Going forward, India’s trade deficit may further decline as the PLI scheme deepens its coverage and extends to other sectors

FinTech BizNews Service

Mumbai, April 26, 2024: The global economic growth landscape is seeing a gradual resurgence, marked by fading fears of recession and rebounding growth in major economies. However, there are disparities among regions, with some areas also experiencing subdued economic activity. Despite these challenges, leading indicators suggest an overall upturn in economic activity driven by expansion in both manufacturing and service sectors, the Finance Ministry stated in its monthly economic report in March 2024.

Global economy: Strong rebound, but uncertainties persist

Geopolitical tensions remain a concern, but notwithstanding recent developments, risk perceptions have softened, offering a potential upside for growth. Amidst these global trends, India continues to exhibit robust economic performance. Factors such as strong domestic demand, rural demand pickup, robust investment, and sustained manufacturing momentum have contributed to India's resilience. Projections by RBI and IMF forecast high growth rates for India, further reinforcing its positive outlook. In March 2024, India's economy was marked by record-breaking stock market performance, remarkable GST collections, and substantial growth in the manufacturing and services sectors, reflecting a buoyant domestic economic landscape. Consumer and investor confidence, as indicated by notable improvements in sentiment, underpin India's ability to navigate global challenges successfully. Globally, inflation management continues to remain a key priority. In India, retail inflation in FY2023-24 witnessed a significant decline, reaching its lowest level since the Covid-19 pandemic. Accordingly, as price pressures continue to abate in India, the RBI’s Monetary Policy Committee (MPC) held policy rates at their current levels, stating that the last mile of disinflation will involve aligning inflation with its target of 4 per cent on a durable basis. Taking into account factors such as geopolitical conflicts, potential adverse domestic weather shocks and the prediction of an above-normal monsoon this year by the IMD, the RBI has projected CPI inflation for FY2024-25 at 4.5 per cent. Global trade is estimated to have contracted in 2023, driven by reduced demand in developed nations and trade weaknesses, coupled with a decline in global commodity prices.

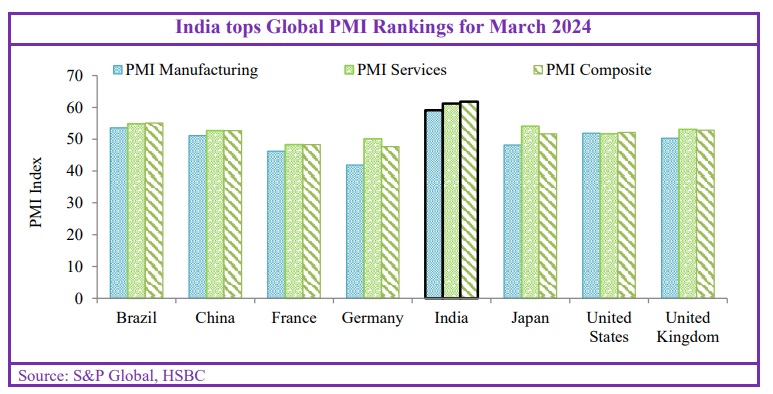

Global economic growth appears to be gradually on the ascent as fears of recession fade. Yet even as most of the major economies exhibit resilience and register strong rebound in growth, others lag behind resulting in diverging growth trajectories around the world. Japan has been registering a strong rebound with the US and the UK witnessing continued growth momentum. However, economic activity remains subdued in the Euro area and China although the magnitude of the downturn has eased. Prominent international agencies have now revised upward growth forecasts of major economies. 2. Leading indicators are also suggesting an upturn in global economic activity. The global composite PMI registered an uptick in March 2024 with quicker expansion across both manufacturing and service sectors. The global manufacturing PMI has been improving and stood at a 21-month high in March 2024. The improvement is across major economies reflecting a broad-based growth and building up of confidence across governments and businesses. Global economy: Strong rebound, but uncertainties persist

1. Global economic growth appears to be gradually on the ascent as fears of recession

fade. Yet even as most of the major economies exhibit resilience and register strong rebound

in growth, others lag behind resulting in diverging growth trajectories around the world. Japan

has been registering a strong rebound with the US and the UK witnessing continued growth

momentum. However, economic activity remains subdued in the Euro area and China although

the magnitude of the downturn has eased. Prominent international agencies have now revised

upward growth forecasts of major economies.

2. Leading indicators are also suggesting an upturn in global economic activity. The global

composite PMI registered an uptick in March 2024 with quicker expansion across both

manufacturing and service sectors. The global manufacturing PMI has been improving and

stood at a 21-month high in March 2024. The improvement is across major economies

reflecting a broad-based growth and building up of confidence across governments and

businesses.

Global commodity prices increased in March 2024, driven by both Energy and NonEnergy commodities. Crude oil prices have firmed up since December 2023, partially driven by increasing tension in West Asia and OPEC+ countries deciding to maintain supply constraints until mid-2024. Besides, robust growth prospects in the USA and signs of recovery in China have boosted crude oil prices.

India remains a bright spot in the revival of the global economy

In contrast to a cautious assessment of the global scenario, the Indian economy continues to exhibit strong economic performance with broad-based growth across sectors. Many international organisations assert India’s pivotal role in determining the growth path of Asia in the coming years.

In March 2024, India witnessed a surge across multiple economic indicators, reflecting robust and resilient business activity. The month marked significant milestones, from recordbreaking performances in the stock market to remarkable advancements in tax revenue collection. The buoyancy extended to the manufacturing and services sectors, as evidenced by the soaring HSBC India Manufacturing PMI and Services PMI. Amidst strong demand and positive market conditions, both sectors experienced substantial growth in output, new orders, and employment. The Indian stock market witnessed another bullish run as both the Nifty 50 and BSE Sensex 30 indices soared to new heights. In March 2024, the Nifty 50 opened with a record high of 22,048.3, ultimately surging to an all-time peak of 22,526.6. Similarly, the BSE Sensex 30 commenced trading with a historic high of 72,606.3, reaching an unprecedented pinnacle of 74,245.2.

In March 2024, the HSBC India Manufacturing PMI surged to an impressive 59.2, a notable increase from the final figure of 56.9 recorded in the previous month. This upswing was driven by robust demand, marking the fastest growth in factory activity since February 2008. Notably, both output and new orders experienced substantial growth, reaching the highest levels in nearly three-and-a-half years.

In March, India's services sector hit a peak, with exports surging to a fiscal year high. The HSBC India Services PMI soared to 61.2, marking one of the sector's most significant expansions in sales and business activity in nearly 14 years.

Consumer durables emerged as a standout performer, registering an impressive growth rate of 12.3 per cent. This significant increase contrasts sharply with the negative growth observed in the same period last year. However, consumer non-durables experienced a decline of 3.8 per cent in the latest period.

Retail Inflation lowest since the Covid pandemic

The government’s efforts in managing retail inflation in FY2023-24 have been highly successful. Inflation measured by the Consumer Price Index declined from 6.7 per cent in FY2022-23 to 5.4 per cent in FY2023-24, which is within the upper tolerance level of the inflation-targeting framework. The government’s positive action has also contributed to inflation control, such as a reduction in petrol, diesel and LPG prices. FY2023-24 ended with an inflation rate of 4.85 per cent in March 2024, which is the lowest inflation rate recorded in the last 10 months. Core inflation, which excludes food, fuel & light, declined to 3.3 per cent in March, which is the lowest in this financial year.

RBI’s MPC holds policy rates steady through the last mile of disinflation

In its first meeting of FY2024-25, the Reserve Bank of India’s Monetary Policy Committee (MPC) held policy rates at their current level and decided to remain focused on the withdrawal of accommodation to ensure that inflation durably aligns with the target, while supporting growth.

Continued transmission of high policy rates was seen in lending and deposit rates of Scheduled Commercial Banks (SCBs) increasing during FY2023-24. While strong credit demand has aided banks in raising lending rates, tighter liquidity conditions and credit-funding requirements have persuaded banks to raise their deposit rates in order to attract fresh deposits.

Looking ahead, the MPC sees food price uncertainties weighing on the inflation outlook. While a record Rabi crop will help in moderating cereal prices, the increasing occurrence of weather shocks poses an upside risk to food prices.

Going forward, India’s trade deficit may further decline as the PLI scheme deepens its coverage and extends to other sectors. Further, the recently signed India-European Free Trade Agreement (EFTA) is expected to increase the global market share of the country’s exports and reduce India’s import dependence. Various international agencies and RBI expect the CAD to GDP to moderate to below 1 per cent for FY2023-24, driven by growing merchandise & services exports and resilient remittances. The result of the 87th round of RBI’s survey of Professional Forecasters on Macroeconomic Indicators projects the CAD to GDP ratio at 1.2 per cent and 1.1 per cent for FY2024-25 and FY2025-26, respectively, driven by rising services exports and remittances and growing merchandise trade.2 The forecast of narrowing CAD is also supported by rising capital inflows, especially Foreign Portfolio Investments (FPIs), and an assumption of improvement in Foreign Direct Investment (FDI).

Moderation in merchandise trade in FY2023-24 24

The trend of growth in Q3 of FY2023-24, continued in Q4 also. Coupled with rising exports, imports also witnessed growth in Q4. The positive effect of rising exports outweighed the impact of rising imports, resulting in the narrowing of the merchandise trade deficit in Q4. However, compared to FY2022-23, trade has slowed with the contraction of both exports and imports. This is due to a slowdown in India’s major exporting partners, impacted by the lagged impact of monetary tightening undertaken the world over.

Rising Capital Inflows

India’s FPI flows saw a significant turnaround in FY2023-24. Supported by rising economic growth, a favourable business environment, and strong macroeconomic fundamentals, India witnessed robust FPI inflows in FY2023-24. Net FPI inflows stood at USD 41 billion during FY2023-24, as against net outflows in the preceding two years.

The Rs/USD exchange rate hovered in the range of Rs82-83.5/USD, being one of the least volatile major currencies among its emerging market peers and a few advanced economies in FY2023-24. It also exhibited the lowest volatility in FY2023-24 compared to the previous three years.

The external debt to GDP ratio stood at 18.7 per cent as at end-December 2023, slightly lower from 18.8 per cent as at end-September 2023.

India’s external debt was placed at USD 648.2 billion at the end of December 2023. The long-term debt accounted for USD 521.9 billion and the short-term debt accounted for USD 126.3 billion.

Conclusion and Outlook 29. Global economic growth recovery is underway in major economies, although disparities persist. While the leading indicators signal increased economic activity and geopolitical tensions have eased slightly, recent conflicts continue to pose risks. Despite the global challenges, India stands out with its strong economic performance, highlighting broadbased growth across sectors and asserting its pivotal role in supporting the global growth trajectory.

Overall, India continues to be the fastest-growing major economy with positive assessments of the growth outlook for the current financial year, for India by international organisations and RBI. Accordingly, the IMF, in its April 2024 WEO has revised upwards its estimate of India’s real GDP growth for FY2023-24 to 7.8 per cent from 6.7 per cent in its January 2024 update and 6.3 per cent in its October 2023 WEO.

(This document has been prepared by Bharadwaja Adiraju, Deeksha Supyaal Bisht, Esha Swaroop, Harish Kumar Kallega, Megha Arora, Radhika Goyal, Shreya Bajaj and Sonali Chowdhry.)