The feature-loaded co-branded credit cards are available in four variants

FinTech BizNews Service

Mumbai, August 20, 2024: Aditya Birla Finance Limited (“ABFL”), a wholly owned subsidiary of

Aditya Birla Capital, India’s leading financial services conglomerate and AU Small Finance Bank

Limited (SFB), India’s largest small finance bank, has announced the launch of Aditya Birla Finance

AU credit cards, powered by and available on Visa and RuPay payment networks.

The feature-loaded co-branded credit cards are available in four variants and offer comprehensive

reward benefits to serve the financial needs of different customer segments, covering both individual

customers and business owners.

i. ABC AU Flex: Affordable option for mass India

ii. ABC AU Nxt: Millennial-friendly with specialized features

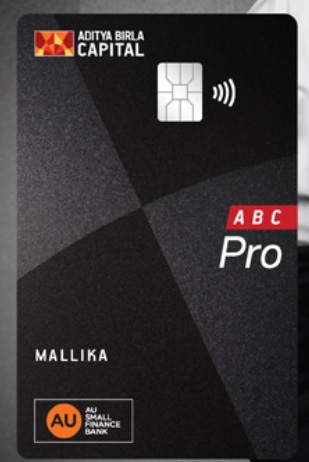

iii. ABC AU Pro: High-end card for the affluent

iv. ABC AU Biz: Tailored for entrepreneurs and business owners

Aditya Birla Finance AU credit cards are curated to offer exciting reward points to customers

across various categories such as lifestyle, travel, dining, education, entertainment, utilities,

insurance, grocery, and government related spends. The cards also come with an unlimited fuel

surcharge waiver of 1%.

With ‘Flex’ and ‘Nxt’ credit cards, customers can avail lifetime-free benefits. They have the flexibility

to personalize their cards through the Aditya Birla Finance mobile app and can earn rewards,

cashbacks and other varied benefits. The ‘Pro’ variant offers accelerated reward points with airport

lounge access and a reduced forex markup fee. The ‘Biz’ variant is a monthly fee-based card

designed for business customers with accelerated rewards points and up to 30% discount across

select dining partners.

Mr. Rakesh Singh, MD & CEO, Aditya Birla Finance Ltd., said: "We are delighted to partner with

AU Small Finance Bank to introduce the Aditya Birla Finance AU Credit Cards. Our expertise in

financial services along with AU Small Finance Bank's innovative banking solutions, will help us

provide seamless and tailor-made financial experience to customers. Powered by Visa and RuPay,

cardholders can enjoy greater convenience, superior rewards and a secure and seamless payment

experience.”

Hosted on Visa and RuPay payment networks, the Aditya Birla Finance AU co-branded credit

cards will provide users with exceptional convenience and seamless transaction experience.

Additionally, the RuPay powered variant can be linked to an UPI ID, enabling safe and secure

transactions through any UPI enabled app.

Mr. Sanjay Agarwal, Founder, MD & CEO, AU Small Finance Bank said, “The partnership

between Aditya Birla Finance and AU Small Finance Bank signifies a major achievement in the

financial services domain, uniting two prominent industry frontrunners to provide unmatched

advantages and rewards to customers nationwide.”

“We, at Visa, are delighted to support the launch of the Aditya Birla Finance AU Small Finance Bank

series of Co-branded Cards. This partnership between our three trusted brands not only offers more

choice and superior rewards and experiences to consumers and small businesses alike, but also the

Visa promise of secure, seamless payments and global acceptance, to our cardholders,” said

Mr. Sujai Raina, Country Manager, Visa India.

Speaking on this development, Ms. Praveena Rai, Chief Operating Officer, NPCI said, “We are

pleased to collaborate with our partners on this innovative product, designed specifically to meet the

unique needs of modern-day consumers. Through this partnership, we aim to provide digitally

enabled credit card lifecycle experience for the customers. Furthermore, UPI-enabled RuPay credit

cards offer users a convenient way to use their cards and enjoy rewarding benefits.”

The launch of Aditya Birla Finance AU credit cards marks a significant step in Aditya Birla

Finance’s commitment to providing customers with a simplified and rewarding financial experience

while offering seamless access to credit with unmatched benefits on a single platform.