Paytm's Revenue up 38% YoY to Rs2,850 Cr; EBITDA before ESOP of Rs219 Cr, margin improved to 8%

FinTech BizNews Service

Mumbai, January 22, 2024: Paytm, India's leading mobile payments and financial services distribution company, is pioneer of the mobile QR payments revolution in India. Paytm builds technologies that help small businesses with payments and commerce.

For Q3 FY 2024, Paytm has reported 38% YoY revenue growth, due to accelerated GMV growth, higher device addition, and growth of financial services business. This was partly boosted by the timing of festive seasons (online sales for the festive season were in Q3, whereas in the previous financial year it was largely in Q2). Net payment margin has gone up 63% YoY to Rs748 Cr due to increase in payment processing margin and increase in merchant subscription revenues.

Payment Processing Margin is in the 7-9bps range (no UPI incentives booked during the quarter). Financial services take rate has improved QoQ due to higher proportion of merchant loans and personal loans distribution (Postpaid loans reduced QoQ as communicated in the December 6, 2023 update) and increasing revenue from insurance distribution business.

Average ticket size of merchant Loan and personal will continue to increase further as proportion of high ticket loans continue to increase. Contribution profit increased 45% YoY to Rs1,520 Cr, due to growth in net payment margin and financial services business.

On a QoQ basis, the contribution profits grew by 7%, but margin declined by 3 percentage points due to seasonal factors, such as higher promotions during festive season, higher proportion of events business and slightly lower payment processing margins (in bps), typically experienced during festive season. On back of growth and operating leverage, Q3 FY 2024 EBITDA before ESOP increased by Rs188 Cr YoY to Rs219 Cr and PAT increased by Rs170 Cr YoY to (Rs222 Cr).

Key Financial Highlights:

• Paytm reported revenue of Rs2,850 Cr, 38% YoY growth

• Contribution profit up 45% YoY to Rs1,520 Cr (margin of 53%, up 2 percentage point YoY)

• EBITDA before ESOP up Rs188 Cr YoY to Rs219 Cr (margin of 8%, up 6 percentage point YoY) • Profit after tax (PAT) improved by Rs170 Cr YoY to (Rs222 Cr)

Payment Business:

• Revenue from Payment services up 45% YoY to Rs1,730 Cr, partly boosted by timing of festive season

• Net payment margin is up 63% YoY to Rs748 Cr; GMV up 47% YoY to Rs5.1 Lakh Cr

• Payment processing margin (without UPI incentive in this quarter) is in the 7-9bps range

• Merchant paying subscription for devices has reached 1.06 Cr as of December 2023, an increase of 49 Lakh YoY

Financial Services Business:

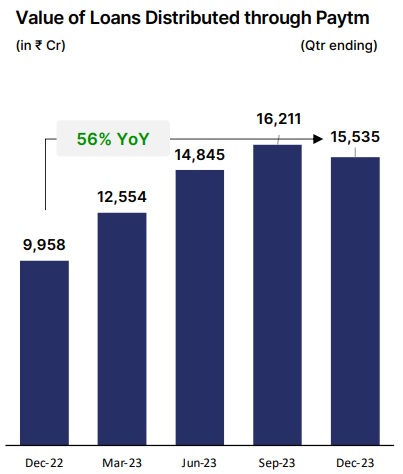

• Revenue from financial services and others up 36% YoY to Rs607 Cr; take rate has improved QoQ • Loan distribution was up 56% YoY to Rs15,535 Cr • Expanding financial services through high ticket loans, insurance distribution and equity broking.

Merchant payment network has large monetization opportunity

We continue to see strong demand from merchants for our mobile payment acceptance products due to innovative features, superior quality, and strong distribution and service network. In this quarter, our merchant subscriber network crossed 1 Cr benchmark and grew by 14 Lakh for the quarter. Strong device growth is also fueling growth in GMV, which helps us drive payment processing revenue.

We continue to be a leading player in merchant acquiring network. We see enhanced monetization opportunities, such as: 1) Subscription revenue, 2) MDR on payments including products on UPI rails like RuPay credit cards, 3) Government and RBI incentives such as UPI, and PIDF 4) Merchant lending, and 5) Marketing services to merchants

We are seeing an increasing trend of customers linking their RuPay credit cards to payment apps and using it to make payments on UPI QR code. Merchants can now accept credit card payments through UPI QR code. Such transactions generate revenue for the consumer payment apps, as well as for merchant acquirers. Considering Paytm’s strength on both sides of the ecosystem, we are benefitting from this monetization opportunity. Our large payment network also gives us opportunity to monetize our marketing services (erstwhile commerce and cloud). We are enabling merchants to offer advertising, deals and gift vouchers etc. on Paytm app which drives customer engagement, as well as consumer traffic to the merchants. Our Average Monthly Transacting Users (MTU) for Q3 FY 2024 grew by 18% YoY to 10 Cr as Paytm app remains a preferred choice for customers, with its offering to pay for various use cases through comprehensive payment instruments, such as UPI (including RuPay credit card), Wallet, Cards etc.

Financial Services: Expanding distribution through High ticket loans, Insurance distribution and Equity broking

Loan distribution business:

In Q3 FY 2024, across our three loan distribution offerings (Merchant Loans, Personal Loans, and Postpaid Loans), loans amounting to Rs15,535 Cr were distributed through the Paytm platforms, up 56% YoY. The amount is 4% lower from last quarter as we have and will continue to calibrate distribution of Postpaid loan on the back of the macro uncertainty and regulatory guidance which was communicated on December 6, 2023. According to feedback from our lending partners, asset quality of the loans distributed from our platform continues to remain steady. Paytm’s large and engaged consumer & merchant base continues to draw interest for lending partnership. Recently we have added one more lending partner and one credit card partner. We are in the process of integration with a couple of lending partners (Bank/NBFC) and one more credit card partner. We have now partnered with 8 NBFCs for our loan distribution business and 3 Banks for our credit card marketing business. We are seeing good ramp-up in the high-ticket loan segment with a distribution of Rs490 Cr in the quarter. With more than 2 Cr whitelist customers, we expect acceleration in this business as we increase lending partners from currently to at least 5-6 partners by Q1 FY 2025. In addition to the existing loan distribution business, financial services distribution has two large opportunities that are now meaningful: 1) Insurance distribution and 2) Equity broking and MF distribution

Insurance distribution: We are building Insurance business by offering embedded insurance and DIY products to Paytm consumers. There is special focus in leveraging merchant ecosystem by offering them various business insurance solutions. Our platform offers contextually embedded products that have Data-driven personalization and best-in-class claims experience by deeper provider integrations.

Equity broking and MF distribution:

Our equity broking and MF distribution continue to scale well with organic traffic from Paytm app. Our focus is on retention of trading customers by offering high quality trading platform and building MF distribution by leveraging SIPs

Focus on AI led operating leverage

We are accelerating the adoption of AI as it allows us to deploy more features at a faster speed within the core tech and product functions. So far AI has delivered more than what we expected, and we expect our AI first approach will allow us to drive operating leverage across various functions, including business and operations. Additionally, we see operating leverage in marketing costs even as we continue to grow our users and merchants. We do expect marketing spends to vary across the quarters due to seasonal factors such as IPL, festive season etc. As a result of these measures, we expect our indirect cost to grow at a slower pace in the coming quarters.

Key Metrics for the quarter ending Dec 2023 (Q3 FY 2024)

Revenue of Rs2,850 Cr from Operations

Driven by increase in merchant subscription revenues, 38% YoY increase in GMV and growth in distribution of loans through our platform.

Contribution Profit Rs1,520 Cr, 45% YoY

Contribution margin increased to 53%, up 2 percent point YoY, due to increase in net payment margin and growth in financial services business

EBITDA before ESOP Rs219 Cr Rs188 Cr YoY.

Margin improved to 8%, an expansion of 6 percent points YoY, on back of growth and operating leverage

Profit After Tax (Rs222 Cr) Rs170 Cr YoY,

Profit after tax has improved due to growth and operating profitability

Merchant Subscription (including devices) 1.06 Cr 49 Lakh YoY.

Our leadership in payment monetization continues. Added 49 Lakh and 14 Lakh new subscriptions in last year and quarter, respectively

Loans Distributed through Paytm Rs15,535 Cr, 56% YoY

As of December 2023, our lending partners have distributed loans through our platform to 1.25 Cr unique Paytm consumers and merchants. Paytm active user and MTU base offers us tremendous upsell and lifecycle benefits across financial services

Financial Update for Q3 FY 2024

Payment Services: Payment business profitability continues to improve

Our payment business continues to scale, led by increase in GMV and higher subscription revenue. In Q3 FY 2024, payments revenue grew by 45% YoY to Rs1,730 Cr. Growth in GMV was partly boosted on account of timing of festive season as most of the online sales in this financial year were in Q3, whereas in the previous financial year they started in Q2. There are no UPI incentives booked during the quarter.

Improved payments profitability

Payments profitability improved with net payment margin expanding 63% YoY to Rs748 Cr. Net payment margin is comprised of:

1. Payment Processing Margin: In Q3 FY 2024, GMV grew 47% YoY to Rs5.10 Lakh Cr., aided by timing of festive season. Payment processing margins (in bps) are slightly lower sequentially because of festive season. It is in the range of 7 to 9 bps (even without UPI incentives) and has improved YoY due to: a) Increase in GMV of non-UPI instruments like EMI and cards, and b) Improvements in payment processing margin on these non-UPI instruments.

2. Subscription revenues: As of December 2023, merchant subscriptions were 1.06 Cr, increasing 49 Lakh YoY. In this quarter, we deployed 14 Lakh devices. We continue to earn Rs100 to Rs500 per month per device.

Financial Services and Others: Expanding distribution through High ticket loans, Insurance distribution and Equity broking

In Q3 FY 2024, revenue from financial services and others grew 36% YoY to Rs607 Cr. Financial Services take rate has increased QoQ due to higher contribution of merchant loan and personal loan distribution and higher revenue of Insurance business. As continuation to our disclosure to the stock exchanges on December 6, 2023, we will continue to calibrate Postpaid further in Q4 FY 2024 and beyond on the back of continued macro uncertainty and regulatory guidance for less than Rs50k loans. We are building Insurance business by offering embedded insurance and DIY products to Paytm consumers. There is special focus in leveraging merchant ecosystem by offering them various business insurance solutions. Our platform offers contextually embedded products that have Data-driven personalization and best-in-class claims experience by deeper provider integrations. Our Equity broking and MF distribution business continue to scale well with organic traffic from Paytm app helping it grow with minimal marketing spends. Our focus is on retention of trading customers by offering high quality trading platform and significantly build MF distribution by leveraging SIPs.

Loan Distribution

In Q3 FY 2024, the value of loans distributed through our platform has increased to Rs15,535 Cr, a growth of 56% YoY. Total number of unique users who have taken a loan through our platform has increased by 44 Lakh over last 1 year to 1.25 Cr. This growing loan distribution user and MTU base offers us tremendous upsell and lifecycle benefits across financial services. We see a large opportunity in the high-ticket loan business, with over 20mn users already whitelisted. We piloted this product in Q2 FY 2024 and has scaled up this quarter as we distributed Rs490 Cr of loans. We expect it to accelerate further in coming quarters, as we onboard more lending partners. We are currently working with 2 lending partners for high ticket loans and we expect to add at least 3-4 more lending partners by Q1 FY 2025.

Merchant Loans

The value of Merchant Loans distributed grew 96% YoY to Rs3,579 Cr. Proportion of loans distributed to a subscription merchant remains greater than 85% this quarter. Our repeat rate (proportion of loans by value to merchants who have taken a loan before) remains at a healthy level of 50%. Average ticket size has increased to Rs200,000 from Rs150,000 a year back with average tenure of 13 months versus 12 months a year back. Penetration for Merchant Loans is at 6.1% of device merchants.

Personal Loans

The value of Personal Loans distributed grew 52% YoY to Rs4,460 Cr. Average ticket size has increased to Rs168,000 from Rs120,000 a year back with average tenure increasing to 16 months versus 15 months a year back. We expect this to increase further as proportion of high ticket loans continue to increase. We will maintain marginal growth on ticket size less than Rs2 Lakh . Penetration1 for Personal loans is at 1.1% of MTU.

Postpaid Loans

The value of Postpaid Loans distributed grew 44% YoY, but was down 17% QoQ to Rs7,496 Cr as we have slowed down Postpaid loan distribution. This is achieved through risk calibration on both consumer and merchant side: a) Consumers: We worked with the lenders to take a conservative view and cut on marginal cohorts. Accordingly, number of eligible users have been cut down by ~15% b) Merchants: We calibrated Postpaid Loan usage with focus on consumption use cases Combination of this has resulted in 50-60% lower Postpaid Loan distribution for the month of December, which will be further calibrated in Q4 FY 2024 and beyond as we will continue to watch for macro uncertainty and regulatory guidance on Marketing Services (erstwhile Commerce & Cloud): Driving additional monetization from Merchants In our Marketing Services (Commerce & Cloud) business, merchants are offered marketing services by leveraging Paytm consumer app traffic. Marketing Services primarily includes, ticketing (travel, movie, events etc.), advertising, credit card marketing, and deals and gift vouchers. In Q3 FY 2024, Marketing Services revenue grew by 22% YoY to Rs514 Cr. • GMV for ticketing, deals and gift vouchers etc. (Commerce business) grew 48% YoY to Rs3,392 Cr, driven by increase in market share in travel and higher volumes in events business. Take rate for Q3 FY 2024 was above guided 5-6% range due to higher contribution of the events business which has higher take rate as well as high direct costs. Revenue: Marketing Services (in Rs Cr) (Qtr ending) 235 225 249 261 267 185 168 156 163 247 420 392 405 423 514 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Cloud Services Commerce Services 22% YoY • Credit card marketing continue to scale with 10.1 Lakh activated credit cards as of December 2023 versus 4.5 Lakh last year. • Advertisement business continue to grow with strong customer engagement. • Marketing cloud has seen decline YoY, and now comprises less than 10% of our revenues from Marketing services, and less than 2% of our overall revenues. We previously used to call this revenue breakup as Commerce and Cloud, but since a vast majority of revenues come from marketing services (as described above), and as the company does not provide cloud computing and data center services, we will henceforth call this revenue breakup as “Marketing Services”. Contribution Profit growth led by net payments margin & financial services business Our Q3 FY 2024 contribution profit of Rs1,520 Cr represents a growth of 45% YoY. Contribution margin improved to 53% from 51% a year ago. On a QoQ basis, the contribution profits grew by 7%, but margin declined by 3 percentage points due to seasonal factors such as higher promotions during festive season, higher mix of events business and slightly lower payment processing margins typically experienced during festive season. We expect contribution margins to remain stable in the mid50s with some variations from quarter to quarter due to seasonality. Payment processing charges were Rs982 Cr, up 33% YoY, while payment revenues grew 45% YoY. Promotional cashbacks & incentives were up 17% YoY to Rs106 Cr, which is 2.1bps of GMV. Sequential increase was due to higher promotional activity during the festive season. Other direct expenses were Rs242 Cr, 30% YoY increase on account of higher: a) collection costs due to the growth of lending business, b) volume growth of the events business, and c) direct costs relating to merchant subscription business. On a sequential basis, increase in other direct costs is mainly on account of increase in events business which has high take rate but also high direct costs. Indirect Expenses: Focus on AI led efficiencies to drive operating leverage For Q3 FY 2024, Indirect Expenses (excluding ESOP cost) has increased 28% YoY to Rs1,301 Cr. Indirect expenses (as a % of revenues), has declined to 46% in Q3 FY 2024 , from 49% in Q3 FY 2023 and 51% in Q2 FY 2024. While there can be quarterly volatility, we expect indirect expenses as a percent of revenues to continue declining over time, despite investment for growth. Marketing cost was Rs169 Cr, was up 24% YoY vs. 38% growth in revenue, demonstrating operating leverage. We see operating leverage in marketing costs even as we continue to grow our users and merchants. We do expect marketing spends to vary across the quarters due to seasonal factors such as IPL, festive season etc. Employee cost (excluding ESOPs) was Rs809 Cr, up 39% YoY. Sales employee cost has gone up by 50% YoY as we have expanded our device deployment to 14 Lakh in Q3 FY 2024 versus 10 lakh in Q3 FY 2023. Other employee cost has gone up 34% YoY as we continue to build platform capabilities. With AI delivering significant efficiencies by automating a large spectrum of workflows, we expect significant operating leverage from employee costs going forward. Software cloud and data center cost was Rs170 Cr, flat YoY. This cost has gone from 8% of revenues a year ago to 6% in the most recent quarter, as a result of optimization of our cloud architecture and discipline on costs. We expect these costs to grow at a lower rate than the growth in payment volume and revenues. Other indirect expenses, which mainly include G&A expenses, was Rs153 Cr, up 21% YoY. It has decreased to 5% of revenue versus 6% of revenue last year. This cost is largely a fixed cost and we expect growth to be lower than revenue growth. Continuous improvement in EBITDA before ESOP; up Rs188 Cr YoY to Rs219 Cr We continue to see consistent improvement in profitability due to strong revenue growth, and operating leverage. In Q3 FY 2024, our EBITDA before ESOP was Rs219 Cr as compared to Rs31 Cr in Q3 FY 2023. EBITDA before ESOP margin for Q3 FY 2024 stands at 8%, which is an improvement of 6 percent points. This does not include any UPI incentives, since we record UPI incentives after government issues the gazette notification. Profit after tax for Q3 FY 2024 was (Rs222 Cr), an improvement of Rs170 Cr YoY Cash Balance Our cash balance has increased to Rs8,901 Cr as of quarter ending December 2023, as compared to Rs8,754 Cr as of quarter ending September 2023. The above includes Paytm Money Ltd (PML) customer funds of Rs319 Cr for September 2023 and Rs462 Cr for December 2023. For 9M FY 2024, we have added Rs626 Cr cash (Rs382 Cr excluding PML customer funds), even without UPI incentive. ESOP Cost and ESOP Pool Schedule We had disclosed our ESOP cost forecasts in December 2022, for the ESOP which were granted till November 2022. That was an illustrative table with the assumption that no new ESOPs are issued, and no employees (who hold ESOPs) leave before their ESOPs are vested. Since September 2022 and November 2022, the company has granted a net 0.73 Cr and 0.42 Cr additional ESOPs, respectively, which will result in some increase in future ESOP charges compared to the table provided previously. We will disclose updated ESOP charge schedule with end of year results. Below is the ESOP pool schedule as of September 30, 2022, and as of December 31, 2023 Investment in GIFT City to offer AI-driven cross border remittance, development centre for innovation We will be investing Rs100 Cr in Gujarat International Finance Tec-City (GIFT City) to build a global financial ecosystem. We will make this investment over a period of time. With GIFT city as an ideal innovation hub for cross-border activity, we will use its proven capability to innovate and build new tech for users across the globe looking to invest in India. As the pioneer of real-time payments and settlements in India, we will replicate its success to now reduce friction in cross-border remittances with faster and cost-effective solutions, driven by Artificial Intelligence. Leveraging its leadership as a tech innovator, we will also set up a development centre in GIFT City to build the above solutions and provide a technology backbone. This centre will create jobs and house engineers to develop a suite of world-class financial products and services.