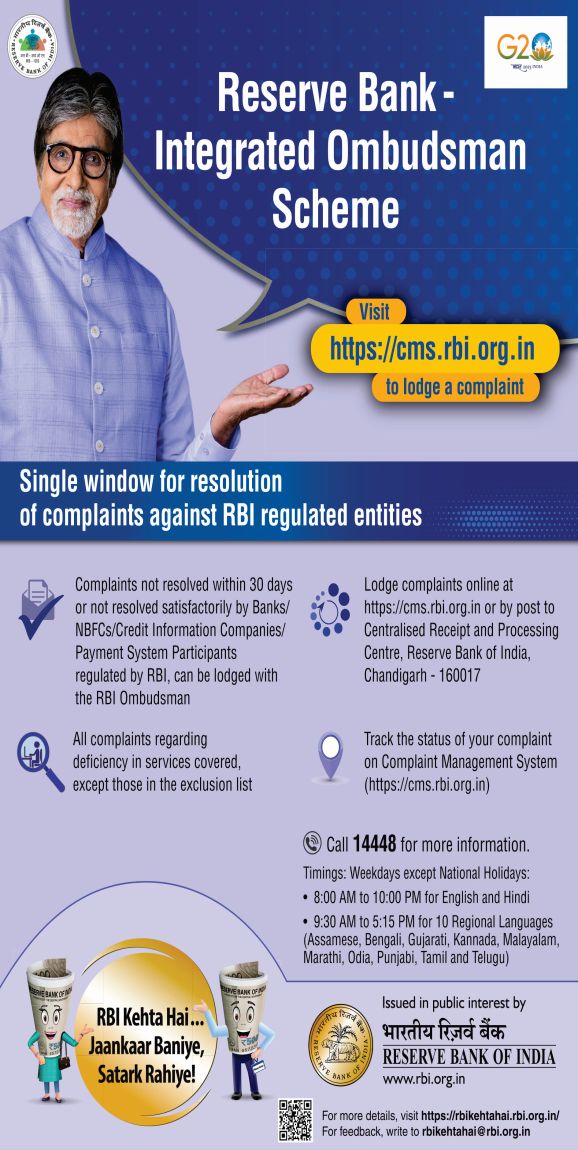

Structural changes in the Reserve Bank – Integrated Ombudsman Scheme (RB-IOS), effective November 2021, rationalized complaints categories, making ‘deficiency in service’ as the sole ground for lodging a complaint, with a specified list of exclusions. Hence, data on the nature of complaints may not be strictly comparable across the years. With this caveat, grievances relating to loans and advances, mobile/electronic banking and deposit accounts were the highest during 2023-24, contributing 64 per cent of the total complaints The share of complaints emanating from urban and metropolitan areas accounted for 71.6 per cent of the total complaints received by RBIOs during 2023-24, which could reflect greater awareness in these regions regarding the Reserve Bank’s grievance redress mechanism. PSBs and PVBs together accounted for 72.7 per cent of the total complaints received by RBIOs. Almost all pension-related complaints were filed against PSBs __ traditionally preferred by pensioners. On the other hand, a large share of complaints (60.1 per cent) relating to credit cards were filed against private sector banks (PVBs).