World Bank’s latest Migration and Development Brief: India Top Recipient Of Remittances in 2023; Officially recorded remittance flows to low- and middle-income countries (LMICs) moderated in 2023; Outward remittances from the GCC countries to destination countries decreased by 13 percent

Dilip Ratha, lead economist, Migration, and Remittances / Economic Adviser to the Vice President of Operations, MIGA

FinTech BizNews Service

Mumbai, June 27, 2024: After a period of strong growth during 2021-2022, officially recorded remittance flows to low- and middle-income countries (LMICs) moderated in 2023, reaching an estimated $656 billion, according to the World Bank’s latest Migration and Development Brief, released on Wednesday, June 26, 2024.

The modest 0.7% growth rate reflects large variances in regional growth, but remittances remained a crucial source of external finance for developing countries in 2023, bolstering the current accounts of several countries grappling with food insecurity and debt issues. In 2023, remittances surpassed foreign direct investment (FDI) and official development assistance (ODA).

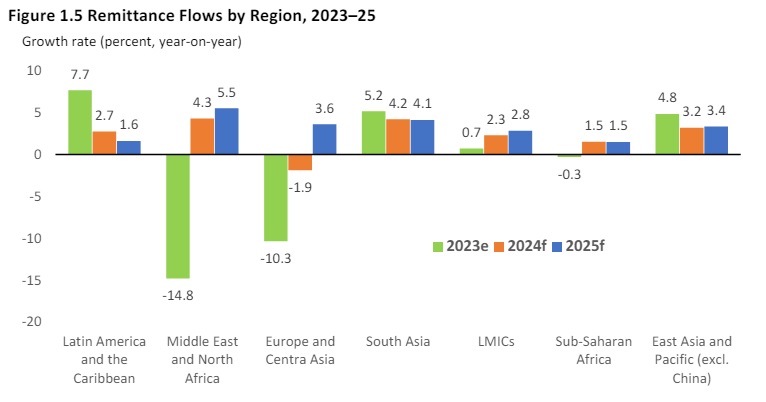

Looking ahead, remittances to LMICs are expected to grow at a faster rate of 2.3% in 2024, although this growth will be uneven across regions. Potential downside risks to these projections include weaker than expected economic growth in high-income migrant-hosting countries and volatility in oil prices and currency exchange rates.

Migration And Resulting Remittances

“Migration and resulting remittances are essential drivers of economic and human development,” said Iffath Sharif, Global Director of the Social Protection and Jobs Global Practice at the World Bank. “Many countries are interested in managed migration in the face of global demographic imbalances and labor deficits on the one hand, and high levels of unemployment and skill gaps on the other. We are working on partnerships between countries sending and receiving migrants to facilitate training, especially for youth, to get the skills needed for better jobs and income at home and in destination countries.”

In 2023, remittance flows increased most to Latin America and the Caribbean (7.7%), followed by South Asia (5.2%), and East Asia and Pacific (4.8%, excluding China). Sub-Saharan Africa saw a slight decline of 0.3%, while the Middle East and North Africa experienced a nearly 15% drop, and Europe and Central Asia saw a 10.3% fall.

Resilience Of Remittances

“The resilience of remittances underscores their importance for millions of people,” said Dilip Ratha, lead economist and lead author of the report. “Leveraging remittances for financial inclusion and capital market access can enhance the development prospects of recipient countries. The World Bank aims to reduce remittance costs and facilitate formal flows by mitigating political and commercial risks to promote private investment in this sector.”

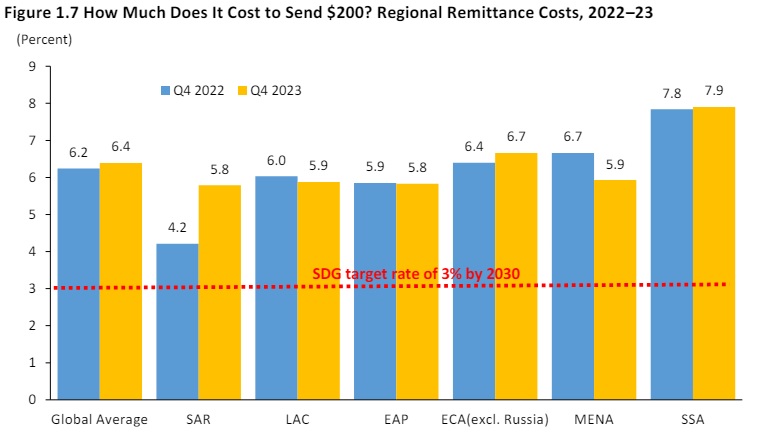

Sending remittances remains too costly. In the fourth quarter of 2023, the global average cost of sending $200 was 6.4% of the amount being sent, slightly up from 6.2% a year earlier and well above the SDG target of 3%. Digital remittances had a lower cost of 5%, compared with 7% for non-digital methods, highlighting the benefits of technological advancements in reducing the financial burden on migrants.

With remittances growing in importance, accurate data collection is essential to support the UN Sustainable Development Goals on reducing costs and increasing volume. However, statistical data remain inconsistent and incomplete. The global gap between inward and outward remittance flows has widened, with informal channels being a major factor, such as migrants carrying cash by hand when they return home. The International Working Group to Improve Data on Remittance Flows (RemitStat) will release a report later this year with recommendations for improving data.

Trends in Remittance Flows

Remittances Continued to Grow in 2023 Remittance flows to low- and middle-income countries (LMICs) grew by 0.7 percent to reach $656 billion in 2023. Remittances continued to be the premier source of external finance for LMICs during 2023, surpassing foreign direct investment (FDI) and official development assistance (ODA).

The moderation in remittances’ growth rate in 2023 reflects a normalization of trends after the post-pandemic increase of 8.3 percent in 2021–22. By comparison, FDI declined sharply, thus widening the gap between the two flows.

Top Five Recipient Countries

The top five recipient countries for remittances in 2023 are India, with an estimated inflow of $120 billion, followed by Mexico ($66 billion), China ($50 billion), the Philippines ($39 billion), and Pakistan ($27 billion) (figure 1.2a). In smaller economies, remittance inflows represent very large shares of gross domestic product (GDP), highlighting the importance of remittances for funding the current account and fiscal shortfalls. Topping the list is Tonga (41 percent of GDP), followed by Tajikistan (39 percent), Lebanon (31 percent), Samoa (28 percent), and Nicaragua (27 percent)

Largest Source Of Remittances

The United States has continued to be the largest source of remittances in the world, followed by Saudi Arabia and Switzerland. As a share of GDP, however, Saudi Arabia has a significantly larger volume of outward remittances than the United States. The top remittance source countries include members of the Gulf Cooperation Council (GCC). However, data on outward remittances tend to overstate the size of the flows in countries that are offshore financial centers.

In 2023, remittance flows were affected by a combination of structural and cyclical factors in the source and recipient countries. Foremost among these factors were the job markets for migrant workers in the source countries, immigration policies that affect the flow of migrant workers, their transit routes, and their employment prospects; exchange rate movements of major source-country currencies against the US dollar (which affects the valuation of remittances in US dollar terms); the prevalence of multiple exchange rates in recipient countries; and war and conflict. The recovery of the job markets in the high-income countries of the Organisation for Economic Co-operation and Development (OECD), following the onset of the COVID-19 pandemic, has been the key driver of remittances, particularly as employment growth during the recovery was more rapid for immigrants than for the native born (figure 1.3 for these trends in the United States). The relative strength of remittances to Latin America and the Caribbean compared with other regions can be explained by strong growth in the US labor market, the region’s main source of remittances.

Outward remittances from the GCC countries

Outward remittances from the GCC countries to destination countries decreased by 13 percent in 2023 compared with a year earlier. Notably, outward remittances from the GCC countries showed an upward trend from 2010 to 2019, with some fluctuations, but a declining trend seems to have set in after 2019. The decline likely reflects post-COVID adjustments, as well as Saudi Arabia’s recent policy allowing foreign migrant workers to bring their families to the country when they work, possibly resulting in fewer remittances being sent to their home countries. This could have negative implications for remittance flows to Pakistan and some North African countries.

Remittances To The East Asia And Pacific Region

Building on the robust recovery of 2022, remittances to the East Asia and Pacific region, excluding China, grew further at about 5 percent to $85 billion in 2023. While still positive, the pace of growth was slower relative to 2022 in most East Asian economies except China, which was rebounding from low growth. Remittance flows to the Philippines—the largest recipient after China in the East Asia and Pacific region—reached $39 billion in 2023, growing at 2.8 percent compared with 3.7 percent in 2022. The sustained growth in remittance flows to the Philippines was an outcome of a well-diversified set of host destinations across the world.

Remittance Flows To Europe And Central Asia

After growing sharply by 18 percent in 2022, remittance flows to Europe and Central Asia declined by 10 percent to reach about $71 billion in 2023. However, flows have remained much higher than prewar levels. The sharp decrease in remittances last year, from the high 2022 baseline, was driven mainly by a slowdown of money transfers from the Russian Federation to its neighboring countries, especially to Central Asian countries. A 39 percent depreciation of the Russian ruble against the US dollar in 2023 decreased the value of money transfers from Russia. Furthermore, remittance flows to Ukraine and Russia remained weaker than expected in 2023 due to negative effects from the ongoing war. Migration from Russia, significant in 2022, has been slowing, with some migrants electing to return home. After a 10.5 percent increase in remittances in 2022, remittance growth slowed in 2023 for Latin America and the Caribbean but still remained significant, at 7.7 percent, to reach $155 billion.

Remittances’ growth rate returned to the pre-pandemic level of 2019 supported by a strong US labor market. Remittances to Mexico reached $66.2 billion in 2023, an increase of 7.8 percent. Mexico receives the most remittances in the region by far, and is the world’s second-largest recipient of remittances. The growth of remittances varied widely across countries in 2023, ranging from an increase of 44.5 percent in Nicaragua to a decline of 13.4 percent in Argentina. Remittances to the Middle East and North Africa fell by 15 percent to $55 billion in 2023, accentuating the impact of the 3.2 percent decline seen in 2022.

The substantial drop of 2023 was largely driven by a sharp decline in flows to the Arab Republic of Egypt, by far the region’s largest remittance recipient. It is likely that remittances have been diverted toward unofficial channels given the wide gap between exchange rates in the official and parallel foreign exchange markets. In 2023, Egypt suffered from a severe lack of foreign currency due to a fixed exchange system and overvalued local currency. This led to the emergence of a parallel market, with the Egyptian pound exceeding LE 70 per US dollar at one point, and significantly cut official remittances from Egyptian expatriates. Remittances to South Asia grew 5.2 percent in 2023 to reach $186 billion, tapering off from the more than 12 percent increase of 2022. The increase is attributable entirely to remittance flows to India, which increased by 7.5 percent to reach $120 billion in 2023. The key drivers of remittance growth in 2023 are a historically tight labor market in the United States, high employment growth in Europe, reflecting extensive leveraging of worker retention programs, and a dampening of inflation in high-income countries. The slackening in remittance growth relative to 2022 is attributable to a decrease in growth in 2023 in Saudi Arabia and Kuwait, and the halving of growth in the remaining GCC countries triggered by the drop in oil prices and production cuts in the OPEC+ countries. The sharp drop in remittance flows to Pakistan and a slowdown in Bangladesh in 2023 reflected the primacy of informal channels of money transfer triggered by exchange-rate-related challenges in the domestic economy, while the sharp rise in Sri Lanka reflected migrants’ renewed confidence in an ongoing economic recovery. Remittance flows to Sub-Saharan Africa reached $54 billion in 2023, a slight decrease of 0.3 percent from the previous year. Remittance flows to the region are projected to rise by 1.5 percent in 2024. The projected moderate growth in remittances reflects the expected slower growth in the United States while a feeble rebound is expected in flows from Europe. The increase in remittance flows to the region supported the current accounts of several African countries that were dealing with food insecurity, drought, supply chain disruptions, floods, and debt-servicing difficulties.

Remittances Likely To Grow Up To $690 Bn By 2025

Looking ahead, remittances are expected to grow by 2.3 percent in 2024 and 2.8 percent in 2025, to reach $690 billion by 2025. In contrast, FDI flows, which have steadily decreased since 2012, are unlikely to recover strongly. The gap between remittances and FDI is therefore expected to widen further in the coming years. Potential downside risks to these projections are influenced by the economic stability of high-income migrant-hosting countries and ongoing headwinds, including an escalation of the evolving conflicts in the Middle East and disruptions of energy and financial markets that could push inflation up and reduce growth.

The outlook for remittance flows for 2024 and 2025 is based on the trajectory of economic activities in major migrant-hosting countries. It is also affected by many country-specific factors. The growth rate of remittance flows to LMICs is expected to recover to 2.3 percent in 2024 and 2.8 percent in 2025, to reach $690 billion in 2025. The most important factors driving the modest growth in remittances in 2024 are expected to be steady economic growth and stable labor markets in several high-income migrant-hosting countries, particularly the United States and Euro area countries. But downside risks, including a further deterioration in the war in Ukraine and the conflict in the Middle East, volatile oil prices and currency exchange rates, and a deeper-than-expected economic downturn in major high-income countries, are potentially significant.

Remittance flows to the East Asia and Pacific region are likely to inch up to $136 billion in 2024. Excluding China, the remittance growth rate is expected to drop from 5 percent in 2023 to 3 percent in 2024 (figure 1.5), leading to remittance levels of $88 billion in 2024 and $90 billion in 2025. The downside risk to remittance flows in 2024– 2025 is related to dimmer prospects of demand for less-skilled migrant labor from within East Asia’s middleincome countries, especially China. Remittance flows to Europe and Central Asia are projected to decline by 2 percent in 2024 due to the continued slowdown of outward remittances from Russia and a lingering weakness in flows to Ukraine and Russia. Money transfers from Russia are expected to continue declining. The projections for 2024 are subject to downside risk, including weaker-than-expected economic growth in major remittance-sending economies or a sharper-thanexpected drop in Russian outbound remittances. In 2025, remittances to the region are expected to grow by about 4 percent to $72 billion

Digital remittances had a lower cost

Sending remittances remains too costly due to limited competition among providers and inadequate cross-border inter-operability. In the fourth quarter of 2023, the global average cost of sending $200 was 6.4 percent of the amount being sent, slightly up from 6.2 percent a year earlier and well above the Sustainable Development Goal target of 3 percent. Digital remittances had a lower cost of 5 percent, compared with 7 percent for non-digital methods, highlighting the benefits of technological advancements in reducing migrants’ financial burden.

Stock Of International Migrants

Based on new census data and national statistics, the stock of international migrants is estimated to have been 302 million in 2023. The top destination countries are the United States, Germany, Saudi Arabia, Russia, and the United Kingdom. The largest origin countries are India, Ukraine, China, Mexico, and República Bolivariana de Venezuela. The largest migration corridor is from Mexico to the United States. According to the UNHCR, by December 2023, the number of refugees and asylum seekers fleeing war, violence, and persecution had reached 50 million. Strong migration pressures facing tighter borders in many destination countries seem to have increased the number of transit migrants, for example, in Mexico and in countries bordering Europe.

Global Economic Outlook in 2024 and 2025

Global growth is expected to remain steady despite elevated interest rates and heightened geopolitical tensions. Global real GDP is projected to grow by 2.6 percent in 2024 before going up to 2.7 percent in 2025 which is well below the 3.1 percent average in the decade before COVID pandemic, according to the latest Global Economic Prospects from the World Bank (June 2024). The 2024 GDP growth rate for advanced economies is expected to be 1.5 percent, unchanged from 2023 (figure B1.1). Among regions, growth forecasts for 2024 are generally strongest in South Asian economies (6.2 percent), and weakest in Latin America and the Caribbean (1.8 percent). Key remittance source countries in the euro area posted small gains (0.7 percent compared with 0.5 percent in 2023), while the growth rate for the United States remained steady at 2.5 percent. The overall outlook is expected to remain balanced over the next two years, but downside risks to the outlook remain relatively high despite the possibility of some upsides. An escalation of the evolving conflicts in the Middle East and disruptions of energy and financial markets could push inflation up and reduce growth. Global inflation has declined since 2022 as relative price shocks—especially those related to energy prices—have faded amid ongoing effects of continued monetary tightening. Global headline inflation is projected to fall steadily, averaging 3.5 percent in 2024, but at a slower pace than previously expected. Core inflation (excluding food and