As per BCG analysis, digital payments are expected to surpass cash in the coming years and contribute to 75% of all retail transactions by FY30; UPI - The Global Benchmark for Digital Payments

FinTech BizNews Service

Mumbai, October 12, 2025: Given the current growth trajectory, digital payments are expected to surpass cash in the coming years and contribute to 75% of all retail transactions by FY30, states the report by NPCI and BCG titled “UPI–The Global Benchmark for Digital Payments Transforming lives at scale.” This report, launched recently at Global Fintech Fest (GFF) 2025 held at Jio World Convention Centre, in BKC, Mumbai, captures the full scope of UPI's impact from inclusion and enablement to transformation and expansion.

3 out of every 4 payments will be made digitally by FY30

By FY26, digital payment modes are expected to be more than 40% of all retail transactions in India, including those made in cash, with UPI emerging as the fastest-growing option. Given the current growth trajectory, as per Boston Consulting Group (BCG) analysis, digital payments are expected to surpass cash in the coming years and contribute to 75% of all retail transactions by FY30—meaning 3 out of every 4 payments will be made digitally.

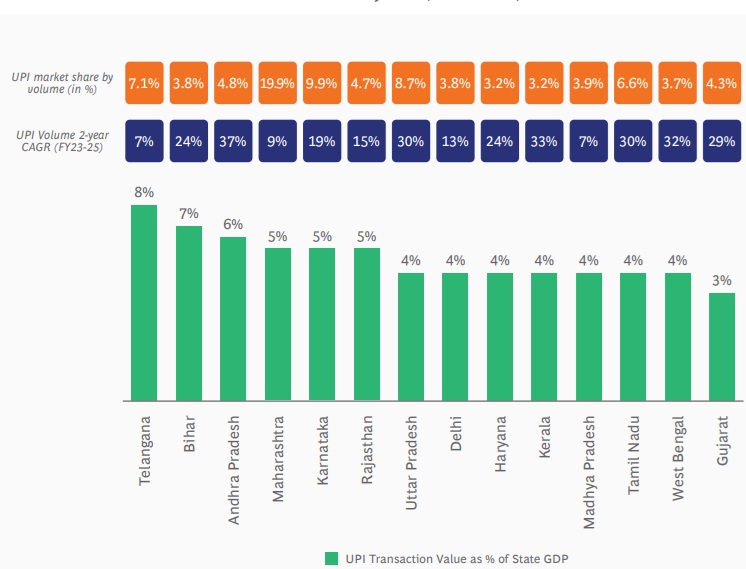

State-wise UPI Volume Growth For FY23-FY25

P2M payments > P2M transactions

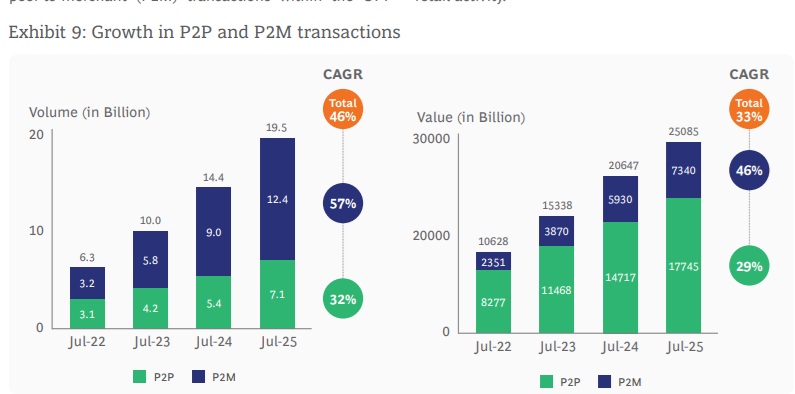

A key driver of this digital surge has been the rise in peer-to-merchant (P2M) transactions within the UPI ecosystem. As seen in Exhibit, over the past three years, P2M payments have grown at a faster pace than peer-to peer (P2P) transactions. This momentum is fuelled by the increasing formalization of the market, with more small merchants embracing digital payment solutions. This is also reflected in the increased share of online UPI transactions, which stood at 77%31 as of August 2025, indicating a preference among users for paying online. As a result, merchant transactions now lead in both volume and value growth, underscoring the expanding role of digital payments in everyday retail activity.

Evolution of new use cases

While the initial part of the growth had been driven significantly by the ease of paying peers (P2P payments), payments to merchants (P2M payments) are taking their fair share today. Merchants in our survey using UPI also reflected this change when 1 in 3 mentioned that they are receiving 41-80% of their payments through digital modes, as against

UPI: crown jewel in India’s DPI

UPI is a crown jewel in India’s DPI. UPI has become an integral part of India's Digital Payments Infrastructure. Developed to enable secure and real-time digital transactions, it has steadily expanded it's reach and impact across consumers, merchants and the broader economy, states the report by NPCI and BCG titled “UPI–The Global Benchmark for Digital Payments Transforming lives at scale.”

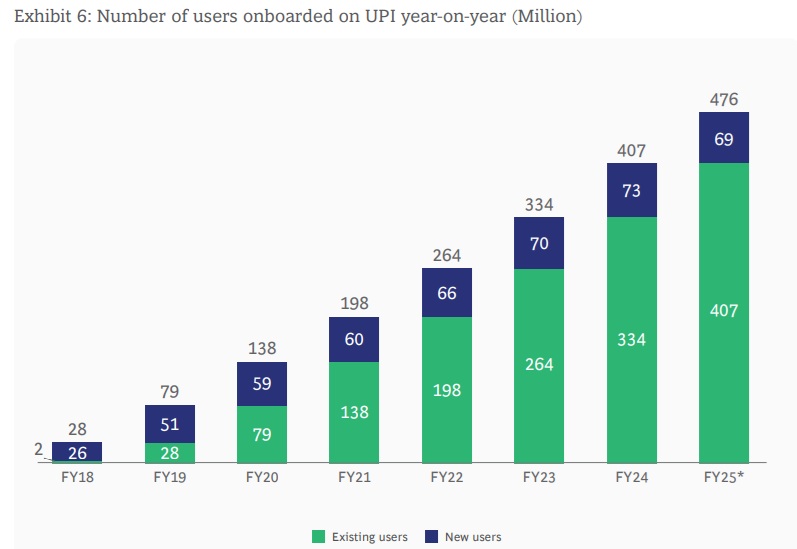

As of August 2025, UPI has 500 million + unique users and over 65 million merchants, processing more than 20 billion transactions every month. It now accounts for 50% of global real-time payment volumes.

Key highlights from the report:

1. UPI is transforming financial habits: 2 in 3 users surveyed state financing has become easier since adopting UPI and 85% of homemakers report reduced reliance on cash for in-store purchases.

2. 40% of users surveyed haven't visited an ATM in the past month, while 49% carry cash only for emergencies and not for everyday purchases.

3. Districts with high UPI volume growth saw 10x higher growth in consumer durable loans, 4.4x in personal loans and 4.2x in business loans during FY 2023-25

Discover more in the full report on UPI's scale, inclusion and innovation story: https://lnkd.in/d7bnT5_E

https://www.linkedin.com/company/upi-chalega