Out of the total complaints received at the ORBIOs, 88.77 per cent were received through digital modes, including on the online Complaint Management System (CMS) portal, email, and Centralised Public Grievance Redress and Monitoring System (CPGRAMS)

FinTech BizNews Service

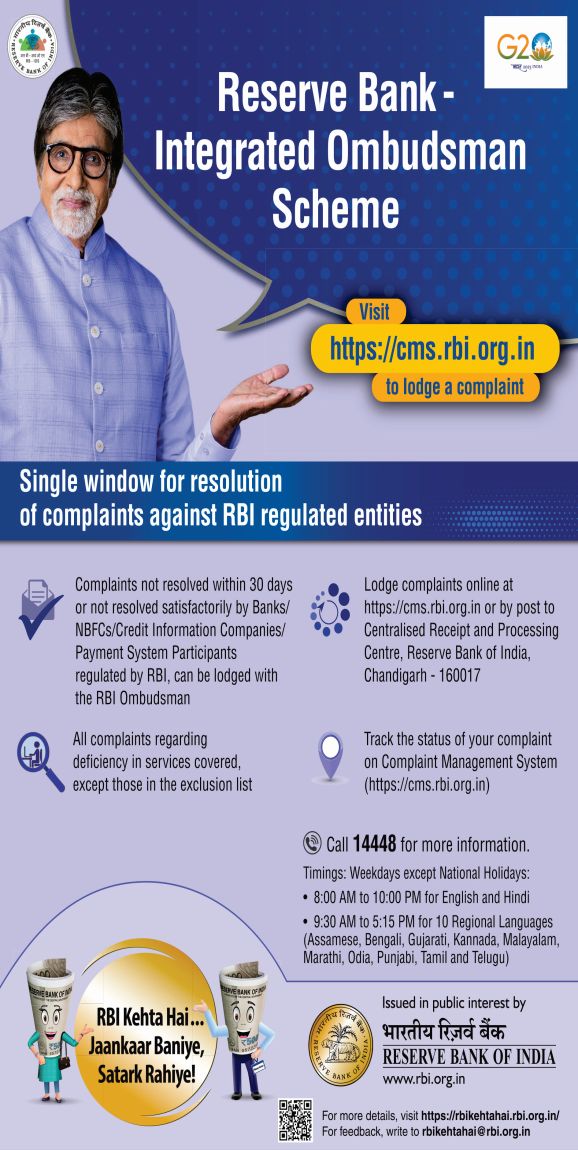

Mumbai, January 24, 2025: The Annual Report of the Ombudsman Scheme 2023-24 provides an account of functioning of the Reserve Bank - Integrated Ombudsman Scheme, 2021 as also the important policy initiatives undertaken by RBI towards Customer Service and Protection.

RB-IOS

The Annual Report of the Ombudsman Scheme 2023-24 under the Reserve Bank – Integrated Ombudsman Scheme (RB-IOS), 2021 provides an insight into the activities of the 24 Offices of the RBI Ombudsman (ORBIOs), Centralised Receipt and Processing Centre (CRPC) and the Contact Centre (CC) during the year. The RB-IOS, 2021 was launched on November 12, 2021 and currently covers the following regulated entities: i) Commercial Banks, Regional Rural Banks, Scheduled Primary (Urban) Co-operative Banks and Non-Scheduled Primary (Urban) Co-operative Banks with deposits size of `50 crore and above as on the date of the audited balance sheet of the previous financial year; ii) Non-Banking Financial Companies (excluding Housing Finance Companies) which (a) are authorised to accept deposits; or (b) have customer interface, with an assets size of `100 crore and above as on the date of the audited balance sheet of the previous financial year; iii) Payment System Participants; and iv) Credit Information Companies.

Receipt and Disposal of Complaints under the RB-IOS, 2021 framework

Under the RB-IOS, 2021, a total of 9,34,355 complaints were received at the ORBIOs and the CRPC between April 1, 2023 and March 31, 2024, showing an increase of 32.81 per cent over the previous year. Out of these 9,34,355 complaints, 2,93,924 complaints (31.46 per cent) were received at ORBIOs, and 6,40,431 complaints (68.54 per cent) were received at the CRPC.

Complaints through digital modes

Out of the total complaints received at the ORBIOs, 88.77 per cent were received through digital modes, including on the online Complaint Management System (CMS) portal, email, and Centralised Public Grievance Redress and Monitoring System (CPGRAMS). The share of complaints from individuals in the total complaints was the highest at 2,56,527 (87.27 per cent) in F.Y. 2023-24. Complaints against banks and NBFCs represented 82.28 per cent and 14.53 per cent of the total complaints respectively. Loans and advances formed the largest category (29.01 per cent) under which complaints were received.

Complaints were disposed by the ORBIOs

A total of 2,84,355 complaints were disposed by the ORBIOs during the year, thereby achieving a disposal rate of 95.10 per cent. The ORBIOs disposed 1,92,886 complaints constituting 67.83 per cent of the total complaints as maintainable complaints, while remaining were disposed as non-maintainable complaints on certain grounds as per the RB-IOS, 2021. 57.07 per cent of the maintainable complaints were resolved through mutual settlement, conciliation or mediation while 40.78 per cent of the maintainable complaints were rejected on account of absence of any deficiency of service.

Appeals

During the year, 82 Appeals were received by the Appellate Authority against the decisions of the RBI Ombudsmen, of which 72 Appeals were received from the complainants and 10 Appeals were received from the regulated entities (REs).

CRPC witnessed a significant rise in complaints, receiving 7,66,957 complaints (including assigned to ORBIOs/CEPCs), which was 30.10 per cent higher as compared to the previous year. Of these, 7,58,483 complaints were disposed at CRPC. While 6,31,876 complaints were closed as non-complaints/non-maintainable complaints, 1,26,607 complaints were assigned to ORBIOs/CEPCs for further redress. Among non-maintainable complaints, 47.75 per cent complaints were closed as First Resort Complaints (i.e. complainant approaching directly RBI without first lodging complaint with the concerned RE) whereas 26.21 per cent complaints were closed because of being addressed to other authorities.

A Contact Centre (CC) with a toll free facility (14448) provides information / clarifications to the public regarding the mechanism at RBI, guides complainants in filing of complaints, as well as provides the status of complaints already filed with the RBI Ombudsman. A total of 7,19,694 calls were received at the CC. While 57.20 per cent calls were attended through the IVRS facility and 35.11 per cent calls were attended by the CC personnel, 7.69 per cent calls were abandoned. 72.42 per cent of calls were received in Hindi, 8.11 per cent of calls were received in English and 19.47 per cent calls were received in ten regional languages (Assamese, Bengali, Gujarati, Kannada, Odia, Punjabi, Malayalam, Marathi, Tamil and Telugu)

Other developments during the year

The major initiatives undertaken during the year in the consumer education and protection vertical are listed below: i) The Master Direction - Reserve Bank of India (Internal Ombudsman for Regulated Entities) Directions, 2023 was issued on December 29, 2023 to strengthen the Internal Ombudsman (IO) mechanism and harmonise the instructions applicable to various regulated entities. ii) Two additional CCs were established at Bhubaneswar and Kochi, in addition to upgradation of the existing CC at Chandigarh to accommodate the surge in call volume and to implement Business Continuity and Disaster Recovery capabilities. iii) The Report of the Committee for Review of Customer Service Standards in RBI Regulated Entities, set-up by the Reserve Bank on May 23, 2022, was placed in the public domain on June 5, 2023 for comments from the stakeholders. Many of the recommendations of the Committee have been implemented while the other recommendations are at different stages of examination. iv) An awareness booklet, ‘The Alert Family’ was released as a sequel to earlier booklets ‘BE(A) WARE’ in March 2022, and ‘Raju and the Forty Thieves’ in December 2022 to provide guidance to public while dealing with various banking services and facilities.

The third edition of ‘Ombudsman Speak’ event was conducted on March 15, 2024 on the occasion of ‘World Consumer Rights Day’. RBI Ombudsmen across the country interacted with the local TV/Radio channels in their respective jurisdictions for spreading awareness, covering aspects related to grievance redress mechanism, safe digital banking practices and roles/ responsibilities of customers. vi) The RBI Ombudsmen conducted 46 town-hall meetings and 203 awareness programmes across the country on avenues of grievance redress and consumer protection. The focus of the programmes was on specific target groups such as students, senior citizens, women, etc. Way forward 10. Consumer Education and Protection Department has identified the following goals for the period April 1, 2024 to March 31, 2025, under the Reserve Bank’s medium-term strategy framework (Utkarsh 2.0) and other short term goals, for enhancing consumer protection and improving grievance redress mechanisms: i) Further improvement in the complaint management system to enhance support in lodging complaints and to ensure greater consistency in decisions and outcomes (Utkarsh 2.0); ii) Develop a consumer protection assessment matrix for REs (Utkarsh 2.0); iii) Strengthen the internal grievance redress framework to encourage banks to take proactive measures to improve customer service; iv) Conduct of survey to assess the reasons for the low level of complaints in the rural and semi-urban areas as well as in states with relatively lower number of complaints; and v) Review and rollout of reoriented Nationwide Intensive Awareness Programme based on feedback received from REs and ORBIOs.