Banks See Room For Improvement To Extract Higher FX Revenue From Cross-Border Payments

FinTech BizNews Service

Mumbai, 22 October, 2024: As Sibos is underway in Beijing, Citi launches its latest GPS Report titled Cross Border Payments 24x7: Faster, Simpler, Smarter.

The payments industry is evolving at pace, led by the rapid growth of cross-border money flows. The report brings together Citi’s latest thinking on cross-border payments and the evolution of the payments landscape.

It shares insights from a Citi Treasury and Trade Solutions (TTS) survey of about 100 financial institutions worldwide including banks, FinTechs and insurance companies. The report also draws on expert insights from Citi’s Future of Finance team, external experts, and our industry leading TTS franchise. The TTS business is part of Citi’s Services organization which moves nearly US$5 trillion for clients each day. Citi Services serves some 19,000 clients and does business in 180 different markets.

Key takeaways from the report include:

The report also checks in on the latest progress in the G20 roadmap – a collective effort to make cross-border payments cheaper, faster, and more accessible.

It looks at how incumbents and new entrants can emerge as leaders in the cross-border payments business. Agile incumbents that adapt to newer industry standards and emerging technologies are likely to retain market share driven by trust and deeper customer relationships.

Banks also need to focus on providing alternative payment methods with nearly two thirds of survey respondents seeing a demand from clients. According to the Citi TTS 2024 survey, bank management thinks delivering always-on operations (24x7) is the leading priority for banks over the next 5 years to address the pain-points of cross-border payments.

The report also checks in on latest progress in the G20 roadmap – a collective effort to make cross-border payments cheaper, faster, and more accessible.

Future of Cross-Border Payments

Cross-border payments are being reshaped. The drivers are heightened demand for a real-time seamless experience, rapid advancements in technology and an evolving regulatory and policy landscape. Globalization continues, but is being driven by the flow of e-commerce, intangibles and other next generation factors, not the offshoring of manufacturing as in the 1990s-2000s.

"The payments industry continues to evolve, led by the accelerated growth of cross-border payments and key trends like tokenization, artificial intelligence, correspondent banking, and embedded real-time payments helping to drive efficiencies at scale. In this new environment our clients and their consumers are expecting payments that are instant, 24x7, and can move across borders, whether the payments are big or small. Therefore it’s imperative that financial institutions select the right global partner so they can deliver the best crossborder payments solutions to help future proof their payments business and gain market share as the industry transforms." – SHAHMIR KHALIQ, GLOBAL HEAD OF SERVICES, CITI

Businesses and consumers are pushing for faster, cost-effective, and more transparent cross-border payments. 1 FinTechs and new entrants are driving change, along with some of the more agile banks/financial institutions. Policymakers and industry bodies are also contributing to the transformation, while balancing innovation with security and compliance.

IMPLICATIONS ON PAYMENTS

Payment experience becoming a core competency & differentiator. Agile solutions supporting both global and/or multi-domestic models. Scale matters & digital as default. Embedded, real-time, 24x7x365. eCommerce and platforms allow big banks to service mid corps and small merchants at scale. Compliance & Data strategy becoming a key differentiator. Flexible operating models vital for regulatory and emerging risks.

Delivering always-on operations (24x7) is a leading priority for banks, according to the Citi Treasury and Trade Solutions (TTS) 2024 survey where 31% of the surveyed bank executives globally listed 24x7 operations as their top priority for the next five years. Over the next 5-10 years, the top expected priority remains the deployment of Artificial Intelligence (AI), followed by Blockchain/DLT.

Cross-Border Payments Market Size & Growth

Wholesale payments (mostly financial market/securities, but also B2B importexport) represent nearly 90% of cross-border volume2 and roughly track GDP growth. Projected global trade growth from 2025-2028 will likely be held back by geopolitical uncertainty, with near-shoring and friend-shoring, offset by normalizing inflation and monetary policy. Despite some of the gloomier big picture trends, hotspots for cross-border transaction growth remain. Business-to-business (B2B) ecommerce, which is the second largest segment, with estimated market size of nearly $10 trillion, is set to grow the fastest at 12% CAGR between 2023-2030, totaling a $22 trillion market size by 2030.3 The growth reflects the proliferation of marketplaces and platforms, as businesses continue to digitize.

"The fastest growth segments in cross-border payments are driven by global ecommerce, digital globalization, and remittances. Higher margins in these segments have attracted digitally native players, but banks and financial institutions can compete by offering differentiated services, smarter pricing, strategic partnerships and adopting newer technologies. – DEBOPAMA SEN, HEAD OF PAYMENTS, CITI

In the consumer segment, payments for travel, healthcare and education remain high-growth segments. Likewise, individual remittances and peer-to-peer payments are expected to be fast growing. Consumer segments – from business to consumer (B2C) to consumer-to-business (C2B) and customer-to-customer (C2C) – are expected to grow high single digits CAGR 2023-2030. By contrast, corporate and B2B flows, excluding e-commerce, are expected to grow only marginally. Meanwhile, corporates are improving liquidity management by using technologies like DLT to reduce costs and risks across multi-currency transactions. The wholesale B2B payments segment continues to be dominated by major banks, using the established correspondent banking network.

We have seen the emergence of FinTech disruptors in the high-margin C2B and C2C segments, where digitally native solutions have led to market share gains in growing revenue and profit pools. The ongoing mix shifts in underlying macro and sector trends – faster growth in cross-border consumer spending and C2C and C2B payments – tends to play to the strength of new entrants. Citi TTS 2024 survey suggest that FinTechs expected to gain an average 10% market share from traditional financial institutions in the next 2-5 years.

"New technology and consumer adoption of digital real-time services is accelerating, and the cross-border payments landscape is no exception, undergoing unprecedented changes at a revolutionary pace. The evolving customer demand for cross-border payments that offer speed, cost efficiency and transparency has surged, but many banks often face challenges with meeting customers’ needs due to legacy infrastructure and budget constraints. However, Banks are increasingly viewing cross-border payments as the epicenter for servicing the wider customer relationship and are now placing greater importance on the pivotal decisions around their cross-border payments strategy, realizing these choices can have a lasting impact on their customers loyalty and ability to grow. In short, banks that do not adapt and invest in crossborder payments risk being left behind. As the world is becoming more fragmented the evolving landscape of cross border payments can be difficult to navigate and the quest for a strategic partner becomes not just important but essential. – EMANUELA SACCAROLA, HEAD OF CROSS-BORDER PAYMENTS, CITI.

In addition to clients demanding better experience, we are seeing increased competition from emerging alternative infrastructures pushing legacy models to evolve. Banks are acutely aware of the disruptive forces reshaping the cross-border payments industry. Over two-thirds of the surveyed banks cite increasing demand for alternative cross-border payment methods from clients. Further, nearly half of the banks in the Citi TTS 2024 survey see some room for improvements in extracting FX revenue from their cross-border payments proposition.

What’s Changed in the Last 12 Months?

Since the publication of our report on cross-border payments in September 2023 (Future of Cross-Border Payments: Who Will Be Moving $250 Trillion in the Next Five Years?), key changes include:

Acceleration of Interconnectivity in Domestic Payments: The industry is shifting towards multilateral connectivity to achieve scalability and efficiency – see the Bank for International Settlements’ (BIS) Project Nexus. Advancements in last-mile delivery – from receiving correspondent bank to the beneficiary at another bank – are enhancing the speed of transactions. More than 70 markets are now operational on instant payment systems (as per BIS).

Continued Exploration Money and Payment Infrastructure: Several banks are experimenting or piloting new market infrastructures based on tokenized deposits and Central Bank Digital Currencies (CBDCs) to enhance cross-border payment efficiency through real-time settlement mechanisms. Currently, 66 countries are in the advanced phase of exploration – development, pilot, or launch.

BIS’s Project Agorà aims to explore how tokenization can enhance wholesale cross-border payments. The project, structured as a public-private collaboration, is set to begin the design phase and has more than 40 financial firms involved along with a group of central banks.

Leveraging Artificial Intelligence (AI) and Data: AI, and specifically Generative AI (GenAI), is increasingly being explored to streamline cross-border payments. However, access to comprehensive data is critical to achieve meaningful results. As transaction messaging shifts to structured ISO 20022 formats, institutions are also realizing tangible efficiencies in their compliance processes.

Industry Realignment Continues: Many banks are streamlining their correspondent banking relationships, opting to work with a reduced number of partners and concentrating their transaction flows to fewer corridors. Some banks are introducing their own brands to directly compete with emerging FinTechs in the consumer-to-consumer cross-border payments space.

Exploring Innovative Market Infrastructure: Public and private sector players are considering new market infrastructures, often based on tokenized deposits and CBDCs to enhance cross-border payment efficiency through real-time settlement mechanisms.

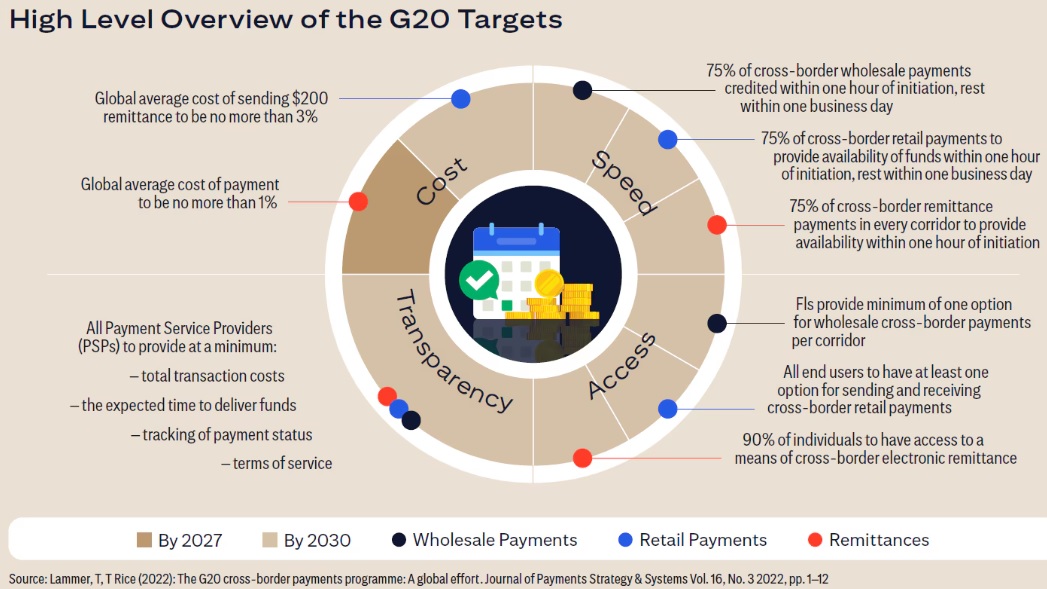

What Gets Measured, Gets Done

The FSB developed a set of targets (endorsed by the G20) to be achieved that further define ‘what good looks like’ for cross-border payments . To operationalize the targets, the FSB developed KPIs to monitor against delivery. In an effort to transition from high level vision to implementation, the FSB together with the CPMI and partner bodies came up with three themes organized into fifteen actions for orientating the next phase of the Roadmap. The themes and actions reflect how the payments policy will unfold. We expect consultation papers, discussion papers, projects, and regulatory developments in the coming years. We are now in the ‘what gets measured gets done’ phase. For the first time we have data from the KPIs and we have a picture of where we stand, where progress has been made and where efforts need to ramp up.

How Did We Measure Up?

The KPIs measure outputs on cost, speed, access, and transparency across different market segments (wholesale, retail, and remittance). As per the findings of the FSB, 15 the key theme is that across all market segments, user experiences differ substantially across regions. Lower income regions are furthest from the cost and speed targets but to the extent this is the case can differ depending on whether the region is the sender or the beneficiary of payments. Another key takeaway is on FX costs. For the remittance segment other fees tend to be higher than FX costs. In contrast, FX costs are the largest slice of total costs for the retail segments (but as per the report the extent to which this is true, differs across both regions and use cases).

On speed, for the wholesale segment, globally, 54% of payments go from the originating bank to being credited to end-customer’s account within one hour and 93% within one day. Most of the time is spent between the beneficiary bank receiving the payment and the end-customer being credited. Speed is perhaps a more realistic target to achieve for the wholesale segment as the big payment volumes are in well-established corridors denominated in USD.

For the retail and the remittance sectors, the numbers are further away from the targets and more work needs to be done.

Globally the proportion of retail services that make funds available to the receiver in one hour is 42% (quite a way off from the 75% target) and the proportion that do so in one day is 76% (again quite far from the 100% target) with significant differences between regions and use cases.

Globally, the proportion of remittances that make funds available to the receiver in one hour is 53% (the target is 75%) and the proportion that do so in one business day is 77% (the target is 100%). On the access to account targets, most adults, and micro small and medium sized enterprises (SMEs) globally have an account, and this is not a surprise when most of the central banks surveyed (81%) said that they must provide accounts by law to any customer requesting an account. What is more surprising is that all but one of the jurisdictions that were surveyed have laws in place on the transparency of payments (information on fees, speed, customer rights etc.) but only 56% provide this information.

We anticipate implementation efforts to ramp up here. Another priority action is the interlinking of fast payment systems across jurisdictions. Such interlinkages can potentially facilitate simpler and shorter transaction chains, as well as lower costs and fees. The idea of the interlinkages extends of course to the 24x7 instant payments systems and, if executed at scale, represents a possible enabler for achieving 24x7 instant cross-border payments. As per the FSB, cross-border payments processed via interlinked fast payment systems are processed within seconds – at most minutes – and thus easily meeting the G20 target on speed. Looking forward we anticipate further interlinking in the short-medium term. Over 40% of the fast payment systems surveyed plan to establish interlinking within two years.

We continue to see global efforts to implement the ISO 20022 messaging standard – another key priority action. Global migration to ISO 20022 could help streamline message flows, harmonize market practices, and help market participants agree on minimum required data models to enhance global interoperability and seamless processing of cross-border payments end-to-end. ISO20022 serves as the key innovation foundation layer that financial institutions will leverage for other things like AML checks, sanctions checks, data, and predictive analytics; so, it is so much more than a compliance requirement.

Finally, there are two policy papers (consultations) that closed in September 2024. They form part of the future policy landscape and correspond with two G20 priority themes: [1] cross-border data exchange and message standards; and [2] the legal regulatory and supervisory framework. Alla Gancz EY highlight the key points from these papers below and share their perspectives further below. Data framework for cross-border payments consultation paper.

The report offers several nuanced insights:

Regulatory Fragmentation: Harmonizing regulatory frameworks is crucial for smoother cross-border transactions, reducing compliance burdens, and enhancing operational efficiency.

Balancing Compliance Obligations: Balancing AML/CFT obligations with data privacy regulations is complex and requires frameworks that ensure compliance without hindering innovation.

Innovation as a Double-Edged Sword: Technological advancements improve efficiency and customer experience but also introduce new risks and compliance challenges, necessitating proactive risk management.

Collaborative Governance Models: Establishing a Forum for diverse stakeholders can lead to effective solutions and best practices, fostering a more integrated global payment ecosystem. Overall, as per EY, the report provides a comprehensive examination of the challenges and opportunities in cross-border payments, reinforcing the importance of strategic collaboration and innovation in navigating this evolving landscape. The supervision of bank and nonbank providers of cross-border payments services consultation paper.

High-level insights from the report:

Alignment of Regulatory Frameworks: Emphasizes the need for consistent regulatory and supervisory frameworks for banks and non-banks in cross-border payments to address ML and TF risk management inconsistencies.

Focus on Risk Management: Highlights the importance of managing operational risks, including fraud and cyber threats, alongside ML and TF compliance, to improve regulatory quality and consistency.

Consumer Access and Transparency: Stresses the need for transparency in service terms, conditions, and pricing to enhance consumer access and foster an inclusive financial environment.

Need for International Standards: Points out the lack of comprehensive international standards for non-bank PSPs in cross-border payments, questioning the need for such standards to ensure consistent and effective regulation.

It Will Take All of Us

What these action plans, progress reports, and consultation papers point to is that solving for cross-border payments is not something the industry can fix in isolation. It will take all of us (public sector, private sector, and countries beyond the G20) to drive forward the delivery of the Roadmap. We saw various encouraging developments over the last year.

Two new taskforces have been established for public-private stakeholder engagement to achieve the G20 targets, namely the taskforce on legal, regulatory, and supervisory matters (LRS) under the auspices of the FSB, and the task force on payments interoperability and extension (PIE) under the auspices of the CPMI. The LRS taskforce will analyze how differences in legal, regulatory, and supervisory frameworks on cross-border payments create frictions and what can be done to address these. The PIE taskforce covers the implementation of ISO 20022, improving access to payment systems, extension of operating hours and interlinking payment systems across borders.

Recognizing that the G20 targets are global in nature and will require global participation to be delivered it was encouraging to see the new community of practice established by the CPMI for central banks (over 40 central banks from around the world are included) in their role as payment system operators and the various regional fora set up by the FSB and the CPMI bringing together jurisdictions within the same region to share experiences and to develop common approaches.

CPMI’s ISO 2022 harmonized data requirements18 developed in collaboration with the payments industry, a key G20 priority, has been delivered. The harmonization requirements should take effect in 2027. However, as they are not rules, it is down to individual entities to implement them. If they have limited uptake, frictions in the processing of cross-border payments will continue to exist.

To address this challenge and on the back of CPMI’s data requirements, the BIS Innovation Hub in London together with the Bank of England (BoE) launched Project Keystone in August 2024. This project will develop a standardized data analytics platform focused on ISO 20022 data. It will address the complexities of handling the IS0 20022 data structure, the associated data storage requirements and provide analysis on the data.

What’s Next?

Key Ingredients for Future Regulatory Framework? Imagine we have delivered on the Roadmap, imagine we have solved for cross border payments – they are easier, cheaper, more transparent etc. Where could the policy discussion go next? We think it will focus on the macro-economic implications. Easier cross-border payments could drive greater cross-border capital allocations and increase their size and volatility.

As per the Bank of England in their approach to innovation in money and payments discussion paper, this could have wide ranging implications such as increased capital outflows, reducing domestic savings or diverting foreign capital that could have been invested domestically or some economic activity taking place in other currencies rather than the domestic currency if this enables more frictionless crossborder transactions. We anticipate these implications will be incorporated in global policy discussions in the future. Our expert contributors from EY set out their views on the future regulatory framework. It hinges on a regulatory environment that is clear, equitable, and adaptable. To achieve this, EY propose a three-pronged approach:

Establishment of a Unified Framework: The Financial Stability Board (FSB) should develop standardized definitions that capture the full spectrum of monetary forms, including Central Bank Digital Currencies (CBDCs) and cryptocurrencies. This will ensure a comprehensive regulatory approach that accommodates the diversity of payment mechanisms and digital money.

Equitable Regulation for All Participants: Regulations should be activity-based, ensuring that the same risks are governed by the same rules, regardless of the entity type. This principle promotes fair competition and integrity, essential for both traditional banks and non-bank payment service providers (PSPs) operating in the global payment ecosystem.

Responsive Regulatory Recommendations: As the payment sector evolves, regulations must be flexible and inclusive to support the diverse range of PSPs. The FSB's recommendations should be dynamic, promoting innovation and competition while safeguarding consumer protection and financial integrity

The Tokenization Thesis – Choosing Best of Both Worlds

– Tony Mclaughlin, Emerging Payments & Business Development, Citi

Traditional financial system and the world of tokenization in their own ways ensures unambiguous record of ownership in a human-readable interface. Financial institutions have been experimenting with blockchains for some time and there are several implementations in live production. However, there has not been market-wide adoption of blockchain technology in finance. Some aspects of Distributed Ledger Technology such as anonymity and proof of work mechanisms are either not appropriate or unnecessary for regulated financial services, while other aspects create the potential for always-on, multi-asset, programmable infrastructures that could deliver meaningful industry progress. A world of tokenized financial instruments will require such a scale of adoption, but this can only happen if there is broad industry consensus on what we are solving for. And, choosing any closed-looped private fiat-denominated tokenized money option could only create negative network effect. The Regulated Liability Network (RLN) is the concept of a next generation Financial Market Infrastructure that hosts both Tokenized Bank Deposits and tokenized central bank money in the same venue. This shared environment would enable the real-time and programmable transfer of value with finality of settlement. Moreover, tokenized bank deposits reinforce and strengthen the existing two-tier monetary system and maintains the singleness of money. Such an infrastructure, which is contemplated by both the RLN and Project Agorà offers the potential for correspondent banking to be re-imagined.

SWIFT Initiatives:

AI to Combat Cross-Border Payment Fraud In May 2024, SWIFT launched two AI-based experiments in collaboration with its member banks aimed at harnessing the power of AI in the fight against cross-border payments fraud. Frauds cost the financial industry $485 billion in 2023 alone. This poses a growing challenge for market participants, particularly with the advent of real-time payments and can also lead to reputational damage. New AI tools are poised to play a pivotal role in reducing risks, whilst also helping increase speed of crossborder payments. Of the two pilots initiated by SWIFT, the first one aims to enhance existing Payment Controls service, which helps financial institutions detect anomalies. The model uses historical patterns of activity on the SWIFT network and screens financial institutions’ outgoing payment messages for potential fraud activities. The second pilot aims to test the use of advanced AI technology to analyze anonymously shared data from different sources. The pilot will be based on a federated learning model, where the AI model is trained on multiple locally held datasets, enabling financial institutions to exchange relevant information with strong privacy-preserving controls.