Decentro Unveils Next-Gen Financial Risk Assessment Tools

FinTech BizNews Service

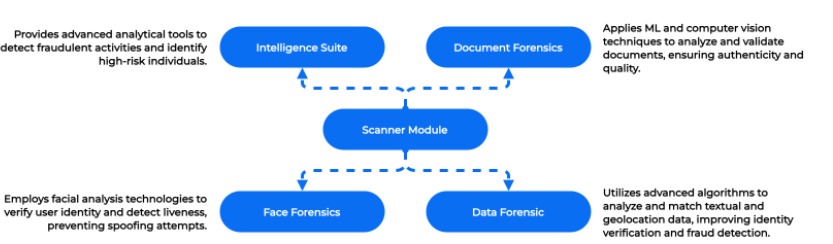

Mumbai, May 22, 2025: Decentro, India's leading banking and fintech infrastructure platform, today announced the launch of Scanner, a groundbreaking fraud detection and user intelligence suite that promises to transform how businesses assess risk and onboard customers. Scanner is the latest addition to Decentro’s Fabric product suite, which aims to help businesses make real-time decisions based on dynamic behavioural signals rather than static identity or credit data.

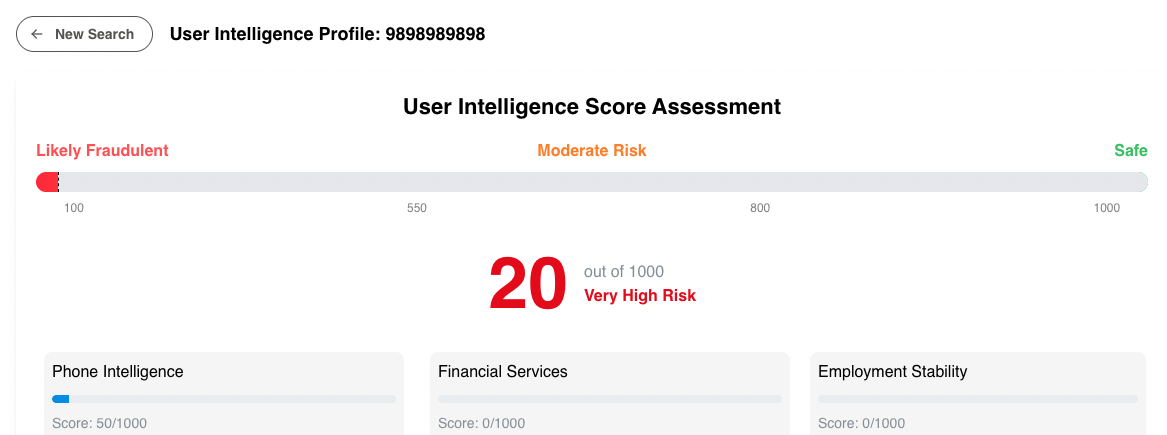

At the heart of Scanner is OmniScore, Decentro's proprietary scoring system that represents a paradigm shift in risk assessment. Unlike traditional credit scores that rely on static data, OmniScore provides a dynamic, 360-degree view of user trustworthiness by analysing over 100+ behavioural signals in real time, delivering, unprecedented accuracy in fraud detection and user profiling.

"India's digital economy is growing at a phenomenal pace, but so is the sophistication and scale of financial fraud," said Rohit Taneja, Co-founder and CEO of Decentro. "With Scanner and OmniScore, we're empowering businesses to make smarter decisions about who they onboard and how they manage risk—all in seconds. This isn't just another verification tool; it completely reimagines how trust is established digitally."

Scanner's introduction comes at a critical juncture for India's financial sector, which is witnessing rapid digitisation alongside escalating fraud challenges. According to industry reports, financial institutions lost over Rs15,000 crore to digital fraud in the last fiscal year alone, highlighting the urgent need for more sophisticated detection systems.

OmniScore integrates three distinct intelligence layers: Digital Identity that evaluates deep & entrenched mobile number usage and location patterns; Financial Credibility that analyses banking and credit-related permissioned data; and Employment stability that verifies employment claims through multi-source validation. This multi-dimensional approach enables businesses to make informed decisions about user intent and trustworthiness beyond what traditional KYC or standard credit bureau can provide.

Scanner has already demonstrated remarkable results in early deployments. Implementation by leading NBFCs has reduced application fraud by 22-25%, significantly improving portfolio quality. Through Scanner's alternative scoring models, Fintech lenders report 30-45% better underwriting accuracy and reduced defaults. Some key e-commerce and gaming platforms have seen checkout fraud drop by 15-18%, dramatically improving transaction success rates and customer trust.