The impressive growth of UPI showcases the growing adoption of digital payments across India

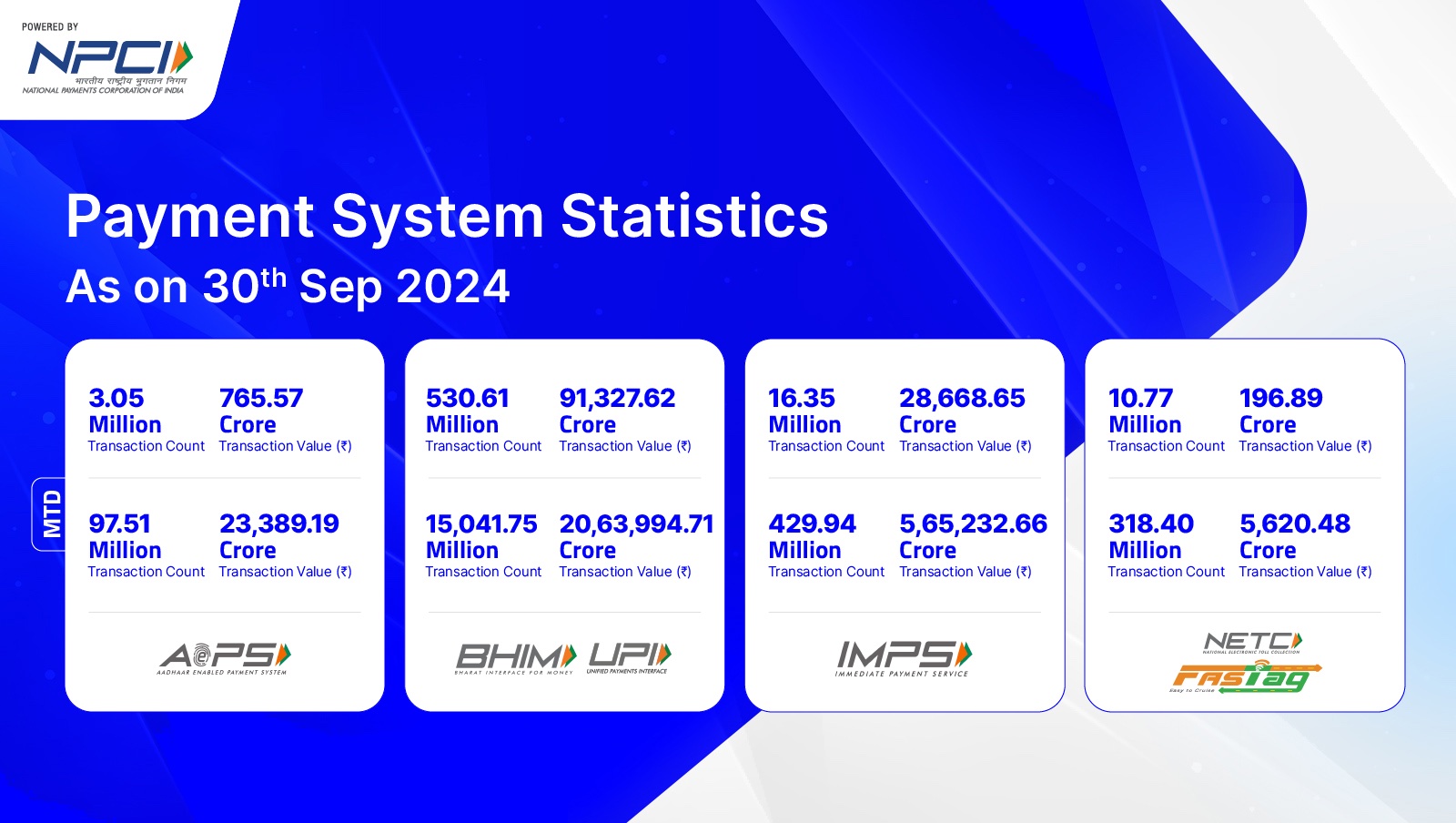

NPS NPCI data as of 30 Sept, 2024

Dilip Modi, Founder & CEO of Spice Money

FinTech BizNews Service

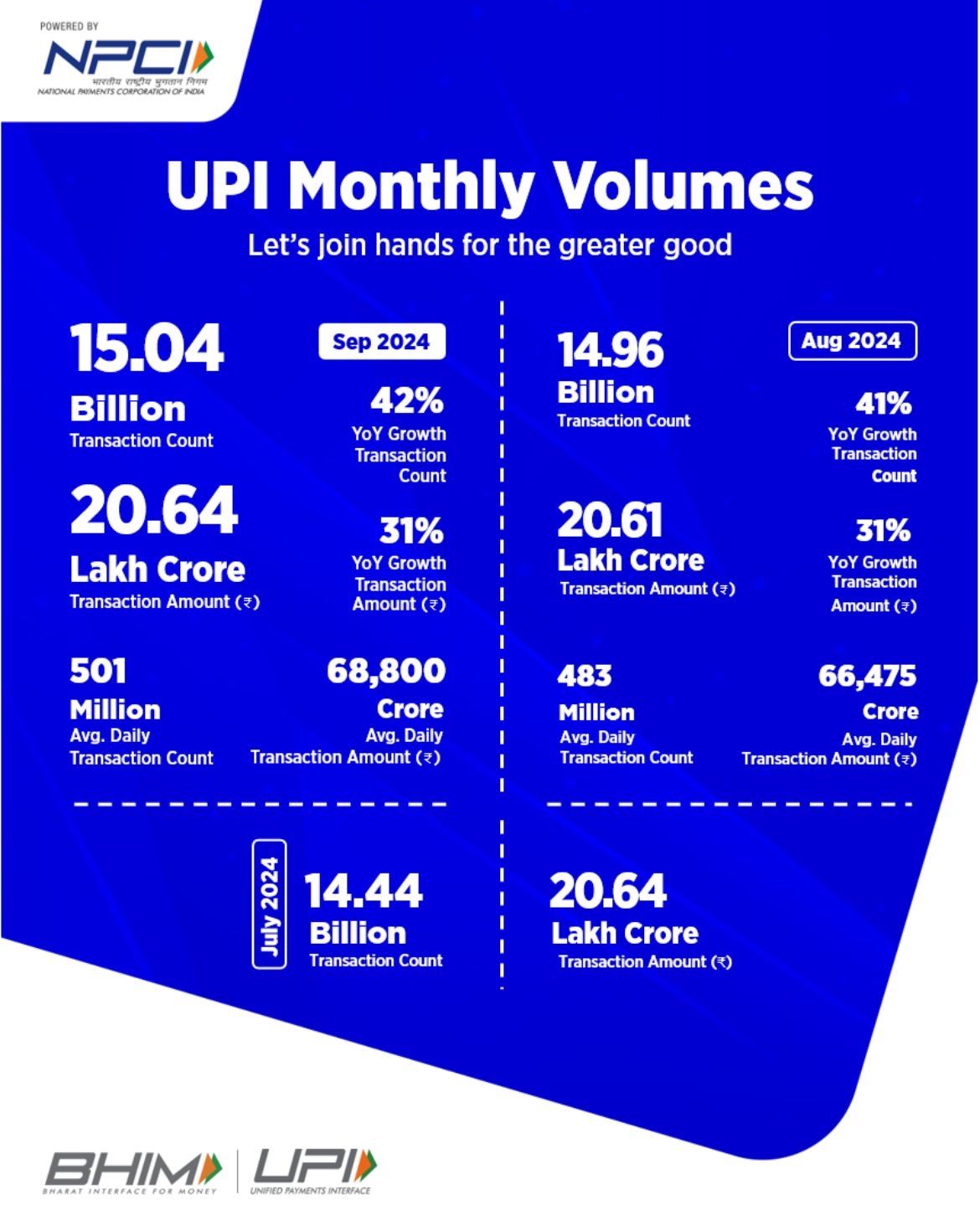

Mumbai, 1 October, 2024: According to the data released today by National Payments Corporation of India (NPCI), UPI crossed 500 million daily transactions (TXNs) in September 2024.

Make seamless payments from your mobile in real-time with UPI.

Use the power of Aadhaar to drive interoperable, digital financial inclusion across the country with AePS.

The transformative power of digital payments is undeniable, particularly in how it can shape the future of financial inclusion and economic empowerment. In India, we are witnessing an unprecedented shift towards a digital economy, with the Unified Payments Interface (UPI) at the forefront.

According to a quote by Nalin Bansal, Chief Relationship Management & Key Initiatives, NPCI, at the time of recent launch of ‘UPI for Her’ Initiative, “While we’ve achieved significant scale in financial inclusion, penetration remains a challenge, with only 25% of payment users being women, and even fewer in semi-urban and rural areas. Many women’s mobile numbers are not linked to their bank accounts, hindering their participation. Yet, data shows women are 50% less prone to fraud and are highly loyal and engaged users. As an ecosystem, we must prioritize personalized, assisted services and continuous engagement across all channels. UPI123 has made strides, especially for initiatives like Ujjwala, and prepaid instruments hold promise as a ‘secret purse’ for women. Building trust is crucial, and it is our collective responsibility to foster it.”

The addressable market for UPI among women in India is 200 million strong.

Maintaining A Value Above Rs20 Lakhs Crore For The Fifth Consecutive Month

Dilip Modi, Founder & CEO of Spice Money, points out: “The impressive growth of UPI, surpassing 500 million daily transactions in September and maintaining a value above Rs20 lakhs crore ( Rs20 Trillion-Tn) for the fifth consecutive month, showcases the growing adoption of digital payments across India. This consistent double-digit growth demonstrates the transformation taking place in our payments ecosystem, making financial transactions more seamless and inclusive.

As more individuals and businesses, from urban centers to semi-urban and rural areas, transition to digital modes of payment, we are witnessing a transformation that is making financial transactions faster, more secure, and accessible. As we continue to expand our reach, the impact of digital payments is evident not only in improving convenience but also in reducing dependency on cash, enhancing transparency in financial dealings, and supporting the overall formalization of the economy.

At Spice Money, we are proud to be a part of India’s digital revolution, especially in rural areas where emerging technologies are enabling greater financial empowerment and contributing to the vision of a truly cashless Bharat.”