Paytm believes that, over a period of time, 40-50% of these ( over 10 Cr) merchants will need software, hardware or a combination of product thereof for managing their digital payments; Paytm Will leverage AI to drive efficiency: Continued automation of various operations to improve efficiency

FinTech BizNews Service

Mumbai, January 20, 2025: Paytm said on Monday its revenue jumped to Rs1,828 Cr on Growth in Payments and Financial Services; EBITDA Before ESOP and PAT improved by Rs145 Cr and Rs208 Cr QoQ*, respectively.

The payments App reported Following:

Financial Highlights:

• Operating revenue of Rs1,828 Cr, up 10% QoQ

• Contribution profit of Rs959 Cr, up 7% QoQ; contribution margin of 52%

• EBITDA before ESOP of Rs(41) Cr, an improvement of Rs145 Cr QoQ

• EBITDA of Rs(223) Cr, an improvement of Rs181 Cr QoQ

• PAT of Rs(208) Cr, an improvement of Rs208 Cr QoQ*

• Cash balance of Rs12,850 Cr, increased by Rs2,851 Cr QoQ, largely on account of PayPay stake sale and improvement in working capital

Business Highlights:

• Payment services revenue of Rs1,059 Cr, up 8% QoQ; Financial services revenue increased sharply to Rs502 Cr, up 34% QoQ

• Net payment margin of Rs489 Cr, up 5% QoQ; GMV of Rs5.0 Lakh Cr, up 13% QoQ

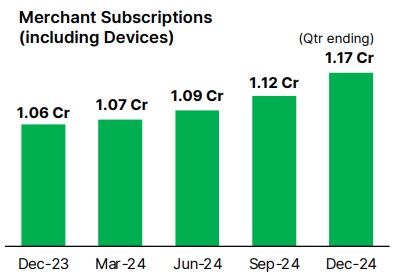

• Merchant subscriber base for devices has reached 1.17 Cr as of Dec’24, addition of 5 Lakh QoQ

EBITDA and Profit After Tax

EBITDA before ESOP was Rs(41) Cr, an improvement of Rs 145 Cr from Q2 FY 2025, due to growth in revenues and contribution profit, and lower indirect expenses. Our reported EBITDA improved by Rs181 Cr QoQ, due to lower ESOP costs. We expect ESOP costs to reduce materially going forward. Profit after Tax (PAT) of Rs(208) Cr, improved by Rs208 Cr QoQ (after excluding exceptional gain in Q2 FY 2025).

Continued focus on payments and distribution of financial services for sustained, profitable growth

In Q3 FY 2025, we achieved 10% QoQ revenue growth, due to increase in GMV, healthy growth in subscription revenues and increase in revenues from distribution of financial services. Growth in net payment margin was largely on account of higher subscription revenue. Payment processing margin continues to remain in the guided range. Higher Financial Services revenue was on account of higher share of merchant loans, higher trail revenue from Default Loss Guarantee (DLG) portfolio (as explained in Q2 FY 2025 earnings release, loans with DLG have higher revenue over the life of the loan), and better collection efficiencies.

Contribution profit was Rs959 Cr, up 7% QoQ.

Contribution margin (without UPI incentives) was marginally down QoQ, at 52%, due to an increase in DLG cost in this quarter as the amount disbursed under the DLG program more than doubled QoQ (largely because we started DLGs in the middle of the previous quarter). We expect contribution margin excluding UPI incentive to remain in 50-55% range and including UPI incentive to be in 55- 60% range. We have been able to reduce our indirect cost by 7% QoQ and 23% YoY to Rs1,000 Cr. Going forward, we expect calibrated growth in marketing costs and sales employee expenses as we invest in customer and merchant acquisition. Our employee costs (excluding ESOP) for 9M FY 2025 is lower by Rs451 Cr YoY, and will comfortably surpass our targeted annualised people cost savings of Rs400 - 500 Cr. With growth in revenue, increase in contribution profit and reduction in indirect costs, EBITDA Before ESOP has improved by Rs145 Cr QoQ to Rs(41) Cr. EBITDA improved by Rs181 Cr QoQ to Rs(223) Cr. PAT improved by Rs208 Cr QoQ (after excluding exceptional gains of Rs1,345 Cr in Q2 FY 2025) to Rs(208) Cr.

Unlocking the Potential of Mobile Payments in India's Merchant Ecosystem

Our extensive distribution and service network positions us well to capitalize on this growing market. We believe that tier-2 and tier-3 cities offer significant penetration opportunities and we will further expand our distribution network to onboard more merchants from these markets.

In India, on the merchant acquiring side, we see potential of over 10 Cr merchants who will accept mobile payments and we believe that, over a period of time, 40-50% of these merchants will need software, hardware or a combination of product thereof for managing their digital payments.