Credit Card Spending Sees Slowdown In Febr'25– Asit C Mehta Research

FinTech BizNews Service

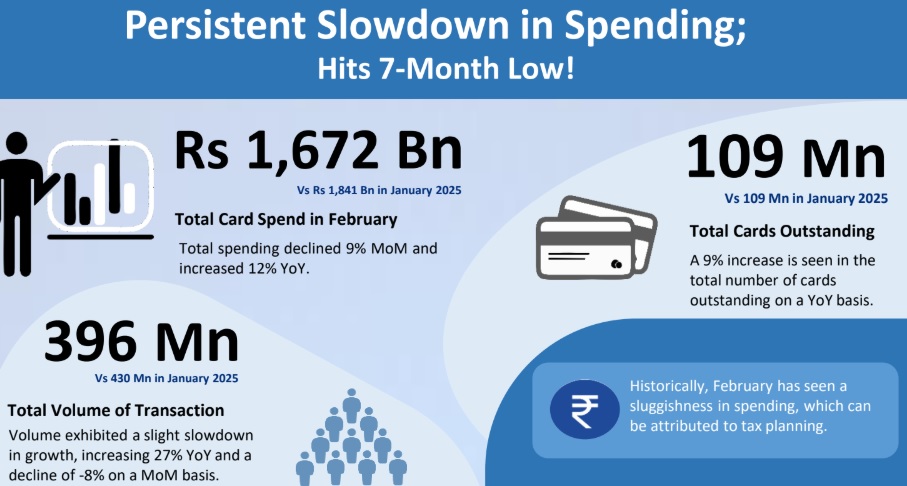

Mumbai, April 4, 2025: Credit card spending in India registered a decline in February 2025, in line with historical trends. The latest industry data reveals a 9% month-on-month (MoM) drop in total card spends to Rs 1,672 billion, marking the lowest spending levels in seven months. However, on a year-on-year (YoY) basis, spending showed a 12% increase, albeit at a slower pace compared to previous months.

Total transaction volumes also followed a similar trend, declining 8% MoM to 396 million, reflecting a moderation in consumer expenditure. This marks the slowest YoY growth in 13 months, with volumes increasing by 27% compared to February 2024. The average spends per transaction softened from Rs 4,282 in January to Rs 4,219 in February, indicating a cautious approach by consumers.

February has traditionally seen a slowdown in discretionary spending as consumers prioritize tax planning. Additionally, with major festive spending already concluded, expenditure patterns remain subdued until the Holi festival period. The total number of outstanding credit cards saw marginal growth of 0.4% MoM, reaching 109 million. However, YoY growth of 9% was the slowest since June 2021, reflecting a cooling in new card issuances after years of aggressive expansion.

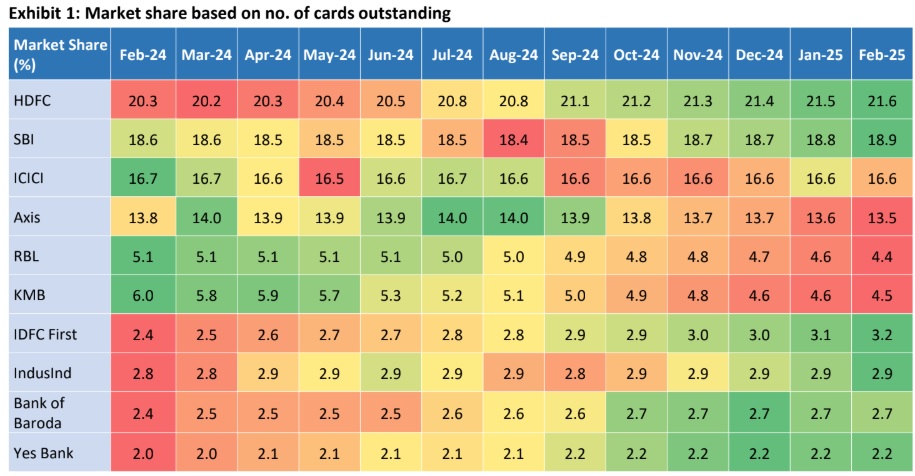

Leading banks continued to consolidate their market positions. HDFC Bank and SBI gained 10 basis points (bps) in market share, reaching 21.6% and 18.9%, respectively by card count. ICICI Bank remained steady at 16.6%, while Axis Bank saw a slight decline of 10 bps to 13.5%. Among mid-sized issuers, IDFC First Bank showed the strongest growth, increasing its market share by 80 bps over the past year to reach 3.2%. Meanwhile, RBL Bank and Kotak Mahindra Bank experienced minor declines.

With the RBI’s recent lifting of restrictions on Kotak Mahindra Bank’s credit card business, the industry anticipates potential shifts in market share. While spending is expected to recover in the coming months, February’s slowdown highlights the continued impact of seasonal trends and industry-wide moderation in growth.

Akshay Tiwari, AVP - Equity Research Analyst – BFSI, Asit C Mehta Investment Interrmediates Ltd, said, “The subdued performance observed in February can primarily be attributed to tax-related planning activities and the lack of festive occasions during the period. This, coupled with increased caution within the industry regarding unsecured lending, led to consumer expenditure declining to a seven-month low. While the overall growth rate has slowed, competitive dynamics among major players have intensified, with HDFC Bank and SBI each achieving a 10 bps increase in market share. Meanwhile, card issuance rates have plateaued, recording a marginal growth of 0.4% MoM, which translates to approximately 440,000 new cards issued during the month. We expect this tepid trajectory to continue in the near term before stabilizing.”