Non-food bank credit2 grew3 by 10.2 per cent as on the fortnight ended September 19, 2025, compared to 13.0 per cent during the corresponding fortnight of the previous year

FinTech BizNews Service

Mumbai, November 2, 2025: Data on sectoral deployment of bank credit for the month1 of September 2025 has been collected from 41 select scheduled commercial banks (SCBs), accounting for about 95 per cent of the total non-food credit by all SCBs.

On a year-on-year (y-o-y) basis, non-food bank credit grew3 by 10.2 per cent as on the fortnight ended September 19, 2025, compared to 13.0 per cent during the corresponding fortnight of the previous year (i.e., September 20, 2024).

Highlights of the sectoral deployment of bank credit as on the fortnight ended September 19, 2025, are given below:

Credit to agriculture and allied activities registered a y-o-y growth of 9.0 per cent (16.4 per cent in the corresponding fortnight of the previous year).

Credit to industry recorded a y-o-y growth of 7.3 per cent, compared with 8.9 per cent in the corresponding fortnight of last year. Credit to ‘Micro and Small’ and ‘Medium’ industries continued to grow in double-digits. Among major industries, outstanding credit to ‘all engineering’, ‘infrastructure’, ‘textiles’, and ‘vehicles, vehicle parts and transport equipment’ recorded buoyant y-o-y growth.

Credit to services sector registered a growth rate of 10.2 per cent y-o-y (13.7 per cent in the corresponding fortnight of the previous year). Growth in credit to ‘non-banking financial companies’ (NBFCs) decelerated, though segments such as ‘tourism, hotels and restaurants’, ‘computer software’ and ‘commercial real estate’ witnessed robust growth.

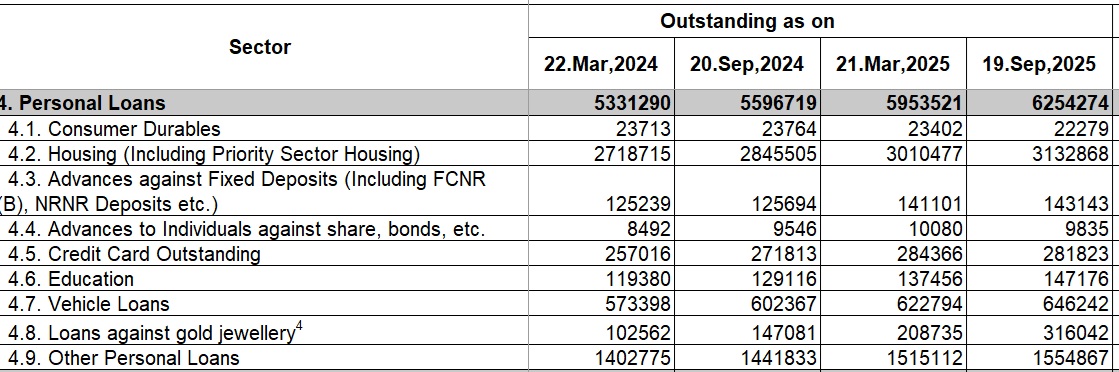

Credit to personal loans segment recorded a decelerated y-o-y growth of 11.7 per cent, as compared with 13.4 per cent a year ago, largely due to moderation in growth of ‘other personal loans’, ‘vehicle loans’ and ‘credit card outstanding’.