This report explores the forefront of FinTech in India. The objective of the report is to identify the key business and technological innovations within FinTech and broader financial services (FS) landscape

FinTech BizNews Service

Mumbai, September 15, 2024: There has been a constant flux within the financial landscape, which is being driven by advancements in technology and evolving customer needs. PwC India’s innovation framework highlights the key areas of product development and distribution with a focus on the key dimensions of product, channel, technology and business model innovation.

Lifecycle Of Innovation

A report titled “Mapping Fintech Innovation Landscape In India And Comparing It With Global Trends”, was released recently at Global Fintech Fest 2024. According to Vivek Belgavi Leader – FinTech and Alliances and Ecosystems PwC India and Mihir Gandhi, Leader – Payments Transformation, PwC India, this report focuses on identifying some of the critical drivers of innovation such as improved customer engagement and diversified product propositions, deciphering the view of the BFSI industry on partnerships for driving innovation, and exploring the impact and challenges faced by companies while adopting innovative ways to conduct business. The insights in the report are inferences based on primary research inputs from senior members of financial institutions and FinTechs. Most respondents considered diversifying and identifying new products as the primary objective for innovation. Furthermore, meeting evolving customer needs emerged as the most prioritised business driver for innovation among organisations. More than 90% of the respondents see partnerships as a crucial level for driving innovation in a BFSI organisation. Partnerships that can enhance customer experience through personalised acquisition and seamless onboarding process enable better management of risk and compliance, and those that focus on specific ecosystems for diversifying service offerings are expected to see increased traction in the industry. The report highlights these and provides more such insights into the innovation and partnership landscape. Despite a few challenges, most of the industry remains optimistic regarding the growth of FinTechs – especially in the areas of risk management, payments and lending – with more mature and sustainable business models focused on long-term viability. We hope that this report serves as a valuable resource for stakeholders navigating innovations in the FinTech ecosystem.

The global FinTech landscape is undergoing a phase of transformation marked by innovation in processes, ideas, products and services in the financial sector. To this end, PwC has developed an innovation framework that explores the lifecycle of innovation, while emphasizing the areas of product development and distribution. By conducting primary research in the form of interviews with senior management representatives from 31 financial institutions and FinTech firms, we’ve identified the factors driving innovation, industry’s perspective on partnerships to catalyze innovation, and impact and challenges faced by the industry as it traverses the path to innovation.

Improving Risk & Compliance, Enhancing Customer Experience

Organisations are prioritising innovation to diversify their product and service offerings to address evolving customer needs and maintain market competitiveness. The FinTech landscape is shifting towards collaborative innovation with partnerships being viewed as the key driver of organisational innovation, with speed-tomarket being a key factor driving this trend. Innovation initiatives are aimed at enhancing customer experience, optimising risk management and improving operational efficiencies through the establishment of innovation labs, R&D centres, idea generation platforms and strategic partnerships. Partnerships are leading to tangible benefits like increased account opening productivity, new product offerings and reduced operational expenses, while challenges such as API maturity, speed-to-market and system integration remain. While innovation initiatives are leading to new product development and enhanced efficiencies, they are facing talent resource constraints and complexities of managing emerging technologies. Emerging themes for FinTech partnerships include improving risk and compliance, enhancing customer experience through seamless onboarding, embedded finance and ecosystem offerings.

Key Imperatives To Foster Innovation

Financial institutions and FinTech firms can harness the potential of innovation by considering the following imperatives that have emerged from the insights of the research conducted:

Leverage digital public infrastructure and upgrade organizational infrastructure, such as APIs for partnerships and sandboxes for proof of concepts, to facilitate innovation initiatives.

Establish a dedicated Innovation Management Office and Compliance Management Office to oversee innovation initiatives while ensuring regulatory adherence.

Develop FinTech/ partnership policies with defined roles, responsibilities and a criteriabased evaluation process, including established KPIs.

Cultivate an innovation-driven culture through active employee engagement. Assess and determine the mode for innovation – build, procure or partner – based on strategic considerations.

Implement a value realization framework to measure the impact of innovation initiatives and partnerships on the organization.

The BFSI industry is optimistic about the growth of the FinTech ecosystem and is anticipating a growth in solutions – specifically in payment systems, risk management, and expansion into other non-FS sectors such as real estate, retail, and telecom. With the growing awareness on cyber and data risk solutions, FinTechs are also developing solutions independently and through partnerships, with a focus on regulatory compliance and long-term sustainability.

Evolving Consumer Preferences

India is experiencing a rise in its per capita income, as reflected by the growth in its gross national disposable income (which includes net primary income and other transfers received from the rest of the world), which is expected to expand by 8.9% in FY24.2 Along with this, there is an increase in consumerism, encouraging companies to innovate and capture a greater share of wallet of consumers. Additionally, with internet penetration in India reaching nearly 820 million users in 2024.

Expansion Of Market Base

Indian MSMEs are facing challenges in terms of limited access to credit as reflected by the credit gap of USD 530 billion faced by them as of FY24.

Digital transactions in India are expected to grow from USD 2 trillion to USD 10 trillion by 2026 from 2023. Thus, there is a growing demand for innovative solutions that can address the credit needs of the underserved segment and increasing volume of digital payments.

A recent PwC survey indicates that 54% of companies have implemented GenAI in a few areas of their businesses.6 Through its capability to analyse large amounts of data, GenAI could potentially be used to personalise FS products and scale customer engagement, while helping reduce operational costs.

From the time of its implementation, Aadhaar has been instrumental in helping companies with over 118 billion digital authentications.7 The Government is also working on further developing the country’s digital public infrastructure with new initiatives such as API Setu, AgriStack and HealthStack. Furthermore, the RBI is working towards creating a regulatory environment that fosters innovation while focusing on consumer protection through initiatives such as the RBIH and regulatory sandbox.

PwC Survey

The PwC survey highlighted that 84% of FIs and FinTechs in India prioritise strategies to understand and meet evolving customer demands. Additionally, 65% of organisations consider risk mitigation and adapting to changing regulatory landscapes as critical factors, underscoring the importance of navigating regulatory challenges while innovating. Market competitiveness follows closely as another important factor, cited by approximately 61% of respondents, highlighting a strong focus on maintaining or enhancing market position through innovative practices. The survey revealed that 55% of respondents consider growth in revenue and achieving cost efficiency as important drivers, reflecting a focus on both profitability and operational effectiveness. Additionally, 35% highlighted brand differentiation, while 32% emphasised improving productivity, suggesting that organisations are strategically aiming to distinguish their offerings in the market and optimise internal processes to drive innovation. Overall, the survey illustrates a comprehensive approach to innovation, combining competitive strategies with customer-centricity, financial objectives, regulatory compliance and operational excellence to foster sustainable growth and differentiation in their respective markets.

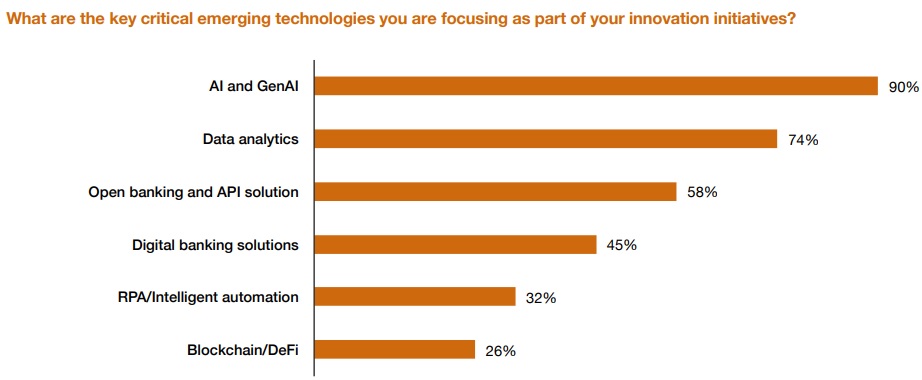

The responses analysed on critical emerging technologies within the FinTech sector in India reveal a strong focus on AI and GenAI, with 90% of the respondents citing them as the primary technology enablers of innovation. Data analytics also continues to emerge prominently across nearly 74% responses, underscoring its integral role in driving insights and decision-making within FS. Open banking and API solutions are highlighted by 58% of the respondents, reflecting efforts to enhance connectivity and interoperability across platforms.