A catalyst for renewed interest in Indian equities, particularly in cyclical and manufacturing-driven sectors. For India, this opens up significant opportunities.

Gaurav Garg,

Lemonn Markets Desk

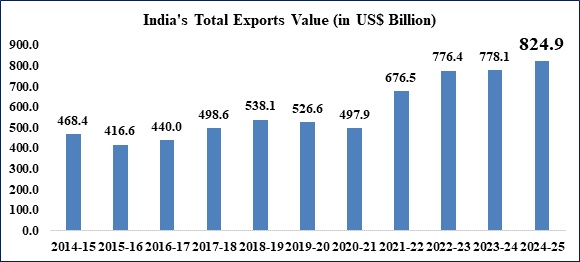

Mumbai, May 29, 2025: "The U.S. court’s ruling limiting the executive branch's power to impose tariffs marks a pivotal shift toward more stable and transparent global trade practices. For India, this opens up significant opportunities. Export-oriented sectors like auto components, metals, and consumer goods stand to benefit from reduced trade barriers, improving the global competitiveness of Indian products and boosting export earnings.

A more predictable trade environment may also lead to a stabilization—and potential strengthening—of the Indian rupee, as capital flows normalize and foreign institutional investors turn their attention back to emerging markets. This could further enhance India’s appeal as an investment destination.

We see this as a catalyst for renewed interest in Indian equities, particularly in cyclical and manufacturing-driven sectors. As global supply chains recover and trade resumes momentum, India—already a key producer of intermediate goods—is well-positioned to meet rising global demand. This not only supports stronger corporate earnings but also fuels long-term investor confidence in India’s equity markets.

In a more interconnected world, global legal decisions like this one have tangible implications for domestic markets. India’s ability to capitalize on this moment depends on how well we align our economic strengths with the emerging global trade order."