Bankers remain upbeat on loan demand during Q4:2023-24 across the major categories of borrowers with some seasonal moderation in Q1:2024-25.

Marginal easing of loan terms and conditions are expected in Q4:2023-24 and Q1:2024-25. The Reserve Bank has released the results of 25th round of its quarterly Bank Lending Survey, which captures qualitative assessment and expectations of major scheduled commercial banks on credit parameters (viz., loan demand as well as terms and conditions of loans) for major economic sectors.

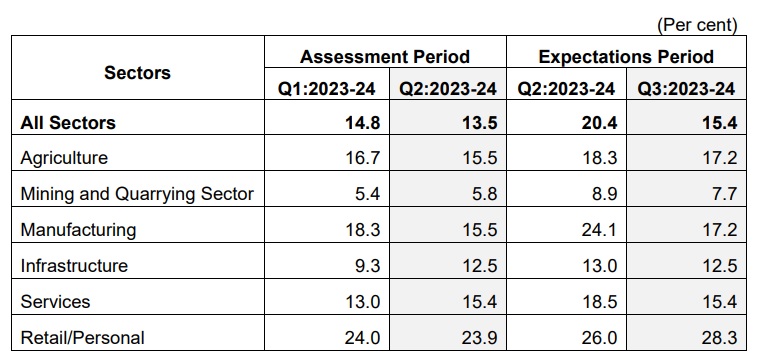

The latest round of the survey, which was conducted during Q2:2023-24, collected senior loan officers’ assessment of credit parameters for Q2:2023-24 and their expectations for Q3 & Q4 of 2023-24 and Q1 of 2024-25. Bankers assessed better loan demand conditions in Q2:2023-24, driven by improvement in manufacturing, services, and retail/personal loans. Respondents assessed broadly similar loan terms and conditions. Bankers remained fairly optimistic on overall loan demand during Q3:2023-24; higher demand for loans is expected from mining, infrastructure and personal/retail sectors. Existing loan terms and conditions are expected to prevail during Q3:2023-24, with more easing for retail/ personal loans.