Our bi-annual review ‘State of States’ analyses the finances of 21 states, using state budgets and related data

Tirthankar Patnaik, PhD, Chief Economist; Prerna Singhvi, CFA; Smriti Mehra; Isha Sinha,

Economic Policy and Research,

National Stock Exchange of India

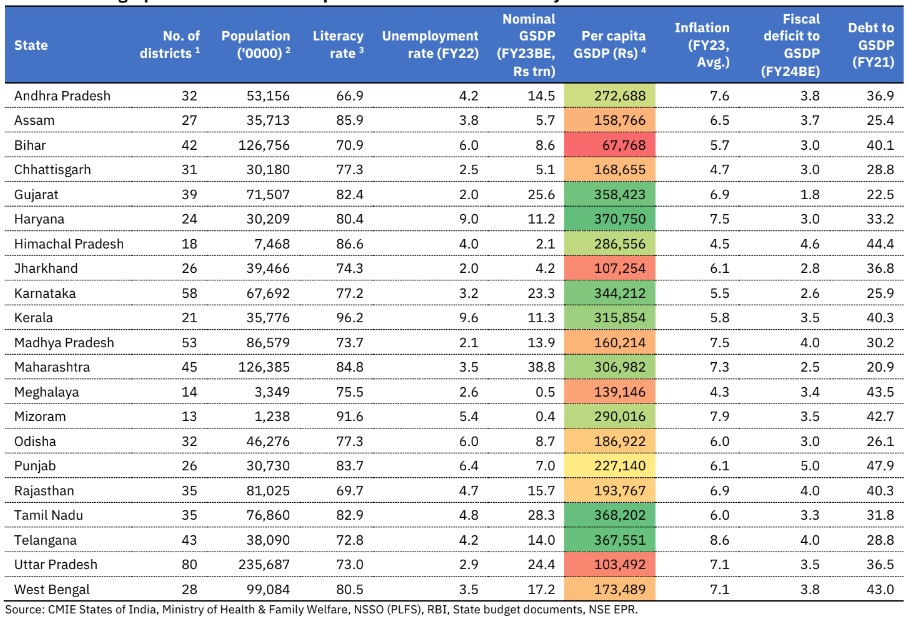

Our bi-annual review ‘State of States’ analyses the finances of 21 states, using state budgets and related data. This analysis—adding up to 93% of India’s GDP—reveals some interesting facts about the health of their finances. The average GDP growth estimated for these states stands at 10.9% (Range: 4% to 19%), marginally higher than 10.5% as per the FY24 Union Budget. Overall revenue receipts for FY24 are budgeted to increase by a sequentially slower pace of 11.1% over FY23RE (+19.7% in FY23RE), primarily led by strong growth in states’ own revenues—tax as well as non-tax, partly offset by reduced grants from the Centre. Tax buoyancy for these 21 states is expected to improve from 1.1 in FY23RE to 1.3 in FY24BE, higher than 1.0 for the Centre, which might face headwinds given the likely growth slowdown.

In line with the Centre, capital spending by states has risen meaningfully over the last two years. Expenditure quality as measured by the ratio of capital to revenue expenditure at 21.7% in FY24BE is the highest in the last six years. Overall capital expenditure growth is pegged at a strong 20.5% in FY24BE on top of a 33.8% growth in FY23RE. While UP and smaller states exceeded their capex targets in FY23, 10 out 21 states spent a lower-than-budgeted amount. Revenue expenditure growth, however, is pegged at a modest 7%, primarily led by interest and pension payments (+12.2% YoY), excluding which revenue expenditure is budgeted to grow at 5.4%.

Overall fiscal deficit of these 21 states is pegged at 3.2% of GSDP in FY24BE vs. 3.5% in FY23RE, in line with the indicated fiscal consolidation path recommended by the 15th Finance Commission. Nearly 77.2% of this would be funded by market loans, with gross borrowings for these states budgeted to rise by 10.3% to Rs 9.3trn in FY24BE. Notably, state reliance on market borrowings has dropped in the last few years, thanks to higher loans by the Centre. States’ outstanding liabilities to GDP ratio at 31.1% in FY21 would actually rise to 34.8% after accounting for contingent liabilities. In our sample, UP accounts for 21% of the overall contingent liabilities of these 21 states, followed by Southern trio (AP, TN, Telangana) at 38%.

With states now accounting for more than 60% of the general government expenditure in India, improvement in their financial positions is becoming increasingly crucial to ensure they are sufficiently equipped to provide for future emergencies and emerging priorities such as climate change. Based on our analysis, the following takeaways emerge, for long-term fiscal health: a) A clear roadmap to fiscal austerity, particularly so for fiscally strained states like Punjab, b) Risk-based pricing of SDLs to bring about fiscal prudence, c) A gradual reduction in contingent liabilities to bring about transparency in state finances, d) Enhanced fiscal prudence across states, and e) Shift from cash to accrual accounting to better assess the financial position of states.