With scale and falling inference costs, could reach as low as Rs50 within 3-4 years

FinTech BizNews Service

Mumbai, October 11, 2025: The Boston Consulting Group (BCG) unveiled its flagship report titled “Convergence: Human + AI for the Next Era of Finance at Global Fintech Fest (GFF) 2025.”

The report underlines how Artificial Intelligence is set to redefine the future of finance, from reshaping business models to transforming daily lives. It highlights that AI-powered financial solutions can viably be delivered at Rs150–250 per month today, and with scale and declining inference costs, this could drop to as low as Rs50 within the next 3–4 years.

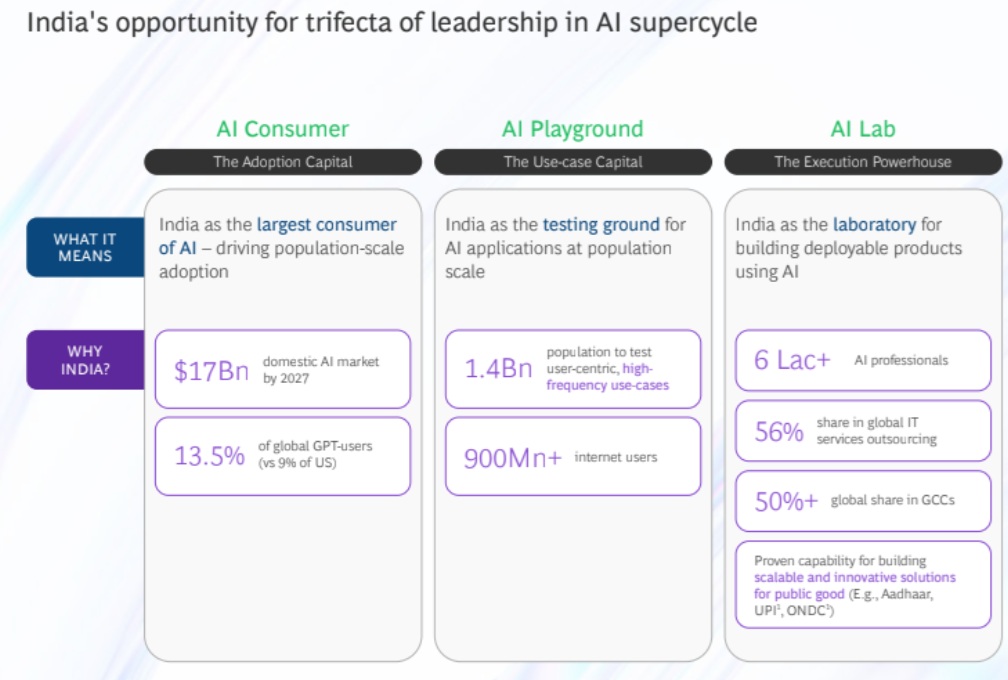

Fintechs in India have witnessed 35% growth over the past two years and are on track to reach $190 billion by 2030. The report emphasizes that India, with its scale, execution capability, and decisive policy push through the IndiaAI Mission, is uniquely positioned to lead the global AI revolution, both as a consumer and as a technology exporter. It also lays out six key priorities from strengthening infrastructure and ethical data frameworks to unlocking Rs10 lakh crore in AI capital and transforming India into the global AI brain.

The report comes at a time when the world is undergoing an Artificial Intelligence supercycle, with more than $1.3 Tn invested worldwide over the past five years, four times global fintech funding. Adoption has been unprecedented with mainstream GenAI tools achieving ~40% penetration within two years among working-age populations, a milestone that the internet took five years to reach.

AI’s impact will not be limited to large institutions. AI has the potential to create transformational impact on the life of every human. It can be an enabler for 'Convenience in Daily Life' and 'Convenience in Business Operations’. The report envisages AI-powered applications such as JanArth.AI and VyaparSaathi.AI, which can transform personal finance management for households and act as a virtual CFO for small businesses.

Yashraj Erande, Global Head of Fintech and India Head of Financial Institutions at BCG added, “India is at a defining moment. On one hand, Indian Fintechs have demonstrated 35% growth in the last 2 years and are on track to achieve $190 bn by 2030. On the other, AI is rewriting the rules of competitiveness globally and has reignited innovation as a top CXO priority for Indian fintechs. The good news for India is that it is uniquely positioned on 3 fronts: as the world’s largest AI consumer market, a global AI use-case playground, and a leading execution hub exporting technology solutions worldwide. India has both scale and execution muscle, and the government has stepped up decisively with the IndiaAI Mission”

Realizing the full potential of the AI opportunity will hinge on India executing across the entire AI stack. The report summarizes it as follows:

1. Infrastructure: Enable at Global Scale, Anchor at Home-

a. Data centers: India faces the “2–20 conundrum” as it is generating nearly 20% of the world’s data but holding just 2% of global data center capacity. To address this gap, India should aspire for at least an 8% share (around 17 GW) of global capacity by 2030, requiring large-scale real estate, and sustainable energy.

b. Compute: A two-speed strategy is critical for India - strengthen global partnerships, while simultaneously investing in indigenous GPU design

2. Data: Build the World’s Richest Ethical Data Commons - India must continue to grow and expand AIKosh, the national datasets platform, to serve the unique model-build needs of India and other emerging economies

3. Models: Create Purpose-Built AI for Bharat and the Global South- India should prioritize domain-specific, population-scale AI models in areas such as healthcare, agriculture, education, and financial inclusion. These models must be tailored to the unique needs of the Global South, incorporating multilingual and multimodal capabilities that work seamlessly across diverse populations, particularly in Tier-2+ cities and rural contexts.

4. Capital: Unlock ₹10 Lakh Crore+ for AI Innovation - Patient capital will be critical for India’s AI scale-up. Enabling M&A exits must be a priority, as global tech leaders have scaled through acquisitions (the top seven US tech companies represent ~1,000 firms via M&A). Unlocking existing domestic pools such as insurance and pension funds (EPFO) alongside private equity, venture capital, and family offices, can mobilize capital for AI. Policy should structurally incentivize high-net-worth individuals (HNIs) and private players to channel long-term capital toward AI.

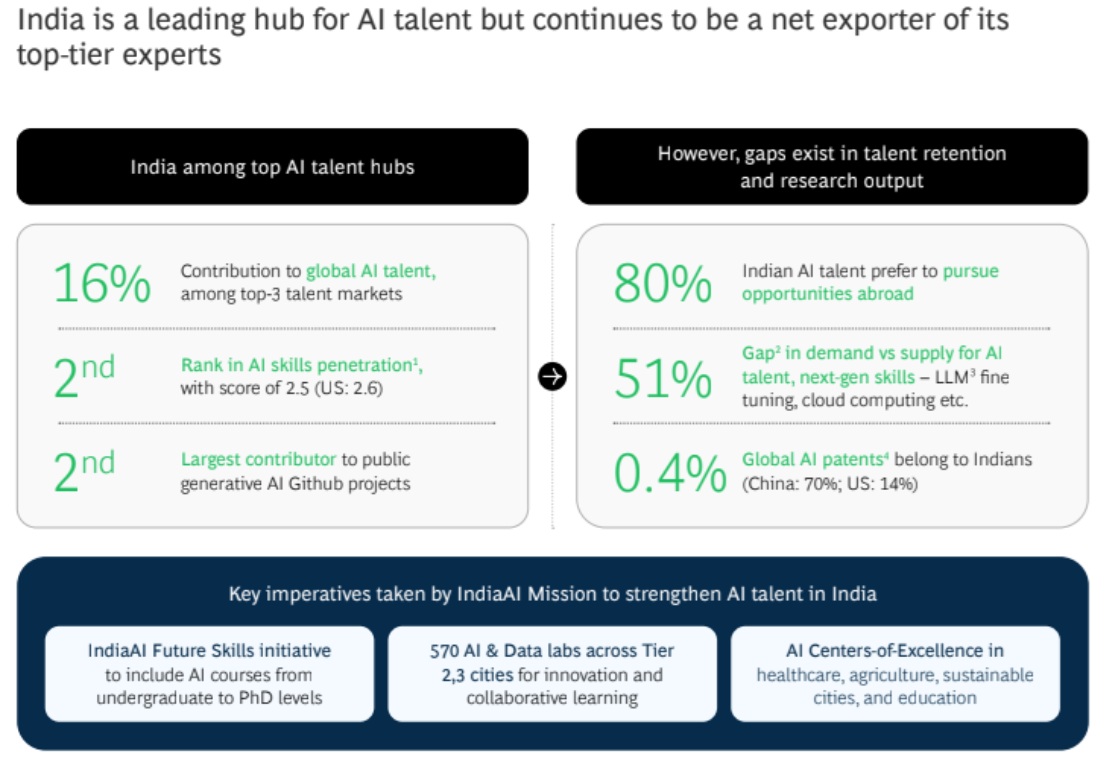

5. Talent: Transform India into the Global AI Brain - India could become a global AI brain by boosting research excellence, retaining talent, and expanding skilling programs

6. Applications: Capture a Significant Share of Global AI Revenues - With its differentiated approach across the AI stack, India is well positioned to capture a significant share of the global AI software and services market. By 2028, this market opportunity is projected at $100–120Bn in revenues, equivalent to ~50% of India’s current IT services market

We are seeing the AI hype-cycle with big deployment announcements, high investments, race for tech supremacy, politics and more, but only 27% companies realize true value from AI globally. The real question is how do we see value from AI? The report outlines a 10-point blueprint for BFSI in India to realize benefits from AI at scale, addressing how the industry can move beyond pilots to value creation. And it emphasizes that responsible and inclusive AI adoption will be key to sustaining this value, ensuring fairness, transparency, and trust as AI becomes deeply embedded in financial systems.

AI brought innovation back to the top of the CXO agenda, with nine in ten leaders prioritizing it and one in four planning to raise AI budgets by over 60% in the next two years. Yet, challenges persist from lack of coherent strategies to gaps in talent, data, and infrastructure. Leaders emphasize the need to scale beyond pilots and adopt UPI-style open innovation to unlock AI’s full potential in finance.