Standard Deduction Of Salaried Employees Increased To Rs 75,000

FinTech BizNews Service

Mumbai, July 23, 2024: The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman tabled the union budget 2024-2025 in Parliament today.

Apart from giving relief to four crore salaried individuals and pensioners of the country in the direct taxes, Union Budget 2024-25 seeks to comprehensively review the direct and indirect taxes in the next six months, simplifying them, reducing tax incidence and compliance burdens and broadening the tax nets.

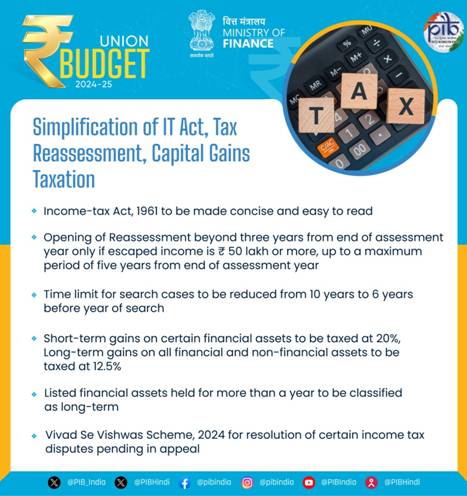

The Budget proposes comprehensive rationalization of GST tax structure along with review of the Custom Duty rate structure to improve the tax base and support domestic manufacturing. A comprehensive review of Income – Tax Act is targeted at reducing disputes and litigations and to make the act lucid, concise and easy to read.

Minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman said that simplification of tax regimes without exemptions and deductions for corporate and personal income tax has been appreciated by tax payers as over 58 per cent of corporate tax came from simplified tax regime in 2022-23 and more than two third tax payers have switched over to the new personal income tax regime.

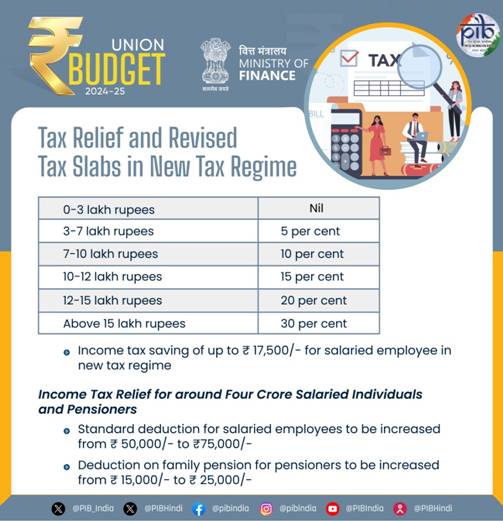

Budget 2024-25 increased standard deduction of salaried employees from Rs 50,000/- to Rs 75,000/- for those opting for new tax regime. Similarly, deduction on family pension for pensioners enhanced from Rs 15,000/- to Rs 25,000/-. Assessments now, can be reopened beyond three years up to 5 years from end of year of assessment, only if, the escaped income is more than Rs 50 Lakh. The new tax regime rate structure is also revised to give a salaried employee benefits up to Rs 17,500/- in income tax.

Income Slabs | Tax Rate |

0 – 3 Lakh rupees | NIL |

3 – 7 Lakh rupees | 5 per cent |

7 – 10 Lakh rupees | 10 per cent |

10 – 12 Lakh rupees | 15 per cent |

12 – 15 Lakh rupees | 20 per cent |

Above 15 Lakh rupees | 30 per cent |

On Capital gains, short term gains shall henceforth attract a rate of 20 per cent on certain financial assets. Long term gains on all financial and non-financial assets to attract 12.5 per cent rate. Limit of exemption of capital gains has been increased to Rs1.25 Lakh per year to benefit lower and middle-income classes. Listed financial assets held for more than a year and unlisted assets (financial and non-financial) held for more than two years to be classified as long term assets. Unlisted bonds and debentures, debt mutual funds and market linked debentures will continue to attract applicable capital gains tax.