The GST rate rationalization does not necessarily weaken revenue collections.... Instead, the evidence points to a temporary adjustment phase followed by stronger inflows as happened in 2018 and 2019...

Dr. Soumya Kanti Ghosh,

Member, 16th Finance Commission &

Group Chief Economic Advisor,

State Bank of India

Mumbai, November 02, 2025: The mind-boggling figures of revenue losses being touted post GST rationalization have been trumped by the latest’s GST data for October (based on September returns that effectively had 9 days post Sep 22 rate implementation) also suggests that rationalization does not necessarily weaken revenue collections…. Instead, the evidence points to a temporary adjustment phase followed by stronger inflows as happened in 2018 and 2019…

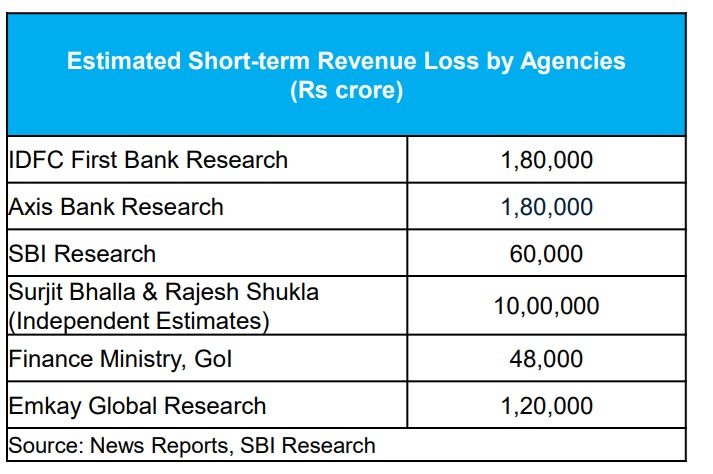

GST Revenue Loss Estimated by Different Research Agencies were always mind boggling

❑ Following the GST implementation, many research agencies and independent estimates had estimated annual revenue loss up to Rs 10 crore…….

Gross GST Collections at Rs 1.96 lakh crore

❑ Defying all speculations of a great fall, Gross GST collections for Oct’25 (returns of Sep’25 but filed in Oct’25) increased by 4.6% to Rs 1.96 lakh crore

❑ While the gross domestic collection increased by 2% yoy the Gross import revenue for Oct’25 (which is actually for Oct not for Sep) increased by 12.8%

E –way bills generated in Sep 25 was at 13.2 Cr

❑ E way bill generated in the month of Sep 25 was highest ever, 13.2 Cr, resulted in a robust GST collection in Oct’25

Net GST Collections is at Rs 1.69 lakh crore in Oct 25 implying better efficiency…

❑ Total Refund for Oct 25 stands at Rs 26934 cr, registering a YoY growth of 39.6%

❑ Total Refund for Apr- Oct 25 is Rs 1.8 Lakh cr, YoY growth of 23.9%

❑ Total refund increased from Rs 1.3 lakh cr in FY21 to Rs 2.5 lakh cr in FY25

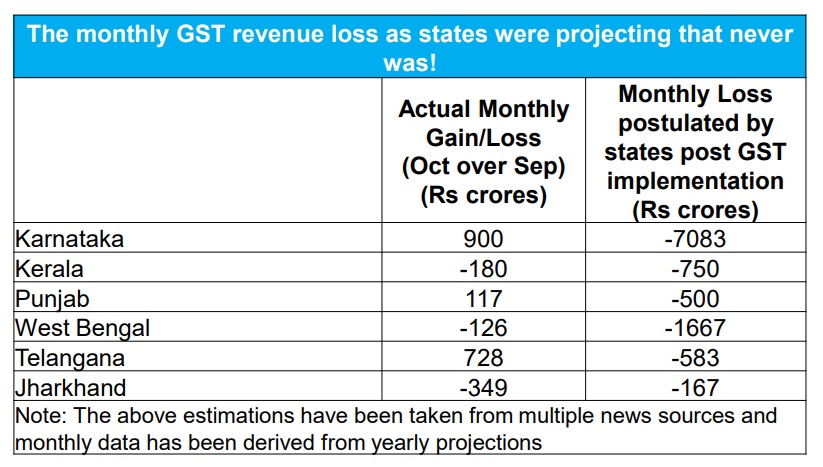

State wise estimated GST loss not materialized…

❑ Various states expected a decline in GST revenue post rationalization. Karnataka estimated a monthly decline of Rs 7083 Crore while West Bengal estimated a monthly decline of Rs 1667 Crore

❑ However, the estimated declines have not materialized as Karnataka actually gained 10% in Oct-25 compared to Oct-24. Similarly, Punjab has gained around 4%, while Telangana gained 10%

❑ The decline for West Bengal is marginal at 1% while Kerala has witnessed a decline of 2%

State wise GST Projections

❑ Assuming that states experience same gains and losses post rationalization as in Oct-25, we project GST revenue for FY26 will still be higher than budgeted GST collections. The projections are based on the growth rate as released by the GST Council

❑ Even given these simpler assumptions, most of the states experience positive gains for the entire fiscal post rationalization

❑ Maharashtra is projected to gain by 6% while Karnataka will gain by 10.7%

❑ Thus, overall states will remain net gainers post GST rationalization

GST post rates Rationalization always results in higher revenue per se

❑ Evidence from earlier rounds of GST rate changes, such as those in July 2018 and October 2019, suggests that rationalization does not necessarily weaken revenue collections. Instead, the evidence points to a temporary adjustment phase followed by stronger inflows. While an immediate reduction in rates can cause a short-term dip of around 3–4% month-on-month (roughly Rs5,000 crore, or an annualized Rs60,000 crore), revenues typically rebound with sustained growth of 5–6% per month

❑ In past episodes, this dynamics is translated into additional revenues of nearly Rs1 trillion. Importantly, rationalisation should be seen less as a short-lived stimulus to demand and more as a structural measure that simplifies the tax system, reduces compliance burdens, and enhances voluntary compliance, thereby widening the tax base. In this broader sense, the Hon’ble PM’s vision of a streamlined GST framework is best understood as a step towards long-term revenue buoyancy and greater efficiency in the economy.