Over the next decade, these solutions will help mobilize private capital towards the US$10.1 trillion needed to meet India's net-zero target by 2070

FinTech BizNews Service

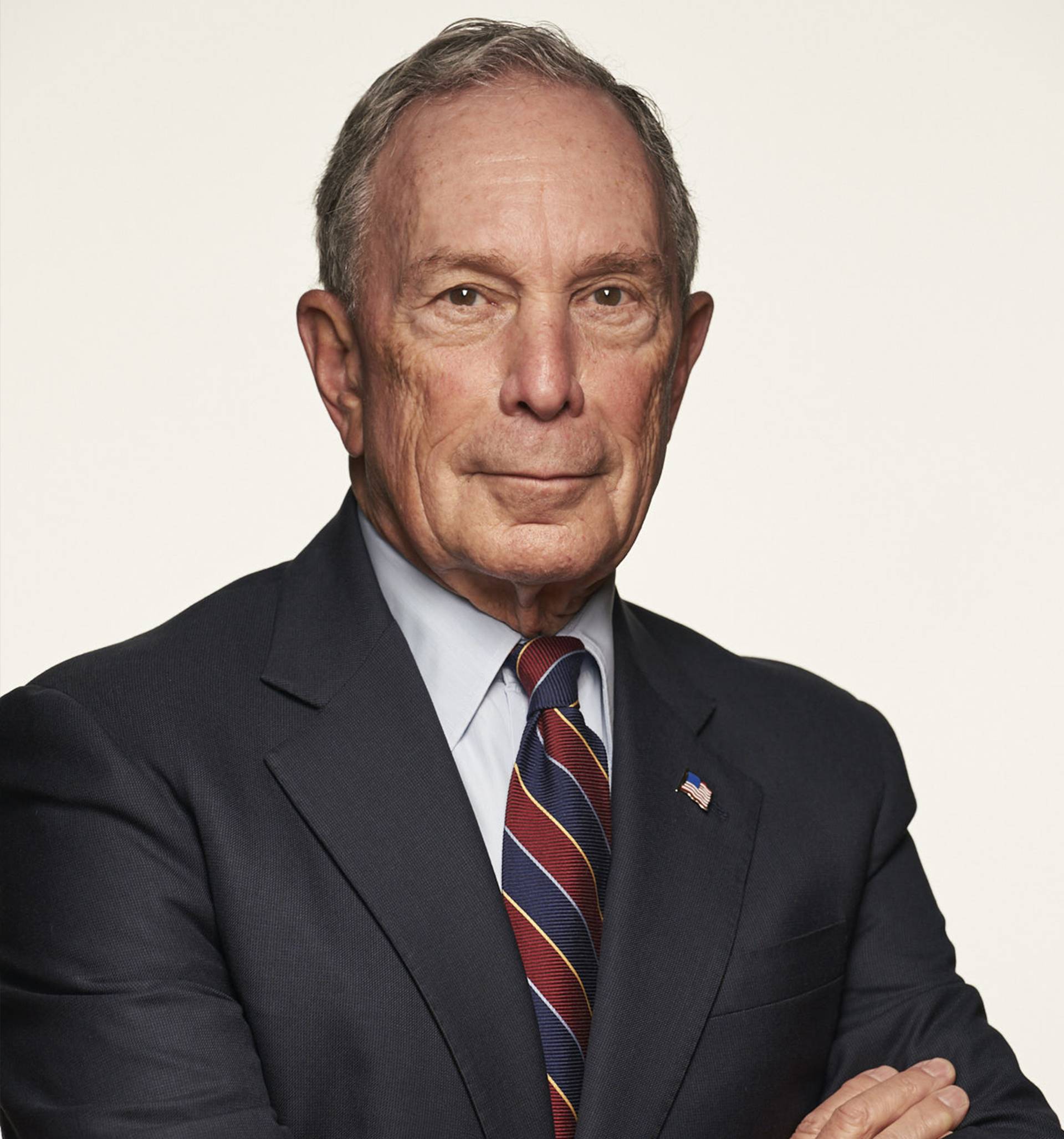

Mumbai, December 1, 2023: Today Michael R. Bloomberg, the UN Secretary-General’s Special Envoy on Climate Ambition and Solutions and founder of Bloomberg L.P. and Bloomberg Philanthropies, and the Climate Finance Leadership Initiative (CFLI) India https://www.bloomberg.com/cfli, announced climate finance solutions with the potential to mobilize over US$6.5 billion in support of India’s low-carbon, climate resilient development at COP28. With support from the Government of India, CFLI India’s members, including CEOs of leading Indian and international financial institutions and businesses, have worked alongside the multilateral development community to originate innovative financing solutions and strengthen India’s policy enabling environment.

Across e-mobility, circular economy, green hydrogen, and renewables, CFLI India’s climate solutions are focused on sectors aligned with the Government of India’s climate priorities and can be scaled across India and exported globally. Over the next decade, these solutions will help mobilize private capital towards the US$10.1 trillion needed to meet India's net-zero target by 2070.

“The culmination of this public-private partnership will help India accelerate its clean energy transition and offers the way forward for India and others to reach net-zero targets, while also improving public health, creating jobs, and building a stronger and more resilient economy,” said Michael R. Bloomberg, UN Special Envoy on Climate Ambition and Solutions and Chair, CFLI.

“The Tata Group is committed towards climate sustainability and is proud to co-chair the CFLI India initiative. India needs very large investments to achieve the global 1.5-degree pathway in line with the Paris Agreement. CFLI India was formed with an objective of accelerating investment in sustainability sectors in India. Over the last two years, CFLI India members have partnered in developing concepts to address complex issues across themes such as e-mobility, circular economy for water and renewable energy. The concepts include innovative financial structures across the public and private sector for circular water economy, new financial products targeted to increase e-mobility adoption, and catalyzing investments for green ammonia and grid upgrades. This initiative has helped advance collaboration between public, private, and multilateral sectors. Learnings from this targeted and rapid approach to scaling climate related investments can be applied across markets,” said N. Chandrasekaran, Chairman, Tata Sons and Co-Chair, CFLI India.

“Unlocking large financial commitments for climate projects in emerging markets calls for close collaboration across the public and private sector. Our experience in India shows that multi-lateral finance institutions are ready to be catalytic and invest alongside private capital to create innovative, scalable solutions in sectors like e-mobility that are critical to slowing emissions growth and reducing air pollution,” said Shemara Wikramanayake, Managing Director and Chief Executive Officer, Macquarie Group and Co-Chair, CFLI India.

CFLI India members announced the following solutions:

Public-private collaboration has been critical to the success of this initiative. CFLI India members have worked closely with the Government of India, His Majesty’s Government, the multilateral development community along with the Global Infrastructure Facility and City of London Corporation, to bring many of these solutions to market.

"At State Bank of India, we are seized of the importance and urgency of addressing climate change and are dedicated to playing a pivotal role in India's journey towards sustainability. As the largest Bank in India, our commitment goes beyond just providing financial solutions; it encompasses active engagement with policy makers, regulators, and key stakeholders for facilitating a conducive framework for achieving the country’s commitment to net-zero targets. In line with this commitment, SBI has established a dedicated ESG & Climate Finance Unit, headed by a senior functionary which is a testament to our proactive approach towards a sustainable future. Our strategic partnerships with major Multilateral Development Agencies, Development Financial Institutions, and key players in the green sectors such as renewable energy and electric vehicles sectors reflect our belief in the transformative power of finance to drive positive change and contribute to a greener, more sustainable tomorrow. By supporting initiatives that contribute to climate resilience, we aim to strengthen India's contribution in the global fight against climate change. State Bank of India is not just a Bank; it's a partner in building a sustainable tomorrow." - Dinesh Khara, Chairman, State Bank of India.

“The CFLI in India represents a trinity of government, corporate and citizen initiatives to accelerate the clean energy transition. The financial ecosystem plays a pivotal role in advancing India’s clean energy investment goals by mobilizing capital and financing. As active participants of the CFLI, we have been working towards developing financing models and creating enabling frameworks for priority to the sector. We have had the privilege to chair the working group on scaling E-mobility and charging infrastructure and have taken initiatives towards expanding sustainable lending for the EV ecosystem. We have also announced a grant supporting research for the real-world application of Green Hydrogen.”- Hitendra Dave, Chief Executive Officer, HSBC India.

“As a leading diversified and integrated financial services Group, Kotak Mahindra Bank is committed to offering sustainable financing solutions. CFLI India provides a great platform that connects like-minded institutions catalyzing enhanced ideation and execution of sustainable solutions using private capital at scale. We are excited in our journey towards developing innovative pooled structures that will enable municipalities to raise commercial capital to develop wastewater, solid waste management and other green infrastructures.” - Dipak Gupta, Managing Director and Chief Executive Officer, Kotak Mahindra Bank Limited

“Climate change is the single largest challenge being faced by all of humanity. While the Indian government has initiated various programs to provide funding for multiple areas such as renewable energy, e-mobility, water and sanitation, there remains a massive funding gap. In this context, CFLI India members have made commendable efforts towards scaling up adoption of EV, promoting wastewater projects, and supporting use of renewable energy through financing structures and policy recommendations.” - S. N. Subrahmanyan, Chairman and Managing Director, Larsen & Toubro Ltd.

“In the transition to a lower carbon economy, partnerships such as CFLI India are indispensable, particularly in scaling groundbreaking technologies. By combining the innovative capabilities of the private sector with the strategic support of the public sector, we can accelerate the development and widespread adoption of these important climate solutions. These collaborations are not just partnerships; they are incubators for cutting- edge technologies, blending diverse resources, expertise, and novel financial structures.” - Sonjoy Chatterjee, Chairman and Chief Executive Officer, India, Goldman Sachs.

“The success of CFLI initiatives across multiple sectors exemplifies the robust partnership between the Government and private sector to build innovative solutions in developing India’s energy markets for achieving net zero objectives.” - Sashidhar Jagdishan, Managing Director and Chief Executive Officer, HDFC Bank Limited

"India’s green infrastructure space is seeing a good flow of investment opportunities for long-term investors like GIC to participate in. We are pleased that CFLI India continues to serve as a multi-party initiative that members from private and public sectors can come together and develop even more opportunities to enable the transition to a net zero economy.” - Jeffrey Jaensubhakij, Group Chief Investment Officer, GIC Private Limited

About the Climate Finance Leadership Initiative

The Climate Finance Leadership Initiative (CFLI) was formed in 2019 by Michael R. Bloomberg at the request of the United Nations Secretary-General, António Guterres, to lead a private sector initiative to tackle the challenge of unlocking climate finance at scale in emerging markets. CFLI has launched country pilots in India and Colombia that convene leading private-sector institutions across the financial value chain to work alongside corporates, policymakers, and multilateral institutions, to identify barriers to investment and deliver catalytic financing and policy solutions that accelerate the deployment of private capital for critical low-carbon, climate-resilient projects