FinTechs are seeing more repeat customers and rising demand for diversified credit products

Bhavesh Jain, MD & CEO, TransUnion CIBIL

FinTech BizNews Service

Mumbai, India, 29 May 2025: India’s FinTech lending sector is undergoing a transformation, driven not just by volume, but by a fundamental shift in borrower demographics, as they increasingly serve younger and more rural populations. This marks a significant evolution in the FinTech customer base, reflecting the sector’s growing role in democratizing access to credit across India’s diverse population.

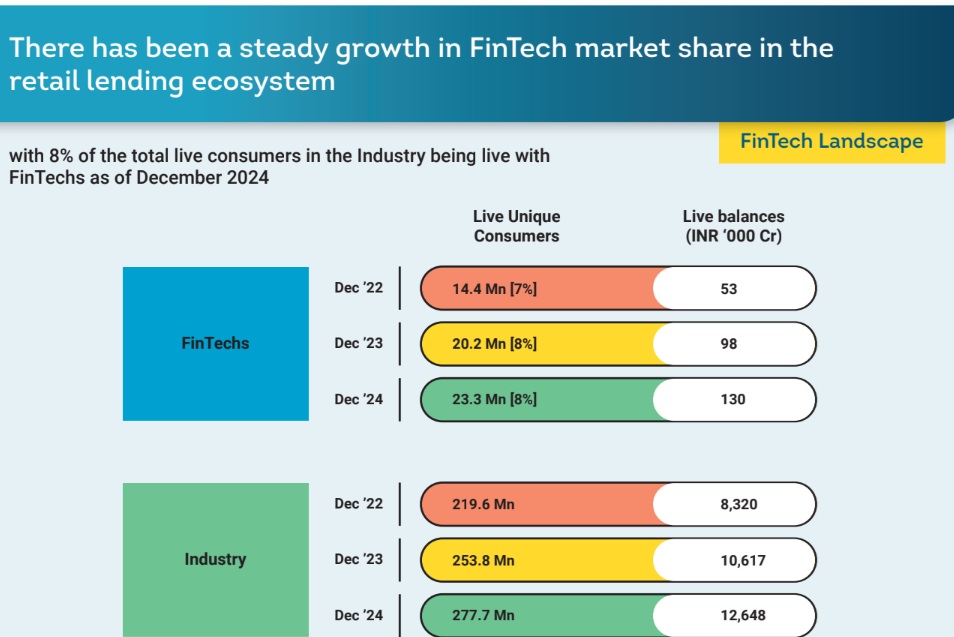

According to the TransUnion CIBIL FinTech Compass report for the quarter ending December 2024, FinTech lenders now serve over 23.3 million consumers – up from 20.2 million in December 2023 and 14.4 million in December 2022. Outstanding balances reached Rs 1.3 trillion, with FinTechs accounting for 1.03% of total retail credit balances, highlighting FinTech lenders’ expanding role in India’s credit ecosystem. Retail credit refers to all loans extended to individual borrowers and includes personal loan, business loan, consumer loan, loan against property and others.

These trends highlight a significant opportunity for FinTech lenders to deepen their reach in underserved segments, positioning them well for sustained growth in India’s evolving credit landscape.

Bhavesh Jain, MD & CEO, TransUnion CIBIL, said: “The FinTech lending sector has played a vital role in reshaping India’s financial landscape by delivering faster and more accessible credit through innovative digital technology. This progress has expanded financial inclusion, reaching millions across diverse demographics and geographies. As the sector continues to evolve, sustained growth will rely on broadening product offerings and adopting data-driven approaches to provide more personalized financial solutions. Maintaining focus on these priorities will be key to fostering inclusive growth and unlocking meaningful economic opportunities for businesses and consumers alike.”

New Borrower Dynamics and Repeat Engagement

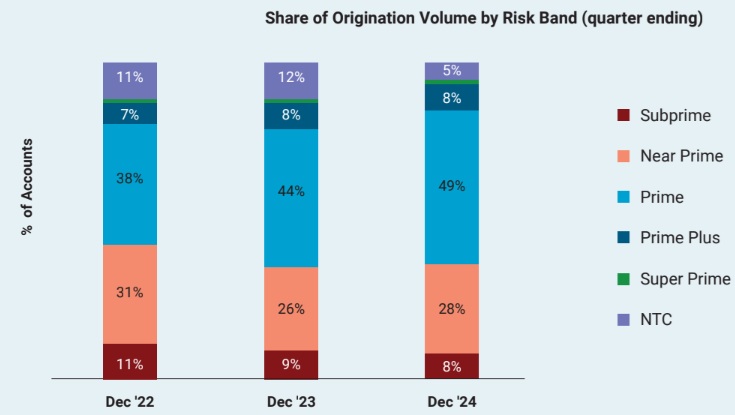

The FinTech Compass report offers key insights into evolving borrower profiles. These lenders are drawing a younger and more rural customer base, with 61% of borrowers being under the age of 30, and 24% residing in rural areas. The share of prime and above-prime consumers in FinTech originations has also increased steadily, reaching 62% in December 2024 from 60% in December 2023 and 55% in December 2022. Notably, however, average ticket sizes have declined across all risk tiers.

Sugandh Saxena, CEO, FinTech Association for Consumer Empowerment (FACE)

FinTechs are also seeing stronger customer retention in the personal loan segment, especially in ticket sizes above Rs 50,000. As of December 2024, 48% of borrowers in this segment had prior credit relationships with the same lender, higher than the 43% who had that relationship in December 2023. However, this repeat customer segment witnessed a marginal increase in vintage delinquency rates, rising by 20 basis points year-over-year (YoY) for the quarter ending June 2024 to 4.7% from 4.5% in June 2023. This trend indicates that underwriting needs to be continually refined using comprehensive credit data, even among more experienced borrowers.

Sugandh Saxena, CEO, FinTech Association for Consumer Empowerment (FACE), the recognized self-regulating organization in the FinTech Sector recognized by the Reserve Bank of India, said: “FinTechs continue to reach ever more people, especially younger and unaddressed segments. As the industry grows, it is important that lending practices stay customer-centric and respond responsibly to evolving risks. Independent industry reports like this support the FinTech community in understanding the wider picture and aligning the business to meet evolving market trends. At FACE, FinTechs large and small unite to promote innovation, customer-centricity and responsible digital finance. These are the foundations for customer and stakeholder trust, creating long-term value from digital finance for everyone.”

Diversification is Key

An analysis of product preferences among FinTech consumers also reveals clear opportunities for further diversification. Of the 20.2 million FinTech consumers in India in December 2023, approximately 9.8 million availed new loans between January and June 2024. These loans amounted to Rs 3.6 lakh crore in sanctioned value. While small-ticket personal loans (STPLs) continued to lead at Rs 26,182 crore, personal loans above Rs 50,000 followed closely at Rs 68,673 crore, with business loans and loans against property sanctioned at Rs 37,231 crore and Rs 26,146 crore respectively. The data suggests that while consumer preferences are evolving, loyalty to FinTech lenders outside the STPL category remains limited, presenting both a challenge and an opportunity for growth.

Driving Growth Through Small-Ticket Personal Loans

Personal loans remain the mainstay of India’s FinTech lending landscape, with STPLs continuing to drive volumes. As of December 2024, STPLs accounted for an overwhelming 92% of FinTech originations and 89% of all STPL originations across the industry.

The average ticket size for personal loans among FinTech borrowers has decreased across all risk tiers. Even among above-prime consumers, the average loan size from FinTech lenders stood at Rs 44,000 in Q4 2024, down from Rs 55,000 in Q4 2023. In contrast, non-FinTech lenders increased their average ticket size across the board. This shrinking ticket size suggests that FinTechs are prioritizing volume and deeper reach, especially to financially underserved segments.

Balancing Reach with Risk

Key trends emerged in delinquency metrics. While early delinquencies for STPLs remained largely stable, business loans experienced a notable increase in delinquency rates. In the case of business loans, the percentage of accounts over 30+ days past due within six months of origination rose from 3.0% in June 2023 to 8.6% in June 2024. Balance-level 90+ days past due delinquencies also increased for business loans (from 1.4% in December 2023 to 1.9% in December 2024) and for loans against property (from 1% in December 2023 to 2.1% in December 2024). These developments underscore the need for FinTech lenders to strengthen portfolio risk monitoring and enhance collection strategies, particularly for newer secured product lines.

Using trended data insights to manage rising credit risks is essential for unlocking untapped growth opportunities in under-penetrated products such as larger-ticket personal loans, business loans, and property-backed lending. While small-ticket personal loans continue to perform steadily, elevated delinquency rates in emerging product categories highlight that FinTechs’ future trajectory will depend on balancing speed and scale with disciplined underwriting and diversified credit strategies.

It is important to recognize that FinTechs often operate with a different risk appetite. Hence, active risk management and continuous portfolio monitoring are essential to ensure sustainable growth and long-term resilience in the evolving credit landscape.