Threshold-Based Incentives For MSMEs Must Have Sunset Clauses: Survey Calls For Dialogue With States On Required Policy Changes; States Would Be Encouraged To Set Up Unity Mall To Promote One District One Product

FinTech BizNews Service

Mumbai, July 22, 2024: For Medium, Small and Micro Enterprises (MSMEs), while bridging the credit gap remains a crucial element, the focus also needs to be on deregulation, enhancing physical and digital connectivity, and putting in place an export strategy that enables MSMEs to broaden their market exposure and scale up. This was stated by Economic Survey 2023-24, tabled by Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman in Parliament today.

Noting that the MSME sector occupies the centrestage in India’s economic story, the Survey adds the sector continues to face extensive regulation and compliance requirements and faces significant bottlenecks with access to affordable and timely funding being one of the core concerns. It says Licensing, Inspection, and Compliance requirements that MSMEs have to deal with, imposed particularly by sub-national governments, hold them back from growing to their potential and being job creators of substance. The Survey says threshold-based concessions and exemptions create the unintended effect of incentivising enterprises to cap their sizes below the thresholds and therefore, calls that threshold-based incentives must have sunset clauses.

Calling for deregulation as a vital policy contribution, the Survey says revival or creation of institutional mechanisms for dialogue with states on required policy changes is essential. It adds that much of the action has to happen at the level of sub-national (state and local) governments. MSME entrepreneurs also need training in critical areas of enterprise management, such as human resource management, financial management, and technology. The productivity of owner-entrepreneurs unleashed by such training will be immense, says the survey.

The Survey mentions that MSMEs are the backbone of the Indian economy, contributing approximately 30 per cent of the country’s GDP, 45 per cent of manufacturing output, and providing employment to 11 crore of India’s population. It says the Government of India has been proactive in boosting the growth of the MSME sector, through initiatives such as the allocation of 5 lakh crore Emergency Credit Line Guarantee Scheme for businesses, including MSMEs; equity infusion of 50,000 crore through the MSME Self-Reliant India Fund; New revised criteria for the classification of MSMEs; rollout of Raising and Accelerating MSME Performance programme with an outlay of 6,000 crores over 5 years; Launch of Udyam Assist Platform on 11.01.2023 to bring the Informal Micro Enterprises under the formal ambit for availing the benefit under Priority Sector Lending. The Survey says these initiatives have been formulated keeping in mind the key challenges the sector faces, primarily for access to timely and affordable credit.

PLI SCHEME FOR 14 KEY SECTORS GIVES FILLIP TO MSMEs

The Economic Survey tabled by the Union Minister of Finance and Corporate Affairs, Smt. Nirmala Sitharaman in Parliament today, highlights the importance of the MSME sector in the Indian economy with an all-India manufacturing output of 35.4 percent.

According to the survey, Gross Value Added (GVA) per worker increased from Rs1,38,207 to Rs1,41,769 and Gross Value of Output (GVO) per establishment increased from Rs3,98,304 to Rs4,63,389 showing increased productivity and labour efficiency. The Survey highlights the success of the Udyam Registration portal that has received 4.69 Crore registrations as of 05 July 2024, playing an instrumental role in formalizing MSMEs by providing a simple, online, and free registration process based on self-declaration. The Survey notes that there has been significant growth between FY20 to FY24 in the amount and number of guarantees for MSMEs with Union Budget 2023-24 allocating Rs9,000 Crore to the Credit Guarantee Fund Trust, aiming to enable an additional Rs2 Lakh Crore in credit with reduced costs.

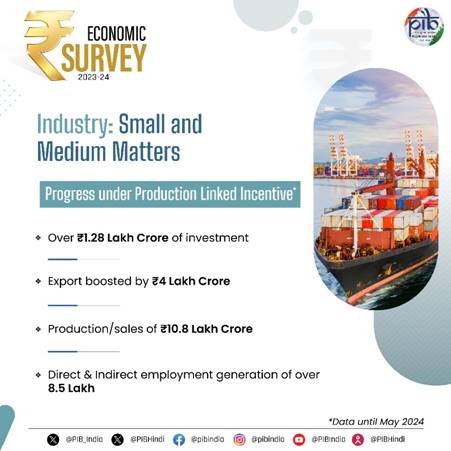

According to Survey, keeping in view India’s vision of becoming ‘Aatmanirbhar’, Production Linked Incentive (PLI) Schemes for 14 key sectors were announced with an outlay of Rs1.97 Lakh Crore to enhance India’s manufacturing capabilities and exports. Further survey states that over Rs1.28 Lakh Crore of investment was reported until May 2024, which has led to production/sales of Rs10.8 Lakh Crore and employment generation (direct & indirect) of over 8.5 Lakh. Survey states export boosted by Rs4 Lakh Crore, with significant contributions from sectors such as large-scale electronics manufacturing, pharmaceuticals, food processing, and telecom & networking products.

Survey highlights, to give an impetus to the One District One Product (ODOP) initiative, the Union Budget of FY24 announced that states would be encouraged to set up a “Unity Mall” in their capitals or most prominent tourism centre or the financial capital for the promotion and sale of their ODOPs. Survey also states that “PM-Ekta Malls” aims to link the artisans of ODOP and consumers. Survey states that these malls are creating a vibrant marketplace for the nation’s unique products, aiming at both domestic and foreign markets. In addition to this survey ‘ODOP Sampark’ workshops were conducted in 15 States to facilitate collaboration between the Centre and local sellers and revive indigenous industries. According to the survey, ODOP showcased India to the world at the G20 events organised across the country during India’s G20 Presidency, where the artisans, sellers and weavers got visibility on the global stage.