Agenda for 2024-25: RBI Will Modernize Currency Management Infrastructure; RBI Will Sustain the Self-Sufficiency In Banknote Production

FinTech BizNews Service

Mumbai, May 31, 2024: RBI released its ANNUAL REPORT 2023-24 on 30 May, 2024. The report contains Part I: The Economy: Review and Prospects and Part II: The Working and Operations of The Reserve Bank of India.

New Shredding and Briquetting Systems

During the year 2023-24, purchase orders were placed for procurement of new shredding and briquetting systems for 21 regional offices following due tendering process. Delivery and installation of these SBS machines will commence from Q1:2024-25 and is likely to be completed in the next two years for all the offices, according to the RBI’s ANNUAL REPORT 2023-24, released on 30 May, 2024.

Mobile Coin Vans (MCVs) for Distribution of Coins

To enhance distribution of coins, the scheme of MCVs operating in select states has been extended across the country. Additionally, the scope of services has been broadened to facilitate the exchange of lower denomination notes, which are unfit for circulation. These MCVs distribute coins and banknotes to the public located particularly in semi-urban, rural and remote areas.

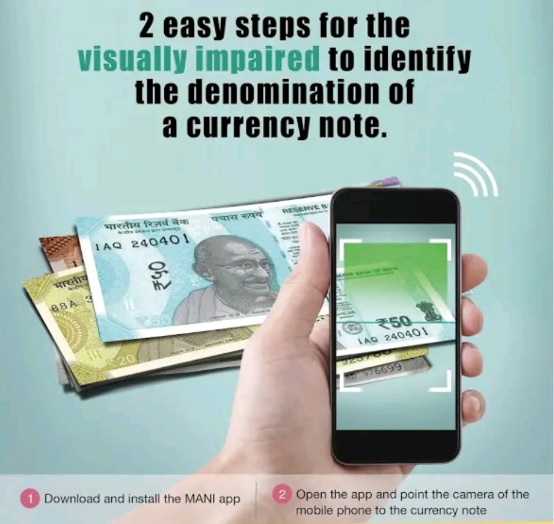

Mobile Aided Note Identifier (MANI) App

The MANI App was launched on January 1, 2020 to facilitate visually impaired persons to identify denomination of Indian banknotes. The App notifies the banknote denomination in 11 regional languages apart from Hindi and English.

Procurement of New Security Features for Indian Banknotes

The Reserve Bank is actively taking forward the process of introduction of new/ upgraded security features for banknotes.

Bharatiya Reserve Bank Note Mudran Private Ltd. (BRBNMPL)

BRBNMPL presses have increased direct remittances of banknotes to currency chests, resulting in enhanced logistical efficiency and cost effectiveness. At the behest of the Reserve Bank, BRBNMPL is also establishing a Currency Research and Development Centre (CRDC) at its Mysuru campus for conducting cutting-edge research in the domain of currency.

Agenda for 2024-25

During the year, the Department will focus on the following:

● Carrying forward the project on modernisation of the currency management infrastructure; ● Replacement of existing SBS machines; ● Exploring more sustainable and eco-friendly disposal of currency note briquettes; ● Finetuning policies and initiating measures for improving delivery of banknotes/coins to members of the public; and ● Implementation of technical standards issued by BIS for NSMs used by banks across the country.

Conclusion

During 2023-24, the Reserve Bank continued with initiatives to enhance banknote distribution efficiency, increase public awareness on banknotes and coins and ensure availability of adequate quantity of clean banknotes and coins for the public. The Reserve Bank formulated an action plan for modernization and automation of currency management infrastructure and smoothly conducted the process of withdrawal of Rs2000 denomination banknotes from circulation. Going forward, the Reserve Bank’s endeavor would be to modernize the currency management infrastructure and sustain the self-sufficiency in banknote production. Analytical research for further strengthening the integrity of banknotes and understanding the trends in public preference for cash vis-à-vis other modes of payment shall continue to remain a focus area.