An assessment of bank group-wise fraud cases over the last three years indicates that while private sector banks reported maximum number of frauds, public sector banks continued to contribute maximum to the fraud amount

FinTech BizNews Service

Mumbai, May 31, 2024: RBI released its ANNUAL REPORT 2023-24 on 30 May, 2024. The report contains Part I: The Economy: Review and Prospects and Part II: The Working and Operations of The Reserve Bank of India.

Fraud Analysis

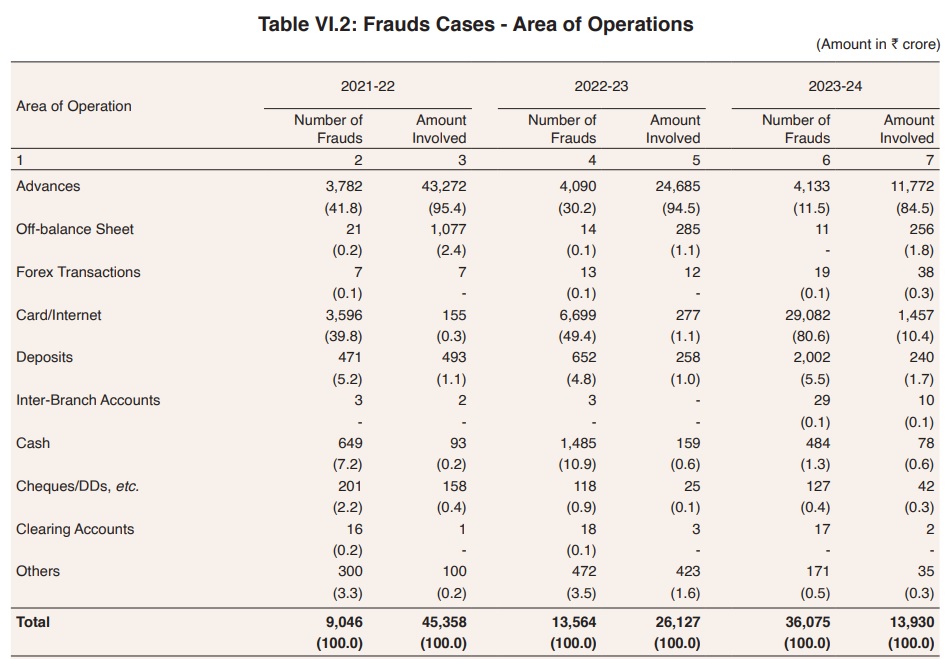

An assessment of bank group-wise fraud cases over the last three years indicates that while private sector banks reported maximum number of frauds, public sector banks continued to contribute maximum to the fraud amount (Table VI.1). Frauds have occurred predominantly in the category of digital payments (card/internet), in terms of number. In terms of value, frauds have been reported primarily in the loan portfolio (advances category) [Table VI.2].

decline in the amount

There was a 46.7 per cent decline in the amount involved in the total frauds reported during 2023- 24 over 2022-23. While small value card/internet frauds contributed maximum to the number of frauds reported by the private sector banks, the frauds in public sector banks were mainly in loan portfolio.

vintage of frauds

An analysis of the vintage of frauds reported during 2022-23 and 2023-24 shows a significant time-lag between the date of occurrence of a fraud and its detection (TableVI.3). The amount involved in frauds that occurred in previous financial years formed 94.0 per cent of the frauds reported in 2022-23 in terms of value. Similarly, 89.2 per cent of the frauds reported in 2023-24 by value occurred in previous financial years.

Data are in respect of frauds of ₹1 lakh and above reported during the period. The figures reported by banks and FIs are subject to changes based on revisions filed by them. Frauds reported in a year could have occurred several years prior to year of reporting. Amounts involved reported do not reflect the amount of loss incurred. Depending on recoveries, the loss incurred gets reduced. Further, the entire amount involved is not necessarily diverted.