In an Exclusive Interview to News18’s Editor-in-Chief Rahul Joshi, FM Nirmala Sitharaman signals aggressive push for CPSE sales to drive revenue; China market access remains slow; balancing imports, make in India key to narrowing trade deficit

FinTech BizNews Service

Mumbai, 2 February 2026: A clear message to investors from FM Nirmala Sitharaman. Speaking to News18 Network’s Editor-in-Chief Rahul Joshi after presenting her record 9th consecutive Budget, she asserts that despite global volatility, the Indian economy's fundamentals remain "absolutely strong."

Excerpts from the Marathon interview:

Q1: I will ask my first question, which I always do when I start. If you look at the reactions to the budget, some people have called it a “status quoist” budget. People have called it a conservative, cautious budget. How do you react to this — people saying “no bold reforms” this time? Of course, much is there in the fine print, and it is all coming out... the markets have come back today. So, what was weighing on your mind when you were preparing this budget?

A: Nonetheless, as was observed by you and by domain experts — not just in India, even outside — the Indian economy’s fundamentals are absolutely strong.

It is the global uncertainties, which, of course, every government has faced global uncertainties of different orders and different levels. But now the extent to which global uncertainties are bearing on countries and impacting decision-making is of an order that we have never seen before. So certainly, we had to keep that uncertainty in mind and plan for what is going to happen this year and what is going to commence in the next five years from this year, in that a new Finance Commission cycle starts. And above all, like the Honorable Prime Minister said, this is going to be the first budget in the second quarter of the 21st century, which is up to 2050. In between, closer to 2050 is 2047, when ‘Viksit Bharat’ will have to be achieved. So, our direction, our goals are all set.

So it was for us to — keeping in mind the global uncertainties — plan for: one, this year; two, the entire Finance Commission cycle; and three, leading up to Viksit Bharat, how do we want to take it forward.

That is why, slightly differently from every other budget, this time a lot more was said through Part B. Which actually is unusual because it is not just the tax proposals taking us towards 2047. It also shows how we want the administration to respond, whether it is tax administration largely, or how the fiscal policy and other things are derived from it.

And that is why I think regarding this budget, everyone is welcome to have their view, and I respect that. I try to understand why a certain perspective has come out. Even if it is criticising, I try to understand the basis from where they have come. But to have had the Indian economy grow at the fastest rate from among major large economies — not just one year, not just two years, but now for a steady four years—it is the stability point that I want to underline.

The Prime Minister’s political stability, because he is in the third term, and also his understanding of how you respond to business, has remained the same always. We have to be receptive, we have to enable, and we have to extend a red carpet, but remove the red tape simultaneously and ease of doing business — these are consistent policies. Tax certainty brings stability for businesses. These have been the core beliefs; it is almost a code for him.

And that is why, remaining in his third term, he has given the message of stability through this budget. Just one last line on this particular observation is: stability, and also making sure businesses are able to do business in India at a time when global uncertainty is making decisions difficult for even businesses from outside to come into India. So, we are clearly projecting India as a place where business can be done, and the large Indian consumer market will have to find its own higher levels of achievements — so, opportunities for them.

So that is, I think, therefore, this message. So, vision, searching for vision, or saying this budget has no vision is, I think, not understanding the perspective with which we are coming.

And one last point here: Budget and aside from the budget, reforms continue. We have done several reforms not through the budget, but yet outside of it through the year. That is why the expression ‘Reform Express’. It is continuing to move and move at a good pace. So not just the budget, please look at the performance.

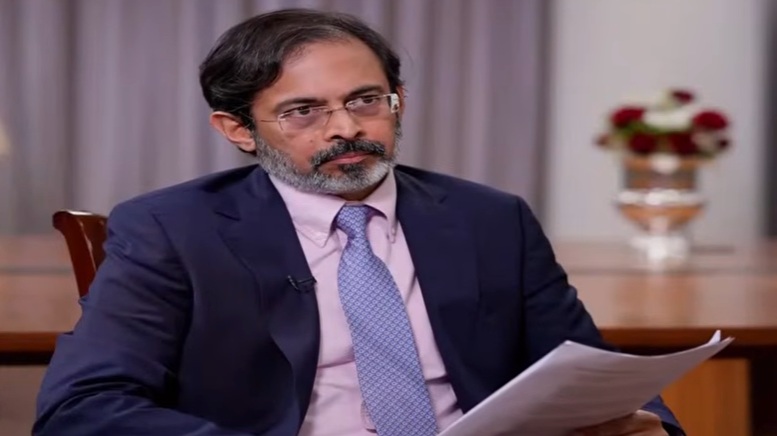

News18’s Editor-in-Chief Rahul Joshi

Q2: No, you have done that with GST rationalisation, which was outside the Budget—a bold reform there. I think there are reforms here as well. What would you consider some of the signature highlights of this Budget?

A: The customs overhaul. Several of them have been mentioned in this Budget, but there are others that could not be mentioned for want of time. There are also a few more that will carry on further. So, the complete overhaul of customs is a major signature reform. And looking at the frontier areas—investing in them and promoting R&D.

Q3: You are projecting a nominal GDP growth of 10 per cent. What is your outlook for inflation, and what is your estimate for real GDP in 2026–27?

A: I think we have indicated this very clearly in the Budget. I am very sure that inflation will remain within the tolerance band, and therefore does not have to worry us much. And everything, therefore, is looked at from the point of view that if the deflator remains low and stable, it will have an impact on your estimates.

Q4: If you look at GDP growth in the last two quarters, 8 per cent has been impressive. Do you think we can sustain this, like China did for many years—an 8 per cent growth? Do you think India can do that in the longer term, to be able to grow at the clip that we are hoping it will achieve?

A: Yes. And that is why the stability of the government, and the policies of the government, matter.

Q5. What is feasible for India, considering that the nominal GDP has been on a decline since FY22? Where do you see the nominal GDP going in the next couple of years?

A. I strongly believe once the fund flows come in because all other factors are strong, all other factors have really been the strength of India. So, your macroeconomic is complete…two days ago we had this news report saying foreign exchange reserves have touched and crossed 700 billion. So, you have every indicator doing well. So what is that one thing which can make a difference? That one factor which can make a difference – and this is common knowledge – is if there are more funds flowing into India, that itself will give us a big relief. And, for that, those who went out also went out booking profits. So, India will have to draw a lot more funds for investments in India.

Q6. We'll come to fund flows in a little while. An interesting thing that I noticed – World of Statistics says that China contributes 26 percent of GDP growth in the world, global GDP growth; India contributes 17 percent. So, overall we are 43 percent. The US has done a mere 9.9 percent. Elon Musk had an observation here: he said that the balance of power is shifting. Would you agree with that, and how soon can we close the gap with China?

A. It is the truth that China and India together contribute so much. That's a fact. For India to aspire to bridge the gap, yes, we have to work very hard. And there are sectors which will have to be given greater stimulus. Productivity gains will have to arise out of using technology. Our manpower should also get better deployed in the areas in which their skills lie. Yes, we have a lot of work to do. And we will have to do it. So – and that is where my trust and faith is – when the government is stable and when forward-looking policies are encouraged, we can still achieve it.

Q7. Stability has been your big message this time. The tax holiday for data centres has been a bold reform. What response do you expect from this? And would it also apply to Indian companies like TCS?

A. See, we are talking about global companies setting up GCCs (global capability centre). Global companies, if they are Indian in origin, will also have to have their profits and other things understood – global profits, profits made in India and most of these global companies, who are setting up business in India, are already also paying tax. It is not as if they are not being covered by taxation for the earnings that they get from India. So, if anyone who fits into this definition – not just this, we've very clearly defined it. Referring to that definition, whoever fits in will get it.

Q. So an Indian company like TCS might fit into that definition.

A. A global company like TCS would fit in.

Q8: Before I go forward, I would like to take, you know, what the opposition feels about the budget. So, Rahul Gandhi has always been very critical of the economy and what you have been doing. You know, when Donald Trump talked about India as a dead economy, he chimed in immediately. In this budget, he says that the finance minister is blind to the realities facing the government. How do you react to this?

A: He is the leader of the opposition in Lok Sabha. I want to take him seriously, and I want to take his observations seriously to see if things can be done better. But most often, I think he shoots from his hip. He doesn't keep good foundational data and then make his observation.

I think on the "dead economy" comment—I'm not referring to anybody else, but being in India, being in the Parliament, being the leader of the opposition, hearing all the questions being asked during question hours, replies being given, written, standing up ministers... that one comment in his haste, voicing the comment made by somebody else from outside... you are a member of the Parliament, you are the leader of the opposition. Are you saying you are living in a dead economy? That itself sort of pulls the carpet from under his feet. You need an opposition leader who speaks with data and with such heft that the government will have to answer you. Now, when you speak sometimes without any kind of basis, I want to respond to him, but what do I respond on? You are speaking out of thin air. India deserves a better opposition party. I am not commenting on individuals. The party should do a lot of homework to make its leaders speak responsibly in the house.

Q9: The one thing that you did this time which has become a subject of conversation—the markets also reacted—was increasing STT in the derivative segment. And I have heard the comments by your secretaries who say that it was to curb rampant speculation. Could it have been done differently, by managing margins or contract sizes? And was it a prudent thing to do at a time when the global sentiment is the way it is and the markets are also on a weak footing? How do you react to this?

A: There are many observations that you are making on which opinions can differ. There are people who within India comment saying India's markets are overpriced. I am not even getting into that debate.

The Revenue Secretary made it absolutely clear: it is not for revenue considerations that we have done this. It is not on all STTs. We are only touching on futures and options. Cash is not even touched.

So it is the speculative tendencies... and in fact, the Ministry of Finance has received several parents, elders who call us and say, "Are you going to sit and watch people lose money?" And one of the studies showed that 90% of people who have gone into futures and options have lost money.

Of course, the market regulator will also do his or her bit; the institution will do its bit. So we have only tried bringing in a deterrent where speculation is rife. We are not touching the market. Other STTs have not been touched.

Q10: Thank you for that clarification. Let me ask you a slightly directional question. Whether it is long-term capital gains or short-term capital gains, in the last few years, they have only inched up, when most of the other taxes have really gone down. So how do you — I am asking you from a broader perspective as the Finance Minister — how do you see this pan out over the years?

A: I don’t agree with you when you say it’s “inched up”. Yes, it has gone up, or it is rationalised so that all asset classes can be treated equally. And that is the logic and reasoning behind that particular rate change. It wasn’t done with an intent of earning out of it. But the disparity and the differential couldn’t be sustained. So we had to rationalise it.

And in fact, after that, we even gave that option to say, “You choose which one you want to have.” I remember standing up during the government amendments time — the Finance Bill passing time — we brought in that flexibility to the people who felt that they were short-changed. So that was rationalisation; that wasn't for kicking up the rates.

Q: So you think that the current rates are comfortable?

A: The stable approach towards tax incidence, or keeping tax incidence stable, has always guided us.

Q11: The other overhang for the markets has been this... you know, US tariffs. Let me ask you a direct question. I feel that, you know, there is a sense of things thawing between the two countries. Are we close to a deal?

A: That’s not so much for me to speculate on. Let us see.

Q: But you do think that... you think that things are improving from both the sides? Looking at...

A: The FTAs are being signed…European Union, UK, Australia, New Zealand. So work is going on in getting FTAs done.

Q12: So, Donald Trump has said — I think yesterday or the day before — that India is ready to buy Venezuelan oil and not Iranian crude. He says that, you know, broadly there is an agreement on the concept of a deal. Would you confirm that?

A: I would have no idea. Not even in my domain.

Q13: Let me move to something else. The RBI has reduced benchmark repo rates by about 125 basis points since 2025, but 10-year bond yields have increased, which means higher borrowing costs. How do we tackle this? How do we reduce the cost of borrowing?

A: I think we are very conscious that yields are going up. Again, without shifting the blame or responsibility, this is dependent on many different factors. Yes, “crowding in” is one of the things on which the market gets heated up, and yields can go up.

But it is a fact that, given the levels of developmental activity that all of us want to ramp up—both the central government and state governments—going to the market is one way of raising funds. However, rising yields also push back, and therefore people who want to look at better timing step back without raising funds. So there is this concern, and that itself could be a deterrent for many states because they cannot afford it. It is a very evolving situation, and we will have to see how it goes.

Q14: Finance Minister, your party has always stood for a strong rupee. But if you look at the Indian rupee over the last year, it has been on a losing streak. It has almost lost 10 per cent against the dollar and around 16 per cent against the euro. Are you comfortable with this level of the rupee, and are you happy with the steps that the RBI is taking to maintain it?

A: Let us understand one thing. Our party, yes, was in favour of—and is in favour of—a strong rupee, no doubt. But it also has to be predicated on the context of how the economy is. An economy suffering from high inflation, being fragile, with the rupee value also not in a good position, makes it really hard and difficult for everybody.

But one thing I can clearly say is that the economy is fine and fit. The macroeconomic fundamentals are strong. That is not to say, therefore, that I am indifferent to the rupee–dollar exchange rate. I am not indifferent. But I will also look at it in the context of the realistic challenges we have, to understand where the rupee finds itself now. The Reserve Bank is closely monitoring the situation.

Q: So you are saying that you are comfortable with this situation at the moment, given the circumstances?

A: I will leave it there. I do not think I will say I am comfortable or not comfortable. I will leave it there.

Q15: India’s holdings of US Treasury bonds have declined by about 25 per cent compared to the peak in 2023. At the same time, the Reserve Bank of India has increased its holdings on gold. Do you see this trend continuing?

A: I think many central banks, not just the Reserve Bank of India, are pitching to buy more gold. And India seems to be following the trend.

Q16: Gold is up by about 80%, silver by 250%. How do you see this in the last one year—this phenomenon?

A: The uncertainties in the world are making people fall back on, let's say, a time-proven asset, which is gold. And that's bound to be, because it is beyond anyone's fair assessment to see where things will move. And therefore, the demand for gold.

Q17. That brings me to the next point, which was also discussed a lot in this budget: capital gains on sovereign gold bonds purchased in the secondary market. Market participants feel this is some kind of a retrospective tax. Do you agree with that? What was the logic behind this?

A: No. The intent of that sovereign gold bond was at the time of the issuance and also making sure that you hold it the full term. So those are the two boxes to be checked. If you are doing one and not the other – you picked it up not at the time of issuance but from the secondary markets – one of the boxes is not getting ticked. And, therefore, you’re taxed. You bought it during issuance, but you are not holding it full term – one box is not checked. So, you’re being taxed. It's only when you have taken it at issuance and you are holding it full term, you get that concession. So every other – for which there are only four situations, right – the other three situations, where both the boxes are not getting checked, is where you are.

Q18: You've set up a committee to review the banking sector. What will be the remit of this committee? What are the timelines that you are looking at? Could you give us some details?

A: I have not worked on the TOR [Terms of Reference] yet. But the broad intent was that towards "Viksit Bharat", there couldn't be a better time for us, especially now when the banks' health is very good.

We would want, from that strength, to understand where we can go. And how do we go. Which is the path that we take to go there. So that is where we want that committee to work.

Q19: You know, in the past you have been disappointed about private sector capex not picking up. You have said it in a couple of meetings; you have said it in our interviews as well. Do you see an uptick now because of certain reforms that you have introduced?

A: I see some green shoots. I think the situation is improving, and I have reasons to believe that private sector investments will only grow.

Q20: When I was asking you about this bank committee, there are two questions that I have related to that. One is, are you looking at the consolidation of PSU banks — you know, some mega banks as opposed to a whole lot of PSU banks today? And the second, would you allow conglomerates, Indian private conglomerates, to get into banking?

A: That's for the committee to tell me. Of course, I have told you that the Terms of Reference are not made yet. But obviously, when you are looking at banking for ‘Viksit Bharat’ — banking sector for a ‘Viksit Bharat’ — there are many core such issues which the committee will have to look into.

We'll wait and see what they have to say. It may not be right for me to give my view and, you know, pre-empt what they are going to say.

Q: But about the PSU banks, directionally, are we in that direction? I mean, you know, there are far too many of them, and a consolidation of some kind might lead to bigger entities which may be more viable.

A: Let’s wait for the committee to say. There is a need for India to have more banks, better banks, bigger banks, whatever. The committee will have to have its mind, that’s it.

Q21: One more interesting question I have that you announced seven new high-speed rail corridors in your budget. Again, a little more details: what is the timeframe that you are looking at? How will you go about it?

A: It is so much left to the Rail Ministry. But the fact that they have done the necessary ground study and the route plan and everything else... and they were absolutely clear that the budgetary announcement will make them sit up and deliberate. They are definitely going to be delivered at the earliest because these are dependent on India's technologies, Indian coaches and so on. So the Rail Ministry will get into the details of it.

Q22. I have asked you this question before, but India's trade deficit with China is greater than $116 billion in 2025. Even though the exports have also gone up, how do you tackle this issue?

A. That is where I think we are very clear in ‘Atmanirbhar Bharat’. We need to have capacities built in India for those essential goods that we import and make sure that we are able to make them in India for the Indian market. Even as I say this, we have not restricted the imports of some of the critical machines or equipment or some raw materials, which are so important for our industries. So capacities will have to grow but, in the meanwhile, you still need – for those very same capacities – imported equipment. So, we are doing a fine balancing act in not denying the raw material or the equipment coming because there are some precision tools, which you so need when you are going to set up a particular type of factory. We need those to come in here. But, at the same time, capacities in India will have to be expanded, ramped up sooner so that our dependencies can come down. But this story is one side of the coin. The other side of the coin is market access in China. I was commerce minister, and I know in my time also, we've been asking for greater market access for Indian goods. That is moving very slowly.

Q23. Now that the relationship with China is improving, would you consider relaxing restrictions on investments by China through Press Note 3? That would really take the relationship to the next level.

A. Well, some discussions were happening. I am not sure where it has reached yet. Once we arrive at something, I will be able to expand on it.

Q24: There are many tax litigations going on in the country. You have done a lot for ease of doing business, but tax uncertainties remain. In IT alone, disputed amounts worth about Rs 25 lakh crore are pending. You had come out with Vivad Se Vishwas—I do not know how successful that was. How do we solve this problem as well?

A: I think even in this Budget I have given—both for direct and indirect taxes—ways in which we can settle such disputes. Even in the last Budget, we made it very clear that in some cases where the department or the board does not have to appeal against a verdict, we should sit back and say, “No, we are not appealing. One level of the court has decided, and we go in favour of the assessee.”

So the approach has to be more about settling and not pursuing matters further. That is today’s understanding in both the boards. And I am very happy about it because now most of our measures are on that route—that we do not go appealing just because we want to earn a few hundred more rupees.

Q25: Nirmala ji, the disinvestment target is something that is missed almost every year in the last few years. This year also, you have taken an ambitious target of Rs 80,000 crore for the coming year. How is it going to be achieved? I have heard, you know, your press conference where it was discussed about IDBI. But what about Shipping Corporation, BPCL, BEML, Container Corporation, and so on? Can you give us some broad roadmap on the road forward?

A: See, I am not repeating my answers, but I also want to underline the fact that when the government has decided in the cabinet that a certain number of disinvestments will have to happen, it is our duty to honour it. We will never be able to bypass it and say “no”, unless the decision itself is changed by the cabinet. And no decision has changed till now.

Earlier — at least a few years ago — it was a Covid-affected market, an economy reviving market. So we had to be cautious about going to the market when it is not so suitable and so on.

But I am very clear that I will be focusing also now on disinvestment. Having given quite a few concessions in direct taxation, having been given in GST indirect taxation, my revenue also will have to be looked at from the point of view of what am I going to get out of disinvestment.

So it’s not to say that I didn't give the attention earlier, but the earlier attention was circumscribed by the fact that we were facing Covid or we just came out of it, or the situation in the market is not... And some sectors do well and therefore you can take them forward faster; some others take their own time. But we will be going ahead with it.

Q: This time it’s a very decisive mandate to go for, and you're very confident of achieving the number as well?

A: Yes.

Q26: Nirmala ji, you know, this budget has also given a big fillip to AI. And I would like you to spend a little time trying to help our viewers understand the rationale behind it. The Economic Survey does point out to an AI bubble building up in valuations. So in that backdrop, what are we planning to do? How do we take this forward?

A: See, the government's interest in bringing AI is to improve productivity. Large-scale production benefits when you have AI influencing it. Small-scale companies, MSMEs in some sectors, will benefit with AI.

AI is also now so much sought after from the point of view of the "orange economy". AI has now become part of every office. I've said this before that in income tax and in GST, using artificial intelligence and deep tech, we are able to detect and see the money trail where we need to chase. Physically, manually, without technology, it would have taken years for us to find the money trail. Whereas now, using AI, you are able to get the entire web before you of who's going where, from where to where money is being sent, and so on.

So if that is the case with income tax, that's the case also with rural technologies, with agriculture, with—surprisingly—even animal husbandry. Crop intensity, and then being able to predict what the crop outcome will be, and so on. So every department is today moving to use AI.

Now, that's not displacing labour; it's creating more job opportunities. But job opportunities for those who are trained and skilled in AI. And that is why in this budget you see that we are listing out ways in which we are going to bring technology into schools and colleges so that they will be able to come out and be an entrepreneur or set up a business to say, "You want some AI solutions? I can give you."

We are doing that as a pilot now in three states at the ITI district level. In the age-old ITIs where students went and learned some technology, they didn't become engineers but they did get a diploma. That used to be the world earlier. Now we are upgrading all these district-level ITIs with the central government's money and making sure that master trainers are sent to all the districts. Students are brought in; they can have the AI training and therefore be ready for the market. Just as in the last budget and the budget before, we had set up institutions of excellence for AI in agriculture, AI in health, AI in cities building.

Q27: That’s interesting. Let me move to some political questions. And before anything else, this time people said there was not much mention of poll-bound states in your budget. In fact, the governments in Kerala and Tamil Nadu have reacted and said that there is nothing in it for us. MK Stalin has said that, you know, Tamil Nadu has been snubbed by you. How do you react to this?

A: It is a sad commentary, you know. It’s a sad commentary.

Super-fast trains—or the trains that we have announced, not Bullet but the high-speed trains—are going to Chennai. They are getting connected to Hyderabad; they are getting connected to Bengaluru. In fact, I was reading somewhere that once this comes in, the travel time between Chennai to Bengaluru will be one hour and 30 minutes or something like that. Is that not happening for Tamil Nadu?

I had gone a couple of years ago when that Ockhi cyclone happened to Tamil Nadu, particularly to the districts which are adjacent to the coast. Every coconut tree had fallen flat. We couldn't even get enough saplings for those farmers that time, because everywhere they were looking at saplings from Karnataka and so on. Now, Kerala and Tamil Nadu, both of them are election-bound states. Coconut trees there... every farmer is going to get benefited because they can replace old trees which are not giving yield with fresh saplings. Coconut promotion—doesn't it benefit poll-bound Tamil Nadu? Doesn't it benefit poll-bound Kerala?

The rare earth corridors. Both Kerala and Tamil Nadu get it. Poll-bound states?

In fact, if I can say, the defence corridor is in Tamil Nadu. Now they get the second corridor, which is the rare earth corridor. Are they suggesting that these are not activities which are going to benefit Tamil Nadu? I have taken the name and said it. Snubbing Tamil Nadu? I can't believe this.

Look at the allocation for Viksit Bharat...G RAM G Act. Rs 95,000 crore is being given for it—the replacement for MGNREGA. But equally, I am not denying all the dues which are in the old scheme, the overhangs. Rs 30,000 crore for that. Put together, it's Rs 1,20,000 crore. Is that against Tamil Nadu?Fourth. Look at the way in which... not just coconut... we are looking at sandalwood. The moment... there was a time in Tamil Nadu, schoolchildren would immediately recall the name of Veerappan—the sandalwood smuggler. Today, the government is not talking about lawlessness or anything; it is saying I want to promote sandalwood growing. Farmers who are cultivating sandalwood—I know of some farmers in Andhra Pradesh, South Andhra Pradesh, who are growing sandalwood—but because it is not given permission, the farmer is not given the permission to cut and sell it, he is encumbered with it. Won't it benefit the farmers there?

So there are ever so many... and Semiconductor! Electronics 2.0: Rs 40,000 crore. Where are these industries? They are not in Tamil Nadu? Semiconductor industry, when you stand next to the company and take a photo saying, "Oh, Tamil Nadu received this investment"—isn't the policy of the Government of India helping you to get it? Why mislead people? Be proud that you are getting it.

Q28: MK Stalin is framing this entire battle in Tamil Nadu as an “Aryan–Dravidian” battle. How do you see this?

A: It is not new.

Q: What do you think are the narratives being set for this election?

A: It is a completely separatist mindset that rules the ruling party of Tamil Nadu. They have lived with it, and they continue doing it. There is a tendency to make Tamil Nadu appear very different from the rest of India and to give a picture of “we don’t care what you do; we are a separate state.” That mindset is what they want to feed continuously, which worries me.

The people of Tamil Nadu are not like that. The current leadership of Tamil Nadu wants to play on this wedge-driving. That is why, for every such comment that they get, there are people who respond, and those responses build on it. It is a sad state. I am not sure I want to credit anybody, but Tamil Nadu has not seen it this bad as it is seeing it under the current dispensation.

Q29: But why has the BJP not really done well in Tamil Nadu?

A: It will take time. A national party like Congress, which lost power 60 years ago in Tamil Nadu, is playing fiddle to the current government. And it is always standing up only with the crutches of a party with whose alliance they try to win some MLAs and a few MPs. They are not able to come back to power. Whereas Tamil Nadu was never under the BJP, we are now trying to serve the people and enter to win some seats. And we hope that the alliance will be able to form a government there.

Q30. How big is the Vijay-TVK factor in Tamil Nadu? The DMK is saying the Bharatiya Janata Party, the government is coercing and harassing Vijay to join the NDA. Stalin and the DMK are saying that they are trying to do CBI raids on him, his film’s not being released. How do you see this? Is he that big a factor in this election?

A. If anybody, who has got to be afraid of a factor that is big and worrying, is the party which is ruling. So why should we be upset about it? If he is a threat to the ruling DMK, I don't need to be worried about it. Good enough.

Q. But if he is on your side, then it can make a difference.

A. That's a different story. So, the DMK being worried about Vijay, I can understand it. Because Vijay on the one side – either with or without us – the AIADMK alliance, the NDA now very strong, also coming up, are all making the DMK, although they are in power, completely insecure. That is why you find all kinds of freebies being announced even now. If you have been in power for five years and you have governed well – whereas I would allege that they didn't govern well because of lawlessness and drugs, like never before in Tamil Nadu – but if you’d governed well and, if that's what you claim, why would you want to throw all these freebies now?

Q31. But, is the BJP worried that Vijay could come together with the Congress? They are both making overtures at each other. So is that a worry – that that could be a formidable combination in Tamil Nadu?

A. Where is the Congress in Tamil Nadu? Despite the crutches that they are holding onto – the DMK crutches – where is the Congress? And today it is a divided house. The Congress in Tamil Nadu is a divided house. Let them make up their mind where they want to be. One group wants to go with the TVK, the other group wants to remain with the DMK. They have embarrassed themselves by wanting to be there, reap benefits but yet want to go to a new alliance. Haven't they messed themselves up?

Q. But do you think Vijay is the X-Factor this election and is he consequential this time?

A. Only the election can prove it.

Full Interview link: https://www.youtube.com/live/MAFbUXROvA8

FM YT : https://www.youtube.com/watch?v=yyKRRsNacRQ

FM X: https://x.com/nsitharaman