85.64% of the total complaints were received through digital modes; The overall disposal rate for the year at the ORBIOs stood at 97.99% with an average Turn Around Time (TAT) of 33 days

FinTech BizNews Service

Mumbai, March 12, 2024: The Reserve Bank of India released the Annual Report of the Ombudsman Scheme for the period April 1, 2022 to March 31, 2023. This is the first full-year report after the launch of Reserve Bank – Integrated Ombudsman Scheme (RB-IOS), 2021 in November 2021. The Annual Report covers the activities under the RB-IOS, 2021 as well as major developments during the year in consumer education and protection and the way forward.

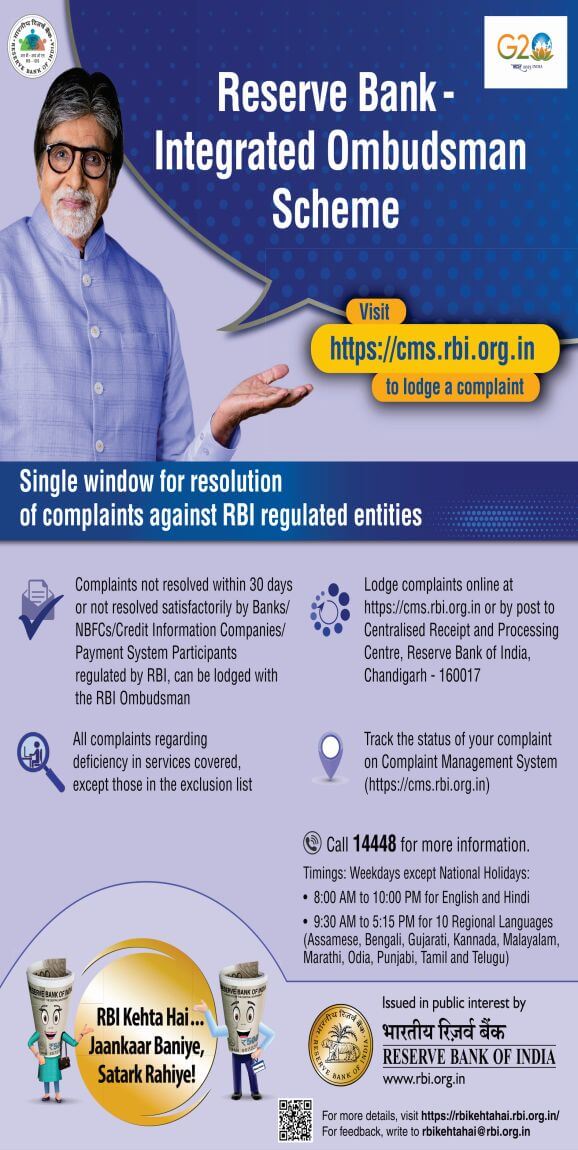

The Annual Report of the Ombudsman Scheme 2022-23 is the first stand-alone report under the Reserve Bank – Integrated Ombudsman Scheme (RB-IOS), 2021 (the Scheme) elucidating the activities of the 22 Offices of the RBI Ombudsman (ORBIOs), Centralised Receipt and Processing Centre (CRPC) and the Contact Centre during the year. The RB-IOS, 2021 was rolled out in November 2021 by integrating the three erstwhile Ombudsman Schemes viz., Banking Ombudsman Scheme, 2006, Ombudsman Scheme for Non-Banking Financial Companies (OSNBFC), 2018, and Ombudsman Scheme for Digital Transactions (OSDT), 2019. Initially, the Scheme covered all Commercial Banks, Regional Rural Banks, Scheduled Primary (Urban) Co-operative Banks and Non-Scheduled Primary (Urban) Co-operative Banks with deposits size of Rs50 crore and above as on the date of the audited balance sheet of the previous financial year, all Non-Banking Financial Companies (excluding Housing Finance Companies) which (a) are authorised to accept deposits; or (b) have customer interface, with an assets size of Rs100 crore and above as on the date of the audited balance sheet of the previous financial year, and all Payment System Participants as defined under the Scheme. With the experience gained ensuing the launch and implementation of RB-IOS, 2021, Credit Information Companies (CICs) were brought under the ambit of the Scheme from September 1, 2022.

Complaints

Receipt of Complaints under the RB-IOS, 2021 framework Under the RB-IOS, 2021, 7,03,544 complaints were received at the ORBIOs and the CRPC between April 1, 2022 and March 31, 2023, showing an increase of 68.24% over last year. Of these, 2,34,690 complaints were allocated to and handled by the 22 ORBIOs, whereas 4,68,270 complaints were closed by CRPC as non-complaints / non-maintainable complaints. Around 85.64% of the total complaints were received through digital modes, including on the online Complaint Management System (CMS) portal, email, and Centralised Public Grievance Redress and Monitoring System (CPGRAMS). The overall disposal rate for the year at the ORBIOs stood at 97.99% with an average Turn Around Time (TAT) of 33 days. RB-IOS, 2021 envisages settlement of complaints through facilitation / conciliation / mediation and thereby, majority of the maintainable complaints (57.48%) disposed by ORBIOs were resolved through mutual settlement / conciliation / mediation. During the year, a total of 122 Appeals were received against the decisions of the RBI Ombudsmen, of which 119 Appeals were received under the RB-IOS, 2021 and the remaining three were received under the erstwhile Ombudsman Schemes.

Other developments during the year

The major initiatives undertaken during the year in the consumer education and protection vertical are listed below:

Way forward

During the period April 1, 2023 to March 31, 2024, as part of the Reserve Bank’s medium-term strategy framework for 2023-25 (Utkarsh 2.0), CEPD will : i) Review, consolidate and update the extant Reserve Bank regulatory guidelines on customer service; ii) Review and integrate the internal ombudsman schemes, applicable to different RE types; iii) Establish Reserve Bank Contact Centre at two additional locations for local languages, including disaster recovery and business continuity facility. Additionally, the recommendations made by the Committee for Review of Customer Service Standards in RBI Regulated Entities will be examined for suitable implementation.