RBI releases the Financial Stability Report, December 2023

FinTech BizNews Service

Mumbai, December 28, 2023: Today, the Reserve Bank released the 28th issue of the Financial Stability Report (FSR), which reflects the collective assessment of the Sub-Committee of the Financial Stability and Development Council (FSDC) on risks to financial stability and the resilience of the Indian financial system.

Highlights:

The global economy faces multiple challenges: prospects of slowing growth; large public debt; increasing economic fragmentation; and prolonging geopolitical conflicts.

The Indian economy and the domestic financial system remain resilient, supported by strong macroeconomic fundamentals, healthy balance sheets of financial institutions, moderating inflation, improving external sector position and continuing fiscal consolidation.

The capital to risk-weighted assets ratio (CRAR) and the common equity tier 1 (CET1) ratio of scheduled commercial banks (SCBs) stood at 16.8 per cent and 13.7 per cent, respectively, in September 2023.

SCBs’ gross non-performing assets (GNPA) ratio continued to decline to a multi-year low of 3.2 per cent and the net non-performing assets (NNPA) ratio to 0.8 per cent in September 2023.

Macro stress tests for credit risk reveal that SCBs would be able to comply with minimum capital requirements, with the system-level CRAR in September 2024 projected at 14.8 per cent, 13.5 per cent and 12.2 per cent, respectively, under baseline, medium and severe stress scenarios.

The resilience of the non-banking financial companies (NBFCs) sector improved with CRAR at 27.6 per cent, GNPA ratio at 4.6 per cent and return on assets (RoA) at 2.9 per cent, respectively, in September 2023.

Financial Institutions: Soundness and Resilience

India’s financial sector has displayed stability and resilience, with ongoing improvement in asset quality, capital position and profitability during H1:2023-24. Macro stress tests for credit risk indicate that even under a severe stress scenario, all banks would be able to comply with minimum capital requirements. Stress in the NBFC sector has been assessed to be higher under a high-risk stress scenario relative to the March 2023 position. Contagion risks may warrant monitoring on account of increased inter-bank exposure.

Credit growth remains robust, mainly driven by lending to services and personal loans. Deposit growth has also gained momentum due to transmission of previous rate increases resulting in repricing of deposits and higher accretion to term deposits. Lending by non-banking financial companies (NBFCs) accelerated, led by personal loans and loans to industry, and their asset quality has improved. Bilateral exposures among entities in the Indian financial system continued to expand.

Non-Banking Financial Companies (NBFCs)

Aggregate lending by NBFCs rose by 20.8 per cent (y-o-y) in September 2023 from 10.8 per cent a year ago, primarily led by personal loans and loans to industry. Growth in industrial advances was largely contributed by the Government NBFCs (18.3 per cent y-o-y), that account for 43 per cent of total credit by NBFCs. During the last four years, the compound annual growth rate (CAGR) for personal loans (nearly 33 per cent) has far exceeded that for overall credit growth (nearly 15 per cent) for the NBFC sector. Going forward, the recent increase in risk weights of select retail loan categories may have implications for NBFC credit growth at the overall, sectoral and sub-sectoral levels. Credit growth by the NBFC sector in the post-pandemic period has accelerated for investment and credit companies (NBFC-ICCs), moving to double digits for infrastructure finance companies (NBFCIFCs), and exceeding 30 per cent for micro-finance institutions (NBFC-MFI).

The GNPA ratio of NBFCs continued on its downward trajectory with improvement across sectors. Among major sectors, the personal loans segment, which had grown rapidly in the last few years, continues to have the lowest GNPA ratio in September 2023 (3.6 per cent). The GNPA ratio relating to Government and private NBFCs moderated further to 2.5 per cent and 6.1 per cent, respectively, but that of private NBFCs’ industrial advances remains high at 12.5 per cent, despite a recent fall and constitutes 21.6 per cent of overall GNPA of the NBFC sector.

Stress Test - Credit Risk

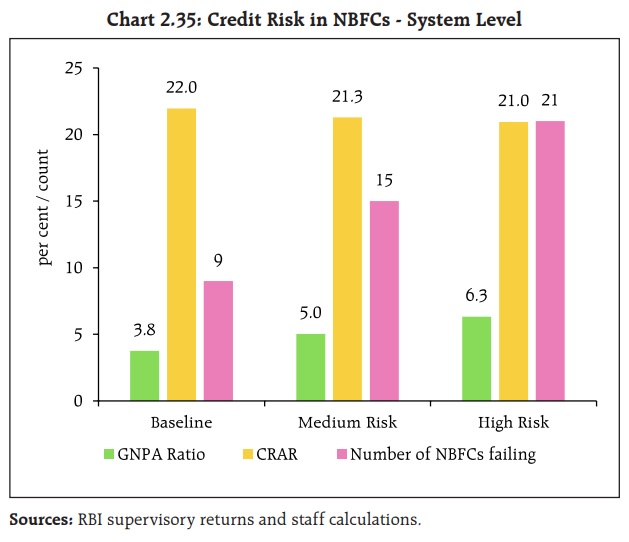

System level stress tests for assessing the resilience of NBFC sector to shocks in credit risk were conducted for a sample of 14638 NBFCs. The tests were carried out under a baseline and two stress scenarios – medium and high risk – with increase in GNPA by 1 SD and 2 SDs, respectively. The capital adequacy ratio of the sample NBFCs stood at 24.4 per cent and the GNPA ratio at 3.1 per cent in September 2023. The one year ahead baseline scenario is built on the assumption of business continuing under usual conditions.

Under the baseline scenario, the one-year ahead GNPA ratio is estimated to be 3.8 per cent and CRAR at 22.0 per cent. Under a medium risk shock of 1 SD increase in GNPAs, the GNPA ratio increases to 5.0 per cent and the resultant income loss and additional provision requirements reduce the CRAR by around 70 bps relative to the baseline. Under the high-risk shock of 2 SDs, the capital adequacy ratio of the sector declines by 101 bps relative to the baseline, to 21.0 per cent. The number of NBFCs from the sample that would fail to meet the minimum regulatory capital requirement of 15 per cent increases from 9 under baseline scenario to 15 under medium and 21 under severe stress scenarios.

Liquidity Risk

The resilience of the NBFC sector to liquidity shocks has been assessed by capturing the impact of a combination of assumed increase in cash outflows and decrease in cash inflows39. The baseline scenario uses the projected outflows and inflows as of September 2023. One baseline and two stress scenarios are applied – a medium risk scenario involving 5 per cent contraction in inflows and 5 per cent rise in outflows; and a high risk scenario entailing a shock of 10 per cent decline in inflows and 10 per cent surge in outflows. The results indicate that the number of NBFCs which would face negative cumulative mismatch in liquidity over the next one year in the baseline, medium and highrisk scenarios stood at 6 (representing 1.3 per cent of asset size of the sample), 17 (10.4 per cent) and 34 (15.0 per cent), respectively

Scheduled Commercial Banks (SCBs)

Mobilisation of deposits by SCBs gathered pace during 2023-24 so far (Chart 2.1 a). Accretions to term deposits rose further, reflective of pass-through of rate hikes alongside efforts to mobilise funds to match credit demand. On the other hand, growth in current account and savings account (CASA) has remained tepid.

Overall, the sustained reduction in the GNPA stock since March 2018 has been mainly on account of persistent fall in new NPA accretions; write-offs and recoveries; and higher upgradation in the post-pandemic period.

At an overall level, asset quality in the personal loans segment has improved, although there has been a marginal impairment in credit card receivables (Chart 2.3 b). Within the industrial sector, asset quality improved across all major sub-sectors barring infrastructure (other than electricity) and petroleum.

Credit Quality of Large Borrowers

With retail loan growth outpacing borrowings by large borrowers, the share of the latter in gross advances of SCBs has declined further between March 2020 and September 2023. Asset quality in the large borrower portfolio saw significant improvement, which contributed to lowering of the share of large borrowers in GNPAs of SCBs. SMA-29 loans for large borrowers, which saw significant reduction during H2:2022-23, reverted to previous levels during June 2023 and September 2023. The same was evident in the SMA-2 ratio also. In the large borrower accounts, the proportion of standard assets to total funded amount outstanding has been improving over the past three years, and the share of top 100 borrowers, which was rising for two years until March 2023, witnessed moderation during 2023-24. As at end September 2023, none of the top 100 borrower accounts remain in the NPA category.

Risks

Under a severe shock of two SDs, it is assessed that (a) the aggregate GNPA ratio of 46 select SCBs would move up from 3.3 per cent to 8.2 per cent; (b) the systemlevel CRAR would deplete by 340 bps from 16.6 per cent to 13.2 per cent; and (c) the Tier 1 capital ratio would go down from 14.5 per cent to 11.0 per cent, well above the respective regulatory minimum levels. The system level capital impairment could be 22.2 per cent in this case (Chart 2.11 a). The reverse stress test shows that a shock of 5.3 SD would be required to bring down the system-level CRAR below the regulatory minimum of 9 per cent.

Bank-level stress tests indicate that under the severe (two SD) shock scenario, eight banks with a share of 18.4 per cent of SCBs’ total assets may fail to maintain the regulatory minimum level of CRAR. In such a scenario, the CRAR would fall below 7 per cent in case of three banks and six banks would record a decline of over eight percentage points in the CRAR. In general, PVBs and FBs would face lower erosion in CRARs than PSBs under both scenarios.

In the extreme scenario of the top three individual stressed borrowers of respective banks failing to repay20, the majority of the banks would remain resilient, with their CRARs depleting by a mere 25 bps or lower. Shocks applied on the basis of volatility of industry sub-sector-wise GNPA ratios indicate varying magnitudes of rise in GNPAs. By and large, sectoral credit risk remains muted.

Unrealised Losses

The distribution of unrealised losses across PSBs and PVBs indicates a contrasting picture across bank cohorts. Unrealised losses of PSBs are predominantly in G-Secs, although the proportion of Central and State government securities held by them in the HTM portfolio are by and large equal but for PVBs, the losses were distributed largely in line with their proportion of holdings.