Gross GST Revenue Collection In May 2024 Records 10% Y-O-Y Growth

FinTech BizNews Service

Mumbai, June 2, 2024:

The gross Goods and Services Tax (GST) revenue for the month of May 2024 stood at Rs1.73 lakh crore (Trillion-Tn). This represents a 10% year-on-year growth, driven by a strong increase in domestic transactions (up 15.3%) and slowing of imports (down 4.3%). After accounting for refunds, the net GST revenue for May 2024 stands at Rs1.44 lakh crore, reflecting a growth of 6.9% compared to the same period last year.

Breakdown of May 2024 Collections:

Central Goods and Services Tax (CGST): Rs32,409 crore;

State Goods and Services Tax (SGST): Rs40,265 crore;

Integrated Goods and Services Tax (IGST): Rs87,781 crore, including Rs39,879 crore collected on imported goods;

Cess: Rs12,284 crore, including Rs1,076 crore collected on imported goods.

The gross GST collections in the FY 2024-25 till May 2024 stood at Rs3.83 lakh crore. This represents an impressive 11.3% year-on-year growth, driven by a strong increase in domestic transactions (up 14.2%) and marginal increase in imports (up 1.4%). After accounting for refunds, the net GST revenue in the FY 2024-25 till May 2024 stands at Rs3.36 lakh crore, reflecting a growth of 11.6% compared to the same period last year.

Breakdown of collections in the FY 2024-25 till May, 2024, are as below:

Central Goods and Services Tax (CGST): Rs76,255 crore;

State Goods and Services Tax (SGST): Rs93,804 crore;

Integrated Goods and Services Tax (IGST): Rs1,87,404 crore, including Rs77,706 crore collected on imported goods;

Cess: Rs25,544 crore, including Rs2,084 crore collected on imported goods.

Inter-Governmental Settlement:

In the month of May, 2024, the Central Government settled Rs38,519 crore to CGST and Rs32,733 crore to SGST from the net IGST collected of Rs67,204 crore. This translates to a total revenue of Rs70,928 crore for CGST and Rs72,999 crore for SGST in May, 2024, after regular settlement.

Similarly, in the FY 2024-25 till May 2024 the Central Government settled Rs88,827 crore to CGST and Rs74,333 crore to SGST from the net IGST collected of Rs154,671 crore. This translates to a total revenue of Rs1,65,081 crore for CGST and Rs1,68,137 crore for SGST in FY 2024-25 till May 2024 after regular settlement.

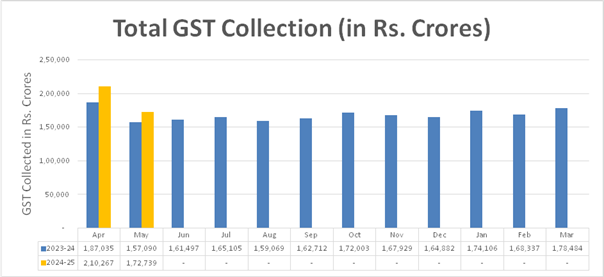

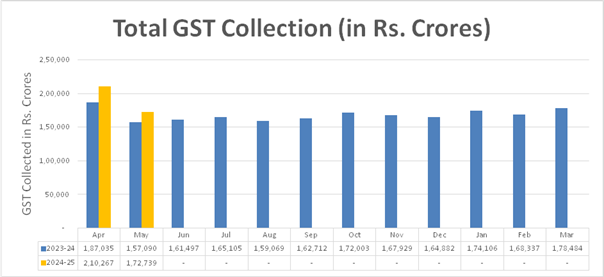

The chart below shows trends in monthly gross GST revenues during the current year. Table-1 shows the state-wise figures of GST collected in each State during the month of May, 2024 as compared to May, 2023. Table-2 shows the state-wise figures of post settlement GST revenue of each State for the month of May, 2024.

State-wise growth of GST Revenues during May, 2024

State/UT | May-23 | May-24 | Growth (%) |

Jammu and Kashmir | 422 | 525 | 24% |

Himachal Pradesh | 828 | 838 | 1% |

Punjab | 1,744 | 2,190 | 26% |

Chandigarh | 259 | 237 | -9% |

Uttarakhand | 1,431 | 1,837 | 28% |

Haryana | 7,250 | 9,289 | 28% |

Delhi | 5,147 | 7,512 | 46% |

Rajasthan | 3,924 | 4,414 | 13% |

Uttar Pradesh | 7,468 | 9,091 | 22% |

Bihar | 1,366 | 1,521 | 11% |

Sikkim | 334 | 312 | -7% |

Arunachal Pradesh | 120 | 98 | -18% |

Nagaland | 52 | 45 | -14% |

Manipur | 39 | 58 | 48% |

Mizoram | 38 | 39 | 3% |

Tripura | 75 | 73 | -3% |

Meghalaya | 214 | 172 | -20% |

Assam | 1,217 | 1,228 | 1% |

West Bengal | 5,162 | 5,377 | 4% |

Jharkhand | 2,584 | 2,700 | 4% |

Odisha | 4,398 | 5,027 | 14% |

Chhattisgarh | 2,525 | 2,853 | 13% |

Madhya Pradesh | 3,381 | 3,402 | 1% |

Gujarat | 9,800 | 11,325 | 16% |

Dadra and Nagar Haveli and Daman & Diu | 324 | 375 | 16% |

Maharashtra | 23,536 | 26,854 | 14% |

Karnataka | 10,317 | 11,889 | 15% |

Goa | 523 | 519 | -1% |

Lakshadweep | 2 | 1 | -39% |

Kerala | 2,297 | 2,594 | 13% |

Tamil Nadu | 8,953 | 9,768 | 9% |

Puducherry | 202 | 239 | 18% |

Andaman and Nicobar Islands | 31 | 37 | 18% |

Telangana | 4,507 | 4,986 | 11% |

Andhra Pradesh | 3,373 | 3,890 | 15% |

Ladakh | 26 | 15 | -41% |

Other Territory | 201 | 207 | 3% |

Center Jurisdiction | 187 | 245 | 30% |

Grand Total | 1,14,261 | 1,31,783 | 15% |