The sector achieved a milestone with eight IPOs in 2024, a 300% increase compared to the two IPOs in 2023; The FinTech sector raised a total of $1.9 billion in 2024.

Neha Singh, Co-Founder at Tracxn,

FinTech BizNews Service

Mumbai, January 13, 2025: Tracxn, a leading market intelligence platform, has unveiled its Geo Annual India FinTech Report 2024. This proprietary report provides comprehensive insights into the Indian FinTech ecosystem, covering funding raised by startups, major industry players, and the key trends shaping the landscape.

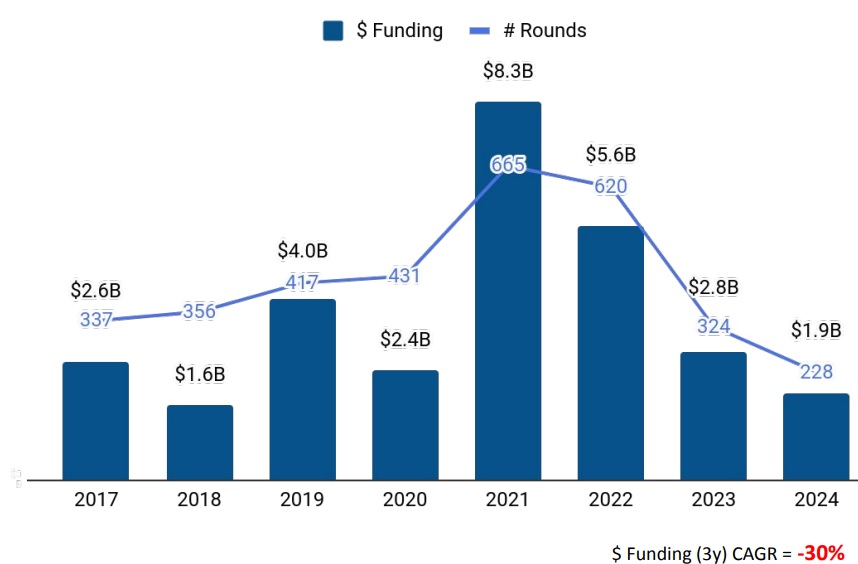

The FinTech sector experienced a notable decline in funding in 2024, with a total of $1.9 billion raised. This represents a 33% decrease from the $2.8 billion secured in 2023 and a significant 66% drop from the $5.6 billion raised in 2022. The Indian FinTech ecosystem has solidified its position as one of the top three globally funded FinTech ecosystems in 2024, trailing only the US and the UK.

Q3 2024 stood out as the highest-funded quarter of the year, with $805 million raised—a 61% increase compared to Q3 2023. Additionally, 59% of the total funding in 2024 was secured during the second half of the year, indicating a late-year recovery. August emerged as the most robust month for funding, contributing $434 million to the annual total.

Like its global counterparts, the sector has witnessed a decline in funding, driven by a broader slowdown in demand and geopolitical headwinds. Despite these challenges, India’s economy has demonstrated remarkable resilience, with a projected GDP growth rate of 6.6% for FY 2024-25, declining inflation, and robust balance sheets across both banking and non-banking institutions.

Neha Singh, Co-Founder at Tracxn, said, “Despite the global funding slowdown, India’s FinTech ecosystem continues to demonstrate remarkable resilience and adaptability. The emergence of two new unicorns and a record eight IPOs in 2024 underscore the sector’s ability to thrive amidst challenges. These milestones, combined with robust economic fundamentals and advancements in technology, highlight the strength of India’s FinTech landscape. As we look to the future, the sector is poised to build on these successes, driving financial inclusion and innovation while solidifying its position as a global leader in the FinTech space.”

The funding landscape in 2024 saw a significant shift, with only three $100 million-plus funding rounds recorded, marking a 50% decline from the six such rounds in 2023. Notable deals included DMI Finance raising $334 million in Series E funding led by MUFG. Additionally, Credit Saison, an online marketplace for consumer and business loans, secured $144 million in a Series D funding round.

The downturn was evident across all funding stages, with late-stage rounds being the most affected. Late-stage funding amounted to $1.1 billion, marking a 42% reduction compared to the $1.9 billion raised in 2023 and a sharp 65% decline from $3.1 billion in 2022. Early-stage rounds followed a similar trend, recording $562 million in funding in 2024. This figure reflects a 16% drop from the $667 million raised in 2023 and a substantial 70% decline from $1.9 billion in 2022. Seed-stage funding also faced challenges, reaching $178 million in 2024—down 19% from $219 million in 2023 and 66% from $529 million in 2022.

M&A activity saw a slight dip, with 26 acquisitions recorded in 2024, down 16% from 31 in 2023. Notable transactions included the $94.5 million acquisition of PureSoftware, an omnichannel banking solutions provider, by Happiest Minds, and the $44 million acquisition of ET Money, a mutual fund investment platform, by 360 One. The sector achieved a milestone with eight IPOs in 2024, a 300% increase compared to the two IPOs in 2023.

Bengaluru maintained its leadership as the top hub for fintech funding in 2024, followed by Mumbai and Delhi. Among investors, Peak XV Partners, LetsVenture, and Y Combinator emerged as the top contributors overall. Venture Catalysts, Y Combinator, and Antler led in seed investments, while Elevation Capital, GMO Venture Partners, and Peak XV Partners dominated early-stage funding. Late-stage investments were spearheaded by Creaegis, The Rise Fund, and Amara Partners.

Sectoral Trends and Key Insights

The Indian fintech space in 2024 has been defined by significant developments, with digital lending solutions accounting for 64% of the total funding raised during the year. Digital lending solutions continue to drive financial inclusion across rural and urban regions, supported by favourable regulatory frameworks and advancements in AI. This sector is poised for further growth in the coming years.

The Investment Tech segment garnered $320 million in funding in 2024, reflecting an 11% decline from the $358 million raised in 2023. The Payments segment, however, experienced a sharper decline, attracting $194 million—a 77% drop from $836 million in 2023 and an 81% decrease from $1.01 billion in 2022. Among the success stories, 2024 witnessed the emergence of two unicorns, Money View and Perfios, compared to a single unicorn in 2023.

Despite the overall decline in large funding rounds, sectors like Alternate Lending, Investment Tech, and Payments emerged as top performers in 2024. The Alternative Lending segment, in particular, attracted $1.21 billion in funding, reflecting a modest 4% decrease compared to $1.26 billion in 2023 and a sharper 44% decline from 2022 levels.

Policy Reforms and Regulatory Milestones

The Union Budget of 2024 introduced key reforms that positively impacted the FinTech sector, including the abolition of the Angel Tax for all classes of investors. As the 2025 Union Budget approaches, further monetary policy support is anticipated, which could provide a boost to the sector.

Regulatory developments have also played a critical role in shaping the FinTech landscape this year. In August, the Reserve Bank of India granted Self-Regulatory Organization (SRO) status to the Fintech Association for Consumer Empowerment (FACE), an industry body representing approximately 80% of digital lending volumes in the country. This move underscores the RBI’s commitment to ensuring that the rapidly growing sector adheres to statutory and regulatory guidelines, paving the way for sustainable growth in the future.