Maharashtra is the 2nd highest-funded state in 2023 in the Indian Tech startup space; Retail, HealthTech and Transportation & Logistics Tech are the top-funded sectors

FinTech BizNews Service

Mumbai, February 22, 2024: Tracxn, one of the world’s largest platforms for tracking startups and private companies, has come out with the state wise annual tech reports for Telangana, Maharashtra and Delhi NCR. The reports include insightful data into citywise trends, investments, exits and unicorns.

TRACXN GEO ANNUAL REPORT

Tracxn Insights

The Maharashtra Tech startup ecosystem is the 2nd highest-funded region after Karnataka in India

with an overall funding of more than $30B to date

○ It is also the 2nd highest-funded state in 2023 in the Indian Tech startup space

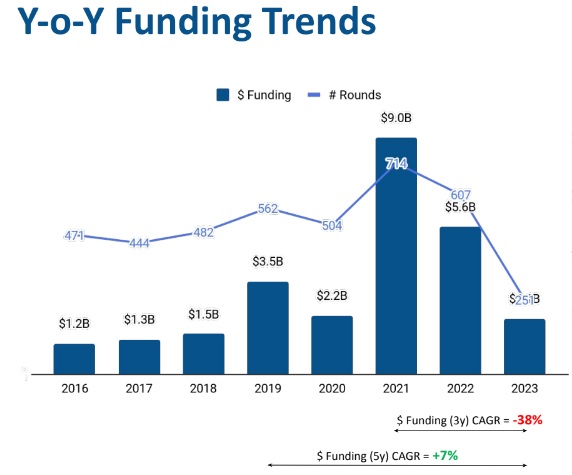

○ Despite being one of the top-funded states in India, the region has witnessed only $2.1B in

funding in 2023, the lowest funding the region witnessed in the last 5 years

● Maharashtra provides a supportive environment for start-ups and has taken several initiatives for

their growth in this region

○ It is setting up the Women Entrepreneurship Cell (WEC) to spur women's entrepreneurship,

developing initiatives to support startups in the disruptive sector by amending regulations and

introducing new policies

It has formed a strategic alliance with Artha School Entrepreneurship and the Japanese Government's

pioneering ‘Knowledge Co-Creation Program on Enhancement of Entrepreneurship and Startup

Ecosystem’, to launch the Maharashtra Startup Acceleration Program, organizing hackathons,

innovation challenges, and mentorship programs to nurture a vibrant startup ecosystem.

○ The Maharashtra state government aims to achieve a $1 trillion economy in the next five years

with a growth rate of 17.13% per year

● Maharashtra Tech startup ecosystem in 2023 saw total funding of $2.1B, 62.5% lower than the funds

raised in 2022, and a drop of about 76% of the funding raised in 2021

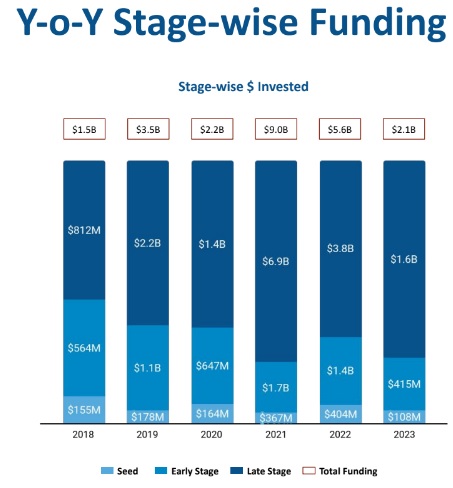

○ Seed-stage rounds in 2023 saw funding of $108M, a 73% drop compared to $404M raised in

2022 and a 70.5% drop compared to $367M raised in 2021

○ Early-stage rounds in 2023 saw funding of $415M, a drop of 70% compared to $1.4B raised in

2022, and a decrease of 76% compared to $1.7B raised in 2021

Late-stage rounds in 2023 saw funding of $1.6B, a 59% drop compared to $3.8B raised in 2022 and a

77% drop compared to $6.9B raised in 2021

● In 2023, Maharashtra Tech has witnessed 4, $100M+ funding rounds, while 2022 witnessed 13

$100M+ funding rounds

○ Pharmeasy, an online pharmacy that sells medicines, diagnostics, and telehealth online has

raised a total of $420M in Series G funding in 2023 alone, valuing the company at $8.45B

○ Zepto, a platform offering on-demand grocery delivery service has raised a total of $200M in

Series E funding in 2023 alone, the company is valued at $1.4B

○ Mahindra Electric Automation, a manufacturer of electric cars has raised a total of $145M in PE

funding in 2023 and the company is valued at $15.3B

○ Mintifi, an online marketplace for business loans, has raised a total of $110M in Series D funding

in 2023 and the company has a valuation of $414M

Retail, HealthTech and Transportation & Logistics Tech are the top-funded sectors in this space in

2023

○ The Retail sector witnessed a total funding of $483M, a drop of 65% in compared to 2022

○ The HealthTech sector witnessed a total funding of $464M in 2023, a growth of 14% in funding

compared to 2022

○ The Transportation & Logistics Tech sector in 2023 has raised total funding of $453M in 2023,

which is a drop of 59% in funding compared to 2022

● The region has witnessed 2 Unicorn companies in 2023, while 8 unicorn companies were witnessed in

2022 and 13 in 2021

○ Zepto, an on-demand grocery delivery was the first company to achieve Unicorn status in 2023

■ The company has grown its sales by 300% year-on-year and is targeting $1 billion in

annualized sales within the next few quarters

Non-banking lending company InCred, achieved a valuation exceeding $1B marking its status as

unicorn in 2023 after Zepto

■ InCred has registered 77.4% growth in operating scale to INR 865.6 crore during the last

fiscal (FY23) as compared to INR 488 crore in FY22

● 2023 witnessed 7 IPOs in this space compared to 5 IPOs emerged in 2022, which is a growth of 40%

● The Maharashtra Tech space saw 34 acquisitions in 2023. Comparing it to 2022 there were 40

acquisitions, which is a 15% drop

● Mumbai leads the space in terms of total funds raised in this period followed by Pune and Thane

● Blume, Venture Catalyst, LetsVenture are the top investors in Maharashtra Tech Landscape

○ 100X.VC, We Founder Circle and Venture Catalysts were the most active Seed stage investors in

2023

○ Elevation, Temasek, and TPG were the most active early-stage investors in 2023

○ Glade Brook Capital, Avataar Ventures and B CAPITAL were the most active Late-stage investors in

2023